Still Not Sure if Private 5G is Better Than Wi-Fi? You Might Not Be Assessing the “Value” of Each Correctly

A few weeks back, I spoke with Puneet Shetty, President of Product Management for Celona, a Zebra Alliance Partner, about why private wireless networks will likely prove more reliable and cost effective in many business settings. As expected, that post spurred debate with many in the industry who feel differently.

For decades, Wi-Fi was the go-to technology for inside the four walls and commercial cellular networks were the mainstay in outdoor environments. Private wireless networks were more of a fringe solution.

While Wi-Fi works great for office spaces, homes, etc., the technology requires greater investment in “uncarpeted” enterprise environments such as factories, warehouses, shipyards, utility/energy sites, and even hospitality venues, where the business case for private wireless (4G/5G/CBRS) has strengthened.

The main reason the numbers have started to make sense is because network reliability has come to the forefront. For the uncarpeted enterprise, Wi-Fi performance indoors can be spotty, while outdoor coverage is even more challenging, requiring further Wi-Fi investment to address. Public cellular network coverage may not meet your business needs as its stability depends on a range of factors – one of which is proximity to a tower, interference from surrounding environment, etc. Private wireless networks are the only ones that offer consistent outdoor performance, consistent mobile performance, and seamless handoffs. Plus, private 5G networks can be set up anywhere you need coverage, which is not the case with Wi-Fi.

Now, I know that may not be enough to convince you to move your entire workforce onto a private wireless network, so I asked Pradhyum Ramkumar, Senior Director, Product Marketing for Celona to give us a deep dive analysis of the value of this technology as compared to Wi-Fi and public wireless networks:

Nader: You’ve told me before that it’s a mistake to choose a wireless network structure based on the total cost of ownership (TCO). Why do you feel that way?

Pradhyum: I believe TCO should influence one’s decision, but it shouldn’t be the only – or even the first – consideration when comparing private wireless against public wireless or Wi-Fi service options. The more important questions to ask are “How easy is it to turn on?” and “What is the time to value?”

Nader: So, don’t lead with TCO when trying to build or justify the business case for the wireless network to your boss?

Pradhyum: Exactly. If you only focus on TCO, you will overlook the extensive value that private wireless network technology might offer, especially if you’re trying to get coverage in an uncarpeted space indoors or outdoors.

