Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

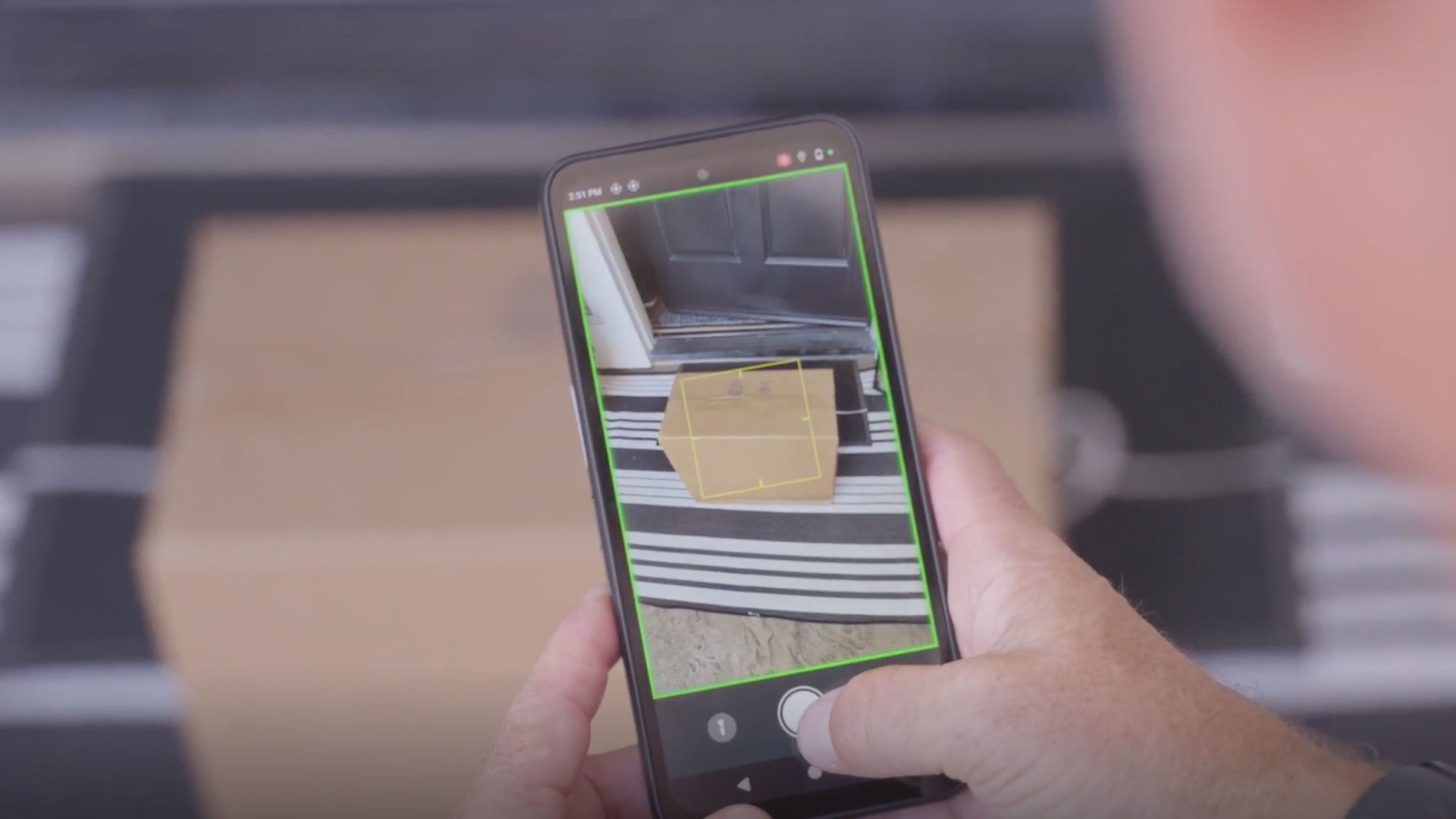

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

Boost productivity with Zebra Frontline AI Enablers: AI vision models, sample apps, and APIs streamline workflows for efficient business processes.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

How to Use Your Bank Branch Scheduling Processes to Drive Revenue

Your branch workforce management processes should ideally empower your network to maximize sales while controlling labor costs, but this can be easier said than done – especially if your bank still relies on dated technology and processes, like paper schedules and manually assigned float pool employees. It’s nearly impossible to increase revenue if you can’t schedule the right employees for multi-skilled roles. With new patterns in branch traffic, high service expectations from customers, and new regulatory fines for predictive scheduling violations, you may be looking for ways to update your scheduling models and processes to ensure you’re driving revenue, improving efficiency, and increasing employee satisfaction. Sound about right?

