Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

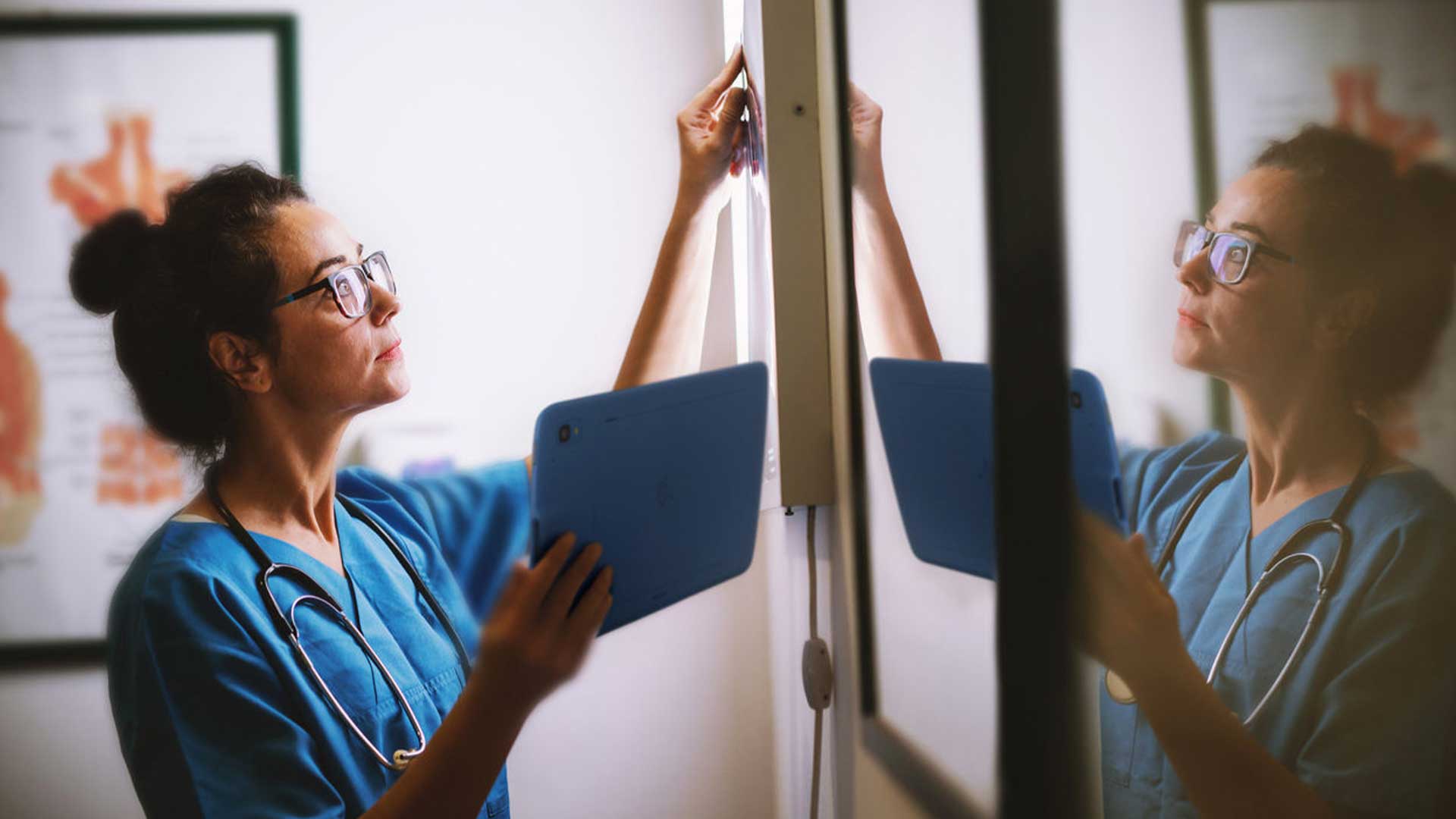

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

Boost productivity with Zebra Frontline AI Enablers: AI vision models, sample apps, and APIs streamline workflows for efficient business processes.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

Getting the Numbers Right: AI Solutions for Grocery Demand Forecasting

The grocery sector was arguably hit as hard by the pandemic as any and is still dealing with the most persistent hangover—namely ongoing supply shortages, inventory imbalances, and excessive spoilage and waste. But I don’t have to tell you that. You’re living it.

