Zebra's Industry Solutions can give your business a competitive advantage by connecting people, assets and data to help you make better decisions.

Scale and energise your retail strategy with a digital backbone that unifies your team, informs priorities and drives results with Zebra's retail technology solutions.

Zebra's healthcare technology solutions provide patient identity management, mobile health devices, and business intelligence data to improve efficiency.

Zebra’s manufacturing technology solutions enable manufacturers to become more agile, optimize plant floor performance and embrace market changes.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

In today's world, the demands on transportation and logistics companies are higher than ever. Dedicated Warehouse, Fleet and Delivery, and Yard and Terminal solutions enable visibility to every aspect of your business and keep operations running flawlessly around the clock.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra’s mobile computing, scanning, and printing solutions connect each operational area in your warehouse to give you the agility to realize transformational gains.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's OEM scan engines, imagers, and private label OEM products offer flexible integration and help enhance product development with modern OEM technology.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Empower the front line with prioritized task notification and enhanced communication capabilities for easier collaboration and more efficient task execution.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimization. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Aurora Focus™ runs on Zebra’s fixed industrial scanners and VS20/VS40/VS70 smart cameras and comes ready-made for specific tasks like barcode reading and verification, OCR, and presence/absence vision inspection.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customization starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aimed at machine and computer vision engineers, Aurora Vision Studio software enables users to quickly create, integrate and monitor powerful machine vision applications without the need to write a single line of code.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

Are Global Supply Chains Ready for the European Union’s Tobacco Products Directive?

Did you know that tobacco is amongst the most commonly traded products on the black market? High profit margins and the ease of movement and production, in addition to low levels of detection, make the market attractive and lucrative to criminals. Some research indicates that 480 billion cigarettes are sold illegally worldwide each year. In the UK alone, HM Revenue and Customs and UK Border Force officers have seized over 2.8 billion illegal cigarettes and over 660 tonnes of tobacco over the last two years. This equates to an annual loss of approximately £2.5 billion in the UK (US $3.27 billion).

In an effort to fight the continuing rise in counterfeit goods and counteract illicit tobacco trade, the European Union has ratified the EU Tobacco Products Directive (2014/40/EU) (TPD), which will enforce new obligations throughout the entire tobacco supply chain, significantly changing how it currently operates. From the 19th May 2019, economic operators involved in the manufacture and distribution of tobacco products must, by law, enforce new measures such as ‘traceability features’ and a ‘traceability system’ to ensure compliance across their supply chains. But how prepared are tobacco stakeholders adapting to the new regulations?

One specific example of traceability features for the TPD is the use of unique 2D identifiers, which must be applied to each unit packet of tobacco products. They will come in either a data carrier or dot code form and will be provided by a nationally appointed unique ID Issuer. These 2D identifiers must enable the economic operators to track and trace tobacco products swiftly as they move throughout each stage of the supply chain. With time and location being logged at each step through the product’s unique identifier, products can be traced and, if necessary, returned to their point of origin.

Implications for the Supply Chain

This strict guidance on the labelling process has prompted a race against time for tobacco industry stakeholders to become compliant. Manufacturers must ensure products are correctly labelled, while those further down the supply chain must ensure the intricate monitoring of tobacco products from their origin to point of sale. All track and trace data must be consistently uploaded into primary repositories within 24 hours, and then into an EU-audited and controlled repository.

Equipping and updating the production line and supply chain with the appropriate technology is a complex task. As part of this directive, organisations across the supply chain will need to purchase the right technology that can decode the 2D dot codes to check product authenticity and ensure compliance with ongoing required tracking. Consequently, there is a lot of work that needs to be done across the supply chain to achieve this compliance, which will need to be properly managed to avoid too much upheaval – especially considering that many tobacco supply chains extend far beyond EU borders. Every global tobacco manufacturer will have to adhere to the directive if they are selling their products in the EU.

Tackling the Black Market

Traceability is key in fighting counterfeit and contraband tobacco. Once the origins of these items can be established, the risk of counterfeit products in circulation is highly reduced. Meanwhile, meticulously-traced products will make it easier for public authorities to determine when and where these items are diverted to the illegal market and to then act accordingly. Increased traceability has the potential to eliminate illicit tobacco trade, but this is not as simple as it appears.