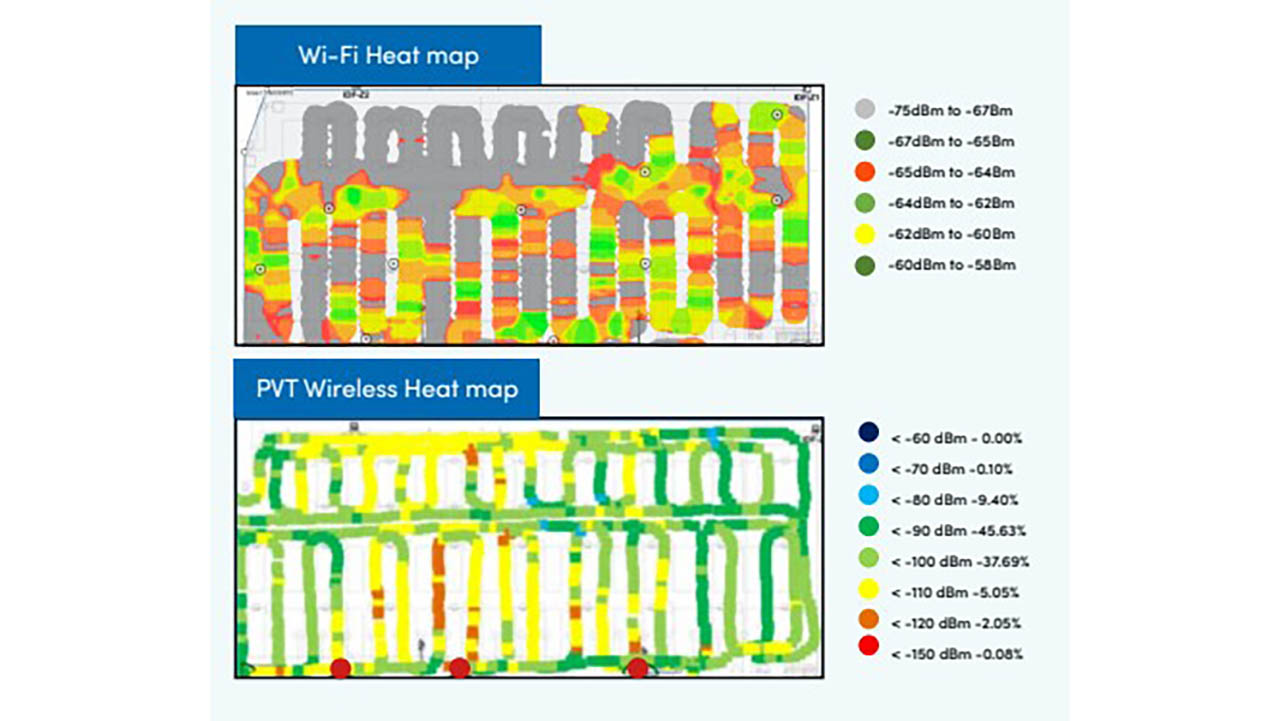

For example, when you look at a heatmap for private wireless versus Wi-Fi coverage in a large outdoor yard, you’ll see the coverage is significantly better with private wireless. This type of visual leaves quite the impression.

Then, when you see the side-by-side breakdown of the infrastructure requirements and potential outcomes from each setup, you’ll see the differences even more dramatically.

Here’s a great example from a real-world comparison we did at an actual distribution center for a customer:

- With 29 pole-mounted Wi-Fi access points (APs), they can get 59% acceptable coverage (-67 dBm or higher)

- With three roof-mounted private wireless APs, they can get 95% acceptable coverage (-110 dBm or higher)

Nader: What a difference!

Pradhyum: And the kicker is that poles are not always available where coverage is needed. So, even if you said, “I prefer Wi-Fi and will just add as many APs as needed to get 95-100% coverage across my operation,” you still may not get to that number. That’s why private wireless is becoming so valuable.

Nader: I would imagine the cost variances between Wi-Fi and private wireless start to become more obvious the more APs that are needed for Wi-Fi, too.

Pradhyum: It does. Running power and fiber optic infrastructure outdoors is expensive (as in 3-4 times the cost of an installation on premises). And since the only way to improve coverage for Wi-Fi is to add more APs and support infrastructure, there are increased costs there, too. Since private wireless has higher transmit power, fewer nodes are required.