You’re keenly aware that chronic out-of-stocks directly equate to lost sales, while spoilage rates for fresh goods—intrinsically between 7-10%, even in the best of times—have become harder to wrangle than ever.

Nearly two-thirds of shoppers who participated in Zebra’s 16th Annual Global Shopper Study say they are still leaving stores without all the items they wanted, and people I know have anecdotally told me that their weekly grocery trip has turned into a virtual “treasure hunt.” If their preferred varieties of milk, eggs, packaged goods, or other staples aren’t available, they’ve become resigned to go without those items for the week – or go to one of your competitors, hoping they’ll have better luck.

Some shoppers are turning to mobile devices to hunt for what they need. Over one-third of shoppers say they’re checking their apps before going to stores to ensure items are in stock, while half say their decision to buy either in store or online boils down to one thing: where can they get what they need.

With inventory visibility – and availability – as important to your customers as it is to your team, you’ve got to keep searching for areas where you can gain a better strategic foothold.

From my perspective, that falls back to demand forecasting.

Now, I know demand has become less predictable as more customers return to stores. The Shopper Study showed a slight dip in the use of mobile ordering for groceries. But is that decline temporary or is that the new norm? I think it’s temporary given that shoppers also said they increasingly prefer retailers who offer buy online, pick up in store and curbside pickup options. And though more shoppers are returning to stores, they are clearly buying groceries online, too. If they weren’t, you wouldn’t have to be working so hard to continuously adapt and re-calibrate inventory around online or app-based shopping, delivery, curbside pickup and other omnichannel options to remain competitive and preserve margins.

So, knowing that things may never truly stabilize, and that pinpointing those elusive “right numbers” across thousands of SKUs has become increasingly challenging, let’s talk about what you need to change to arrive at more consistently accurate forecasts.

First: Let’s just acknowledge that the tumult of the past three years has wreaked havoc on what you used to mostly do on your own, which is projecting sales based on order quantities, store allotment, pricing and promotions, and evaluating historical performance.

Let’s also accept that outmoded, inaccurate sales forecasts are rapidly giving way to demand forecasting, backed by advanced artificial intelligence (AI) and machine learning, which can aggregate a wealth of internal and external datapoints into right-sized, on-hand inventory serving every store, every SKU, and every customer. When a foundation of data-driven insights tells you what you can expect your customers will want to buy, other planning in turn becomes more reliable.

Feel like this is a lot? That you’re not in a position to play around with AI? That it’s too risky given everything you’re up against?

Well, unbeknownst to many store managers, AI is already making a game-changing difference in their own center-store aisles—at least for Direct Store Delivery (DSD) vendors, as my colleague Jasneet Kohli has previously discussed. From beverage companies to iconic bakery brands, algorithm-based tools have redefined predictive ordering, incorporating a wealth of granular-level daily and weekly datapoints affecting every store delivery—including projected seasonal demand, store promotion schedules, even local weather conditions.

