Zebra's Industry Solutions can give your business a competitive advantage by connecting people, assets and data to help you make better decisions.

Scale and energise your retail strategy with a digital backbone that unifies your team, informs priorities and drives results with Zebra's retail technology solutions.

Zebra's healthcare technology solutions provide patient identity management, mobile health devices, and business intelligence data to improve efficiency.

Zebra’s manufacturing technology solutions enable manufacturers to become more agile, optimize plant floor performance and embrace market changes.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

In today's world, the demands on transportation and logistics companies are higher than ever. Dedicated Warehouse, Fleet and Delivery, and Yard and Terminal solutions enable visibility to every aspect of your business and keep operations running flawlessly around the clock.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Technology is a key enabler in helping the Public Sector provide their frontline and back office workers automate business process and assets with a digital voice.

Zebra’s mobile computing, scanning, and printing solutions connect each operational area in your warehouse to give you the agility to realize transformational gains.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

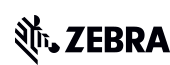

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's OEM scan engines, imagers, and private label OEM products offer flexible integration and help enhance product development with modern OEM technology.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Empower the front line with prioritized task notification and enhanced communication capabilities for easier collaboration and more efficient task execution.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimization. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Aurora Focus™ runs on Zebra’s fixed industrial scanners and VS20/VS40/VS70 smart cameras and comes ready-made for specific tasks like barcode reading and verification, OCR, and presence/absence vision inspection.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customization starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aimed at machine and computer vision engineers, Aurora Vision Studio software enables users to quickly create, integrate and monitor powerful machine vision applications without the need to write a single line of code.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

The Self Checkout Comes of Age

Cast your mind back to 1995. It was a seminal year from a tech viewpoint for many reasons. It was the first year that mobile phones didn’t resemble bricks. You may have been among the first people to buy a book from Amazon or to put in a bid on eBay. You may have watched Toy Story, the first movie to use computer-generated imagery (CGI). And, if you visited Safeway in the UK, you may have been one of the first shoppers to use Shop ‘n’ Go.

That year, Safeway became ‘the first UK supermarket chain to experiment with self-scanning’ and, due to the overwhelming response from its customers, ultimately deployed Personal Shopping Solutions (PSS) on a mass scale. Although other grocers around the world were testing the waters with self-checkout at the time, many consider Safeway to be the PSS pioneer.

PSS: Risky or Smart?

At the time, I worked for Symbol, the mobile data capture specialist that’s now a part of Zebra, and was responsible for the Safeway PSS rollout. (They were using our devices.)

When people learn of my role, they often ask: why did Safeway do it? Mobile phones were a luxury for most, and mobile shopping didn’t exist yet. There was no consumer expectation around convenience, at least not at the level that exists in today’s ‘now economy.’ Plus, 25 years ago, many deemed it risky to let a customer leave the store without an employee personally scanning and bagging each item. Store surveillance and theft prevention measures weren’t as sophisticated in supermarkets back then as they are today. Trusting that customers would pay for everything they put into their carts was risky, and it certainly put the honour system to the test.

However, Safeway was one of the many grocers that found it riskier to continue with business as usual.

The number one gripe I heard across the retail industry at the time was about peak time checkout queues. Supermarket customers found long checkout lines especially frustrating. So much so that many shoppers did what we still do today: abandon their carts and go elsewhere for what they need.

Some grocers tried to speed up checkout for customers by segmenting customers by the size of their carts. However, Safeway believed that it was odd to give people with 10 items or fewer a dedicated or express lane. That still left people with larger carts – who were spending more money – in longer queues in their (now fewer) ‘dedicated’ checkout lanes.

So, Safeway asked us to help solve this dilemma and to find new ways to improve the checkout experience for people spending more. Of course, they wanted to enhance the customer experience for all shoppers in the process. The resulting Shop ‘n’ Go solution was big news. We had the BBC, national press and global TV crews descending on the first Safeway store in Reigate in the UK to witness the ‘go live’, with many predicting that this was the beginning of the end of the personal, associate-based shopping experience. People were sure to be replaced by automation, they reported, leaving many workers to be wary of technology.

But workers had nothing to fear. The need for associates hasn’t decreased over the last 25 years, even as PSS and self-checkout (SCO) technology use has increased. And these scan-and-shop solutions sure have become popular.

SCOping the Future

As we look forward, it seems certain that PSS and SCOs will become more common in stores.

Technavio predicts that 468,000 terminals will be in place globally by 2021. This growth makes sense. PSS and SCO technologies deliver a frictionless shopping experience, which was desired back then but demanded today.

The technology also frees associates to focus more time on customers, and the investment-versus-return equation is increasingly favourable. What’s more, the user experience is improving too. Newer PSS devices such as our PS20 have voice assistants so customers can ask for help (like hey Siri or hey Alexa) to find items or get information, with the answers displayed on the device. And with locationing technology becoming more accurate and cost-efficient, retailers will be able to send relevant offers to the PSS device based on a shopper’s location. If retailers also use an app – and the customer has ticked the appropriate permissions – personalised incentives can be sent to shoppers too.

Indeed, 25 years after it first came to market (and the supermarket), PSS technology has come of age.

Or has it?

A Curious Relationship

I was attending a trade event in London earlier this year and sat with a number of large retailers, most of whom are Zebra customers. All of them were saying that they plan to roll out more PSS and SCO units in their stores. In some ways this isn’t surprising. The brands I work with report that, from a cost / return on investment (ROI) perspective, the technology is proven. Retailers who have implemented the solution say that PSS helps to increase sales between 7-15 percent, according to a VDC Research report. In the UK, some retailers tell us that they see up to 20 percent of revenue go through PSS systems – with even more benefits gained in terms of improved customer service and enhanced staff productivity. Plus, repeat visits, loyalty and satisfaction levels tend to increase when people use mobile and fixed SCOs.

This said, there is a ‘but’ here. And it’s this: some retailers still say that they worry about increased shrinkage associated with deploying PSS. So much so that they do not fully trust the technology and cannot see how it will work for them in their stores. This, too, is not surprising.

Research reports often point to an increase in shrinkage through theft when self-service systems are in situ. And social media is not averse to suggesting how to cheat systems. So, as we look forward, do we continue to see the expansion of PSS and SCOs as double-edged swords? I think not. From what I’ve seen over the last 25 years, there are ways to maximise the positives and minimise shrinkage.

###

Editor’s Note: Tune in next week for tips on how to prevent shrinkage and get the most from your PSS and SCO investments.

Peter Ward

As a member of Zebra’s EMEA retail team, Peter Ward spends his days working with retailers to enhance sales, service and staff productivity through mobile and visibility technology. Specifically, he is focused on helping customers utilize Zebra Technologies’ retail technology solutions to unlock revenue, grow loyalty and drive operational efficiencies.

Prior to Zebra, Mr. Ward held various sales and leadership roles with retail and mobility solution providers, including Retec Interface, IBM, Symbol Technologies, Wavetrend and Siemens Nixdorf. Earlier in his career, he served as the Sales Director for Zebra’s Location Solutions in the Process & Emerging Industries across EMEA. In this role, he was focused on helping companies in Oil & Gas, Construction, Mining and Energy improve their visibility into widely-dispersed operations

Zebra Developer Blog

Zebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. ©2024 Zebra Technologies Corp. and/or its affiliates.