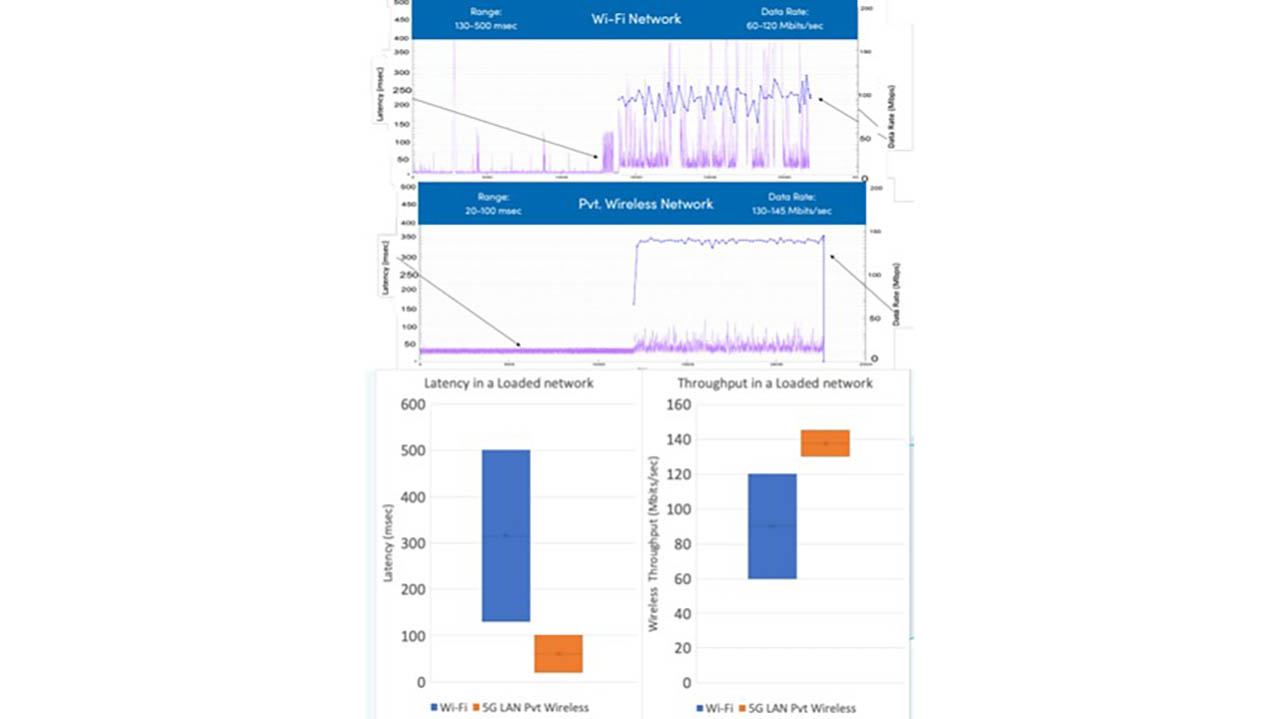

Nader: Costs aside, assuming coverage is at 95% with both Wi-Fi and private wireless, is network performance comparable? Or is that where you assign greater value to private wireless?

Pradhyum: In many uncarpeted spaces, whether a factory, sorting hub, yard or even a retail store, there is a concern about noise, latency and interference from machinery, metal structures, and co-channel interference – especially when talking about Wi-Fi connectivity. But when it comes to private wireless, because it leverages 4G/5G technologies, it operates with higher signal strength and has lower susceptibility to noise. Additionally, since private wireless uses Citizens Band Radio Service (CBRS) spectrum in the U.S., which is managed centrally by Spectrum Access Systems (SAS), there is less radio interference from other equipment, hence better performance. If the use case involves mobility as in a workforce on forklifts or the use of autonomous mobile robots (AMRs) around a large property like a distribution center, the device goes through a handoff between APs as it traverses the property. Private cellular networks are designed natively for seamless mobility. The network infrastructure controls handover decisions that are precisely timed, which is not the case with Wi-Fi. As a result, Wi-Fi connectivity can be unreliable for mobility use cases depending on the network layout.

In fact, we did a quality of service (QoS) evaluation on a loaded network using a static download mechanism and found that private LTE has one-fifth the average latency of Wi-Fi and twice the throughput.

These observations played a critical role in a customer’s recent decision to go with private wireless because its front-line workers run business critical applications on industrial-grade rugged tablets, always requiring consistent connectivity indoors and outdoors. If the tablet of an employee tasked with inventory tracking goes offline due to poor coverage, the data would only be synchronized with the inventory management system once the tablet re-establishes connectivity. This often leads to omission, duplication and discrepancies in data essential for the business. The customer wanted to avoid this scenario.

Nader: So many companies have been using Wi-Fi for years. Why is QoS suddenly an issue?

Pradhyum: I wouldn’t say this is a new issue, but as connected applications become critical to the operations, managing QoS has come more into the fore front. Running applications like voice, video and robotics automation requires tight control of QoS parameters such as latency, throughput, and traffic prioritization, which is generally more complex to handle in a Wi-Fi network.

Fundamentally, Wi-Fi uses contention-based mechanisms for a device to get connected to the network. As a result, performance on the network is “best effort.” Devices can get deprioritized by others on the network and, therefore, may suffer slow speeds or experience high latency. But with private wireless technologies such as Celona’s 5G LAN, the enterprise IT administrator can setup data bandwidth and latency requirements on a per device or even per application basis. So, priority devices will always experience a consistent QoS, even as overall network traffic increases, thus meeting service level objectives.

Nader: I know private wireless uses local spectrum such as CBRS, n48 and n78 bands. But what happens if the network fails for some reason?

Pradhyum: Unlike a public cellular network, private cellular network redundancy can be built into the solution since the private network is local and managed by the enterprise. For example, the Celona 5G LAN solution supports redundant APs and edge gateways to ensure a highly available network. Also, Celona Edge has intelligent spectrum management built in to dynamically optimize network performance based on available spectrum.

Administrators can always set up devices to fall back on a public network, depending on the coverage area. The handoff for the front-line worker – the device user – would be seamless, especially if using Zebra devices that are compatible with both private and public 4G/5G cellular network technology.

Editor’s Note: Zebra has been working with all the major infrastructure vendors and doing a lot of engineering to ensure Zebra devices support 4G / 5G private networks in both licensed and unlicensed bands, to include CBRS in North America. To learn more, click here.

Nader: When you say locally, do you mean independently, as in within the organization? Could the network admin technically be offsite?

Pradhyum: The APs and the edge (running the 4G/5G core, unified data plane, routing, and functions) are setup on-premises where the network is being used. However, the orchestration layer is a cloud-based network administration platform. This allows an IT manager to setup the network services and policy remotely.

Nader: How does the security compare to Wi-Fi?

Pradhyum: Many Wi-Fi networks utilize pre-shared keys and open SSIDs to allow for IoT and/or guest device connectivity – opening doors to additional risk factors for critical enterprise infrastructure.

