Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

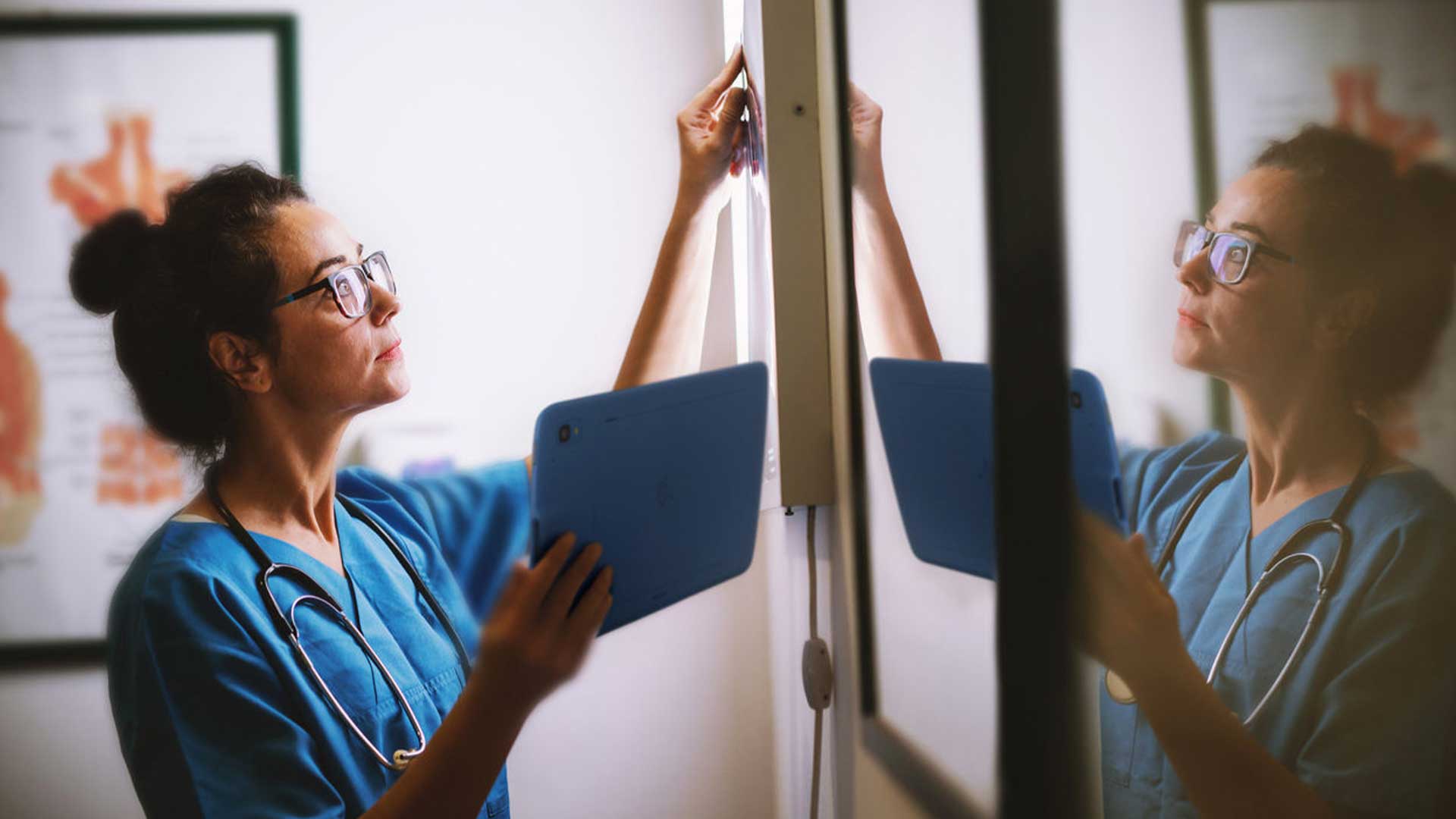

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's public sector technology solutions enhance decision-making, streamline operations, and safeguard communities with advanced software and rugged hardware.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

Boost productivity with Zebra Frontline AI Enablers: AI vision models, sample apps, and APIs streamline workflows for efficient business processes.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

The Long Road to Branch Operations Modernization: Are You on the Right Path?

For years, we’ve been watching digital transformations happen across the banking world as banks try to respond to an ever-shifting landscape influenced significantly by two things:

Evolving customer demands – Younger generations are increasingly shifting to online banking. They like the convenience of being able to complete everyday transactions on their smartphones. Yet, when it comes to the big financial decisions, like getting a loan to start a business or buy a home, they want to come into a branch. Branches need to offer an efficient and satisfactory customer experience to keep attracting new customers and retaining current ones.