If so, let’s talk about what you can do to manage labor in a way that will help drive more sales at your bank branches.

Improve Forecasting and Analytics

With the rise of digital banking and many branches now serving as consulting centers, it’s critical that branch staff have time for customer conversations. Customer service is imperative to convert sales. This requires you (or whoever on your team is responsible for scheduling) to accurately predict staffing needs and recognize both short-term and long-term trends in branch traffic and wait times.

That is impossible to do without the help of technology. People simply can’t see what artificial intelligence (AI) can. So, you will need to apply machine learning models to your forecasting process to help your team easily make sense of past labor forecasts compared to actuals, the impact of weather, and other anomalies that influence staffing needs and ultimately guide decisions. A forecasting solution with AI assistance can drastically improve forecast accuracy and someday even allow you to match employee personas or experiences with those of your employees for a deeper, more useful connection.

Something else to remember: Your forecasts should account for the full workload in branches; you’re not solving just a piece of the puzzle. With a workforce management solution that operates natively alongside activity management, time and attendance, appointment setting and branch execution technology systems, you can ensure your staffing forecasts account for factors like queue levels and wait times, upcoming events or promotions, routine activities like opening and closing procedures, and any variations in actuals versus forecast. As a result, you will able to schedule the right number of people with the right skills in the right place at the right time to efficiently foster customer engagement.

Reduce Friction for Branch Managers

Many banks are struggling with the administrative time that branch managers and field leaders are spending to create and manage schedules. A recent survey found that the average manager spends almost nine hours a week managing schedules - almost a quarter of their time. The more time these leaders have to spend scheduling, the less time they have to focus on other responsibilities in the branch, like engaging with clients and employee coaching and development. If this is a familiar problem, it’s time to look at new workforce management tools because, with the right solution, branch managers can get optimized schedules in a matter of minutes.

What does the right solution look like?

Likely one that uses AI-powered algorithms to autogenerate optimized schedules that account for labor forecasts and budgets. With something like this in play, your branch managers can ensure their branches are adequately staffed for anticipated workload and branch traffic, while balancing colleague availability, skill set and certifications, preferences, and local or national labor rules and regulations. They just need to make small tweaks and revisions to get the final schedule, reducing a process that used to take hours to a matter of minutes. In turn, branch managers can put that time back into training branch colleagues, engaging customers, and driving sales.

Get Buy-In from Branch Colleagues

The scheduling process should also be easy for branch staff; when colleagues are happy with their schedules, they’re more likely to be engaged at work and less likely to call out or seek opportunities elsewhere. Research has shown that unplanned absences can be costly for employers, so getting schedules right and increasing employees’ confidence in the process is key.

Employee self-service tools empower your branch employees to engage with the scheduling process and help branch managers fill open shifts effortlessly. With iOS and Android mobile-first self-service apps, staff can easily view their schedules from their phones, adjust their availability, call in sick or request time off, as well as swap shifts or bid on open shifts at neighboring branches. Branch leaders will still have to approve any changes before they’re finalized and applied, and there will be guardrails in the framework of this self-service tool to ensure business objectives are still met with the right staffing from a skills perspective. However, by giving employees the opportunity to make some adjustments without having to go through their manager for pre-approval, it becomes a win-win for the employee and the bank.

Just make sure the mobile employee self-service function is a native function of the workforce management platform, as this will enable any staffing changes to be automatically incorporated into the schedule. Managers are alerted if any proposed changes would violate labor regulations or branch rules, avoiding penalties or overtime expenses.

In the today’s leanly staffed branch network, there are a number of opportunities to use modern workforce technology to drive revenue, efficiency, and employee satisfaction. I know you’re probably still debating when and how you should upgrade or enhance your workforce tooling to make the most of these opportunities, but I recommend you consider starting this process as soon as possible. Legacy solutions are only going to fall further behind as transactions shift to digital channels and the pressure mounts to optimize branch staffing.

For more insights on what makes a difference to today’s lean branches, check out the recently released Fourth Annual International Branch Banking Employee Survey.

Zebra Developer Blog

Zebra Developer BlogZebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story HubZebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the BlogSearch the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2026 Zebra Technologies Corp. and/or its affiliates.