Private wireless uses strong device identification and authentication as well as robust encryption mechanisms for data in-flight and at rest. In addition, SIM-based authentication ties each device to a physical SIM or embedded SIM (eSIM) that can be strictly controlled and tracked.

Nader: What is the time to value for the average private wireless network deployment? And how does it compare to Wi-Fi?

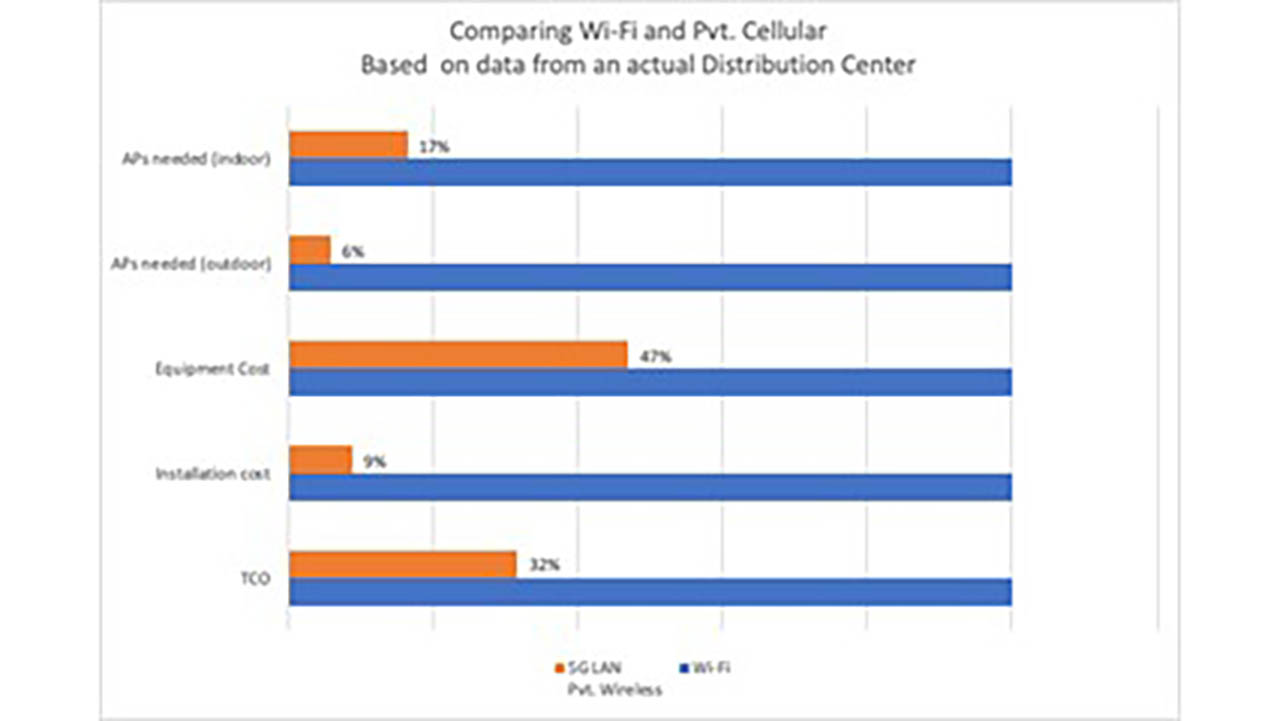

Pradhyum: Since the installation of indoor private wireless APs is similar to Wi-Fi, time to value is comparable. The primary difference is that private wireless requires fewer APs, so that’s something to keep in mind. However, there is a significant time to value advantage in an outdoor private wireless installation since Wi-Fi always requires a larger number of AP in addition to trenching and cabling. Private wireless requires less than one-tenth the number of APs that Wi-Fi does, and since private wireless APs can be mounted on a rooftop, installation costs are lower.

Also, one doesn’t have to be an expert to adopt and manage a private wireless network. A private wireless solution provider like Celona or our partners will help customers with the RF design and network design and propose all the components required. Once installed, the 5G LAN private wireless network integrates seamlessly to the existing LAN and can be operational within hours. Since the management of the network is all cloud-based, it is very similar to managing a Wi-Fi network.

Finally, with Zebra devices being 5G LAN certified, customers don’t have to worry about interoperability issues and can further reduce time to value.

Nader: If Wi-Fi is working well indoors, but there are connectivity issues outdoors, would it make sense to go ahead and rip and replace the network infrastructure outdoors to transition to a private wireless network?