A tight labor market – Inflation continues to be high and employee turnover for front-line bank associates has spiked, hitting 23.4% last year. According to Gartner, nearly 50% of front-line workers want greater control over when, where, and how they work. Banks that want to be successful need to be able to provide a work environment where employees feel like their work is meaningful.

From what I can tell, banks are responding well to these challenges. However, there is another area of opportunity where the focus has trailed the opportunity.

Specifically, there is untapped potential to modernize branch operations in a way that makes them even more efficient and gives managers and associates more time to spend with customers.

Don’t get me wrong. I’ve seen a lot of progress made by bank leaders to reduce paperwork, automate workflows, and gain an increased understanding of execution and communication so as to make improvements in both areas. Yet, there is more we can do. Much, much more.

Too Many Apps

Earlier this year, we released our Fourth Annual International Branch Banking Employee Survey Report. One of the findings that popped out to me is how much time branch employees still spend on operations tasks.

Branch employees acknowledge that some of the paper and process have been removed and/or streamlined. But all too often this is done using one software application to create a forms library, another to create some workflows, and yet another to track completed tasks/forms. This is a situation in which technology is not the solution bur rather contributing to a lingering problem, with the average branch manager still spending 1.5 hours a week just assigning, managing, and logging tasks and 8.9 hours on managing employee schedules. Furthermore, despite this “digitalization,” branch associates spend on average 13.2 hours a week on administrative and schedule-related tasks. This adds up to 23.6 hours per week per branch taken away from servicing customers.

Why? Why isn’t technology proving to be the right solution? From where I’m standing, it’s because too many software platforms are being used – and too many of the wrong software platforms.

Unified Solutions, Unleash Your Branch Associates’ Full Capabilities

Banks benefit most from a unified branch operations and execution solution that gives leaders the flexibility to easily add/create/modify branch operations forms, create a centralized and personalized task list for each branch/employee, and embed workflows to simply and enhance execution, all without needing to use IT or third-party resources to make changes.

Finding this right task management solution will help you and your team…

Increase efficiency: Having all your administrative and operational tasks assigned, managed, executed, and logged in one place reduces the time it takes for a branch manager or associate to complete a task. It limits distractions and standardizes the steps. This creates huge time savings. In fact, the University of California at Irvine found that on average it takes about 23 minutes for someone to get back to a task after a distraction. Centralizing the work means fewer chances for an associate to get distracted.

Improve flexibility: Branch operations employees like corporate and branch managers have the greatest level of insight into what they need to get the job done. The right solution will give them the tools they need to independently update or create new forms as they analyze insights or identify new needs. Instead of asking for help from what we know are limited IT resources or going back and forth with vendors, they’ll be able to make the most of their insights and improve the customer experience and business outcomes.

Accelerate time-to-value: A key measure of success for any tech solution is how quickly your business will see a positive impact. By minimizing the barriers users face to make the most of the software, your branches will be able to maximize the time spent on customer-facing and revenue-generating tasks. The more they get to focus on those, the faster your business will see a return on investment.

Remember

When you aren’t using technology built specifically for the problem you’re trying to solve, you’re going to end up with a messy tech stack. Beyond the impacts on branch operations, using multiple software platforms or the wrong software means your corporate branch operations teams are going to have to coordinate multiple different solution vendors/internal resources to understand analytics, make updates or tweaks to forms or processes, or troubleshoot functionality. And beyond the core users of the solution, it means that the IT team’s bandwidth is being stretched thin, which can cause bottlenecks, longer processing times, and a lack of ownership.

Those obstacles add up and each has a cost. Implementations take longer. Training takes longer. Time-to-value takes longer. As you continue your journey to modernize and streamline your branches, having too many apps creates a lack of flexibility and slows down your ability to optimize resources, improve employee experience, and improve operations.

As an industry, we’ve come so far. We’ve weathered global recessions and face continued threats from fintech startups. We’ve been able to do so because when we’re faced with a challenge, we take strong, decisive action to meet the needs of all our stakeholders.

As customer demands increase and the labor market continues to be tight, you have an opportunity to rise to the occasion by implementing the right kinds of technology that will make life for your employees more fulfilling and power the financial dreams of your customers in a way only you can. So, let’s talk about how the Zebra team can help your team(s) make the right technology decisions so that you can better serve branch customers without making that job harder for branch associates or IT teams.

Zebra Developer Blog

Zebra Developer BlogZebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story HubZebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the BlogSearch the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2026 Zebra Technologies Corp. and/or its affiliates.