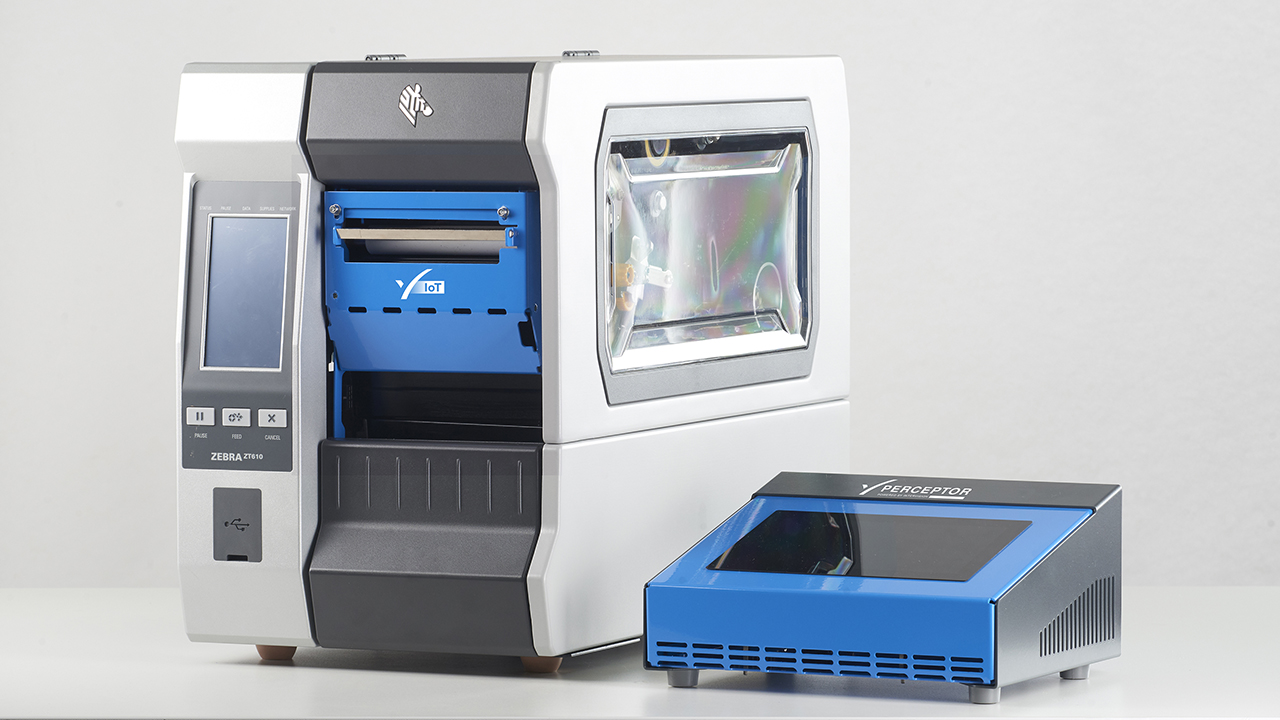

As tobacco products pass through the supply chain, the visibility of smaller packets becomes more complicated as pallets are broken apart, cases are opened, and individual cartons are distributed as part of mixed orders. All of this has significant implications on the ability to track and trace, especially as the unique 2D IDs must be maintained throughout and a data scan completed at every check point. In the future, tobacco stakeholders must meet the minimum requirements as outlined within the TPD. Hardware must be able to read 2D data codes, including the 2D dot codes or data matrix that are applied to each individual pack, no matter the condition of the packaging. The hardware must simultaneously be compatible with software, applications and utilities used to comply with the TPD and conduct other day-to-day manufacturing, warehousing, transportation and distribution operations. This will allow stakeholders to identify products and packaging, check their validity, record the steps in the business process and transmit this data to the relevant data repositories.

Compliance Benefits Business

The implementation of the EU Tobacco Products Directive (2014/40/EU) will benefit the industry to potentially reduce counterfeit goods and contraband by providing greater visibility across the entire global supply chain. However, for those businesses who have not yet prepared, there is still a significant amount of work to do ahead of the 19 May, 2019 deadline.

For help finding the right track and trace technology for the directive, please read our comprehensive solution guide for TPD.

Darren Russell

Darren Russell is Senior Director of the Solution Sales Group at Zebra Technologies. He is responsible for the strategy and management of the solution sales teams focused on delivering Intelligent Edge Solutions to Zebra customers across EMEA. The Intelligent Edge Solution portfolio incorporates Real Time Location Solutions, SmartLens for Retail, SmartPack for Transport & Logistics, Workforce Connect voice and Zebra’s RFID portfolio. Additionally, Mr. Russell is responsible for the Professional and Managed Services sales teams and the Multinational Account Managers who manage Zebra’s largest accounts across the region, including customers with global deployments of Zebra solutions.

Prior to joining Zebra, Mr. Russell was Head of Public Sector Sales at Blackbay, a mobility software organization. In this role, he was focused on delivering software applications that improved field worker efficiency.

Mr. Russell previously served as Regional Sales Manager at both IKON Office Solutions and Thales Telematics, where he led sales teams across the technology managed services and fleet telematics software industries.

Zebra Developer Blog

Zebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. ©2024 Zebra Technologies Corp. and/or its affiliates.