Pradhyum: It depends. If you have an existing Wi-Fi network that meets your needs, then there is no reason to switch to private wireless. If you have coverage issues with Wi-Fi (especially outdoors), are deploying new technologies like AMRs or just setting up a new network from the ground up, consider private wireless. Rather than patch the solution with more Wi-Fi access points, a private wireless solution can provide a much more robust alternative.

The chart below shows that in case of private wireless, you only need 17% of the number of Wi-Fi APs for indoor scenarios and 6% of the number of Wi-Fi APs for outdoor scenarios for the same level of coverage. When you factor in the installation costs, you will see that the blended 3-yr TCO (indoor+ outdoor) of private wireless is 32% of the TCO of Wi-Fi.

This TCO calculation does not account for efficiency losses due to poor connectivity, though. It also does not factor in device upgrades needed to support private wireless vs. Wi-Fi.

While the cost associated with device upgrades in addition to network upgrades will draw some financial considerations, it is important to also understand what poor connectivity is costing your organization in terms of lost productivity and sales in addition to related expenses. Also consider what it would cost to continue patching your existing Wi-Fi network without actually solving the connectivity issues that will still persist. The cost savings associated with fewer APs and the cost of installation can significantly offset the cost of a network upgrade to private wireless and device refresh.

Nader: What else increases the value of private wireless technology compared to Wi-Fi? Is there something intangible that most people don’t consider? Something that may be hard to quantify in a TCO or ROI calculation but needs to be weighed equally alongside the numbers?

Pradhyum: Ultimately, we are all in the technology business to solve customer problems. If operations at a distribution center are hindered by lack of connectivity, it’s going to have a significant economic impact to the business, especially in times of labor shortage. Deploying new technologies like AMRs or even automated guided vehicles (AGVs) would be impractical with Wi-Fi. For safety reasons, an AGV or AMR would stall if it loses connectivity, affecting workflow. With private wireless, Celona and Zebra are providing an alternative to Wi-Fi and public cellular networks to solve – and ultimately mitigate – this problem.

###

Editor’s Note:

If you’d like to connect with Pradhyum and the Celona team, you can reach them here: https://www.celona.io/zebra.

These two white papers would also be great resources if you’re looking for more data to justify the switch to private 5G:

Comparing Wi-Fi and Celona Private Wireless within a Real-World Distribution Center

VDC Research: The Adoption of Private Wireless for Enterprise Digitalization

Additional information on the pros and cons of different wireless network technologies is available in these posts:

- Ask the Expert: Why Should I Use a Private Wireless Network versus a Wi-Fi Network for My Business?

- Ask the Expert: What’s Next in Wireless Technology? And How Will It Impact My Enterprise Mobility Strategy?

- Ask the Expert: What Are the Benefits of Using the Citizens Broadband Radio Service (CBRS) or a Private Wireless Network, in General?

- Ask the Expert: What Is 5G Network Slicing? And How Can It Improve My Business Applications?

- Ask the Expert: My Business is Growing. Will Wi-Fi 6 Really Give Me Enough Coverage Long Term for All My Connected Devices and IoT Applications? And What Happens If I Want to Expand My Device Usage or Network Range Down the Line?

- Wireless Network Traffic is Growing by the Day, Which Means Factory, Warehouse and Retail Store Workers Will Probably Need Wi-Fi 6 Mobile Computers Sooner Than You Think. This is How You Can Prepare.

- Cisco Leader Agrees: The Pandemic Subtly Accelerated and Dramatically Altered Enterprise Adoption of 5G

- Are Traditional Wi-Fi Troubleshooting Mechanisms Giving Your IT Team and Workers Trouble? Check Out This New Tool.

Nader Newman

Nader Newman is currently a Product Manager at Zebra where he is responsible for Zebra’s Enterprise Mobile Computing Wireless Connectivity Solutions for Wi-Fi, Cellular, and PAN. Nader has more than 20 years of experience within the mobile industry and has managed Zebra’s Mobility DNA software portfolio, including Zebra’s Mobility Extensions, suite of development offerings and Terminal Emulation products.

Previously, he served as Product Manager with Motorola Solutions and Psion, where he managed a portfolio of software products, Wi-Fi access points and wireless base stations. Nader holds Computer Specialist and Digital Telephony Service degrees from Toronto School of Business as well as Humber College.

![[Category, Subcat or Product] Representational Image 16:9](/content/dam/zebra_dam/global/zcom-web-production/web-production-photography/newsroom/2026-images/photography-web-newsroom-featured-03-16x9-en-us-013026.jpg.imgo.jpg)