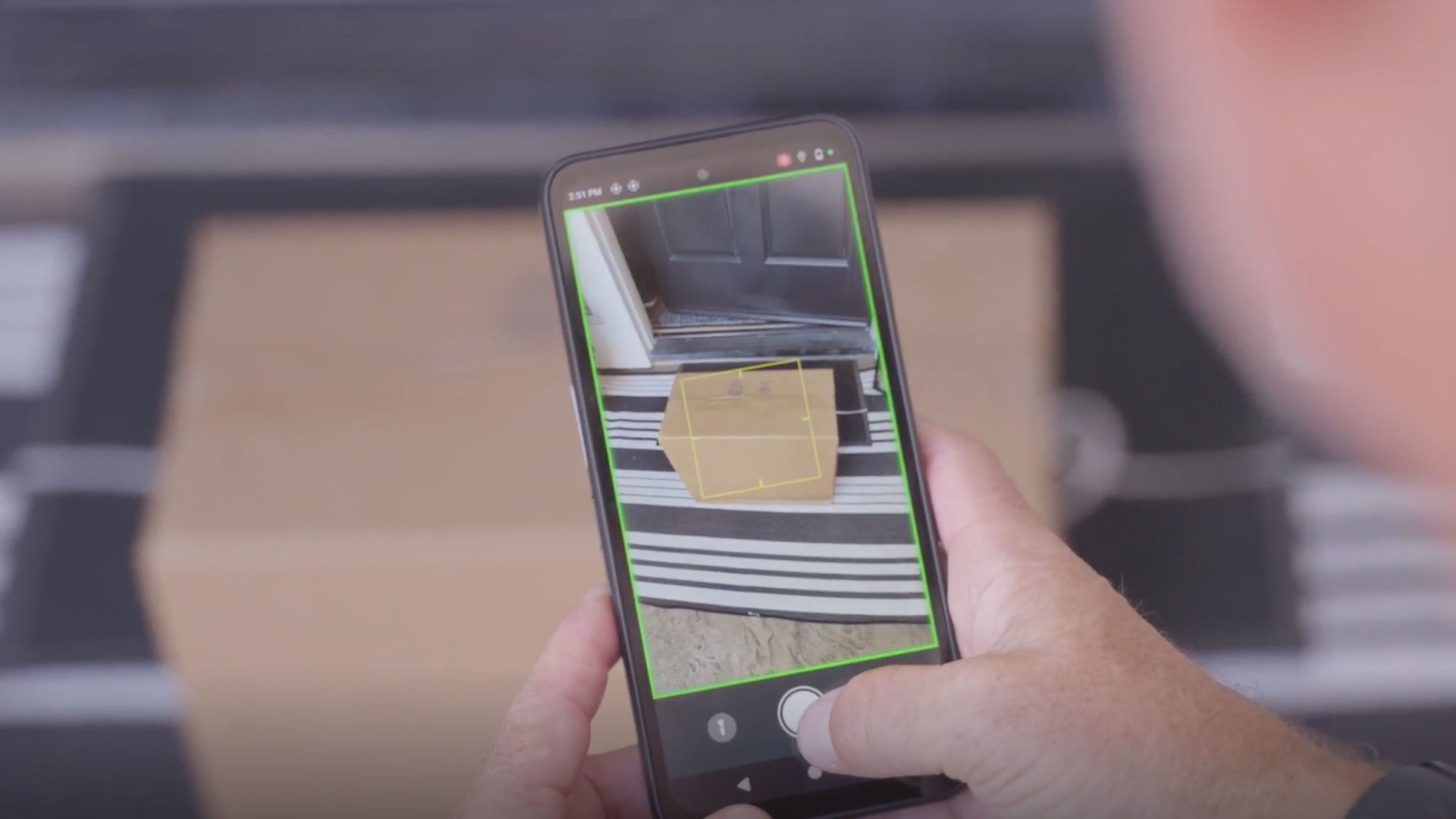

This automated process in turn recommends an optimal order quantity for every stop on a DSD route, which drivers can readily access via a tablet-based user interface. These AI-powered tools make the most efficient use of limited space on every delivery truck, right-sizing individual store deliveries while significantly reducing margin-killing spoilage return rates. They can also incentivize drivers and other workers for doing their jobs more efficiently.

On a scale comparable to grocery, Walgreens—a prime Antuit success story—was among the first nationwide retailers to take the bold leap into data-driven demand forecasting and planning across its 9,000 store locations. A single SKU within one store which may have been once influenced by only a few variables, such as medicines during cold and flu season, may now be potentially nuanced by dozens of intricate real-time internal and external datapoints—from nearby events to local economic conditions to trending social media. This is far more information than a small army of humans and spreadsheets could manually decipher into a data-driven, profit-optimized pricing strategy.

The proven early success of AI-powered demand forecasting among consumer packaged goods companies (CPGs) and drugstores offers strong promise for better managing the larger “universe” of SKUs within the typical supermarket. Syncing inventory and allocation around anticipated customer demand can help reduce those off-putting bare spots on shelves—while at the same time preventing costly excess inventory from clogging warehouses and stockrooms.

Beyond packaged goods in the center-store, we can expect AI-powered demand forecasting to also play an emerging role in the prepared food sections of the store—the bakery and deli, offering grocers greater ability to sync right-sized quantities of raw ingredients and finished product on-hand—where freshness and variety are even more important to discerning customers.

While there may be a bit of trepidation surrounding AI these days, we can point to the positive differences it’s already made for grocers and the retail sector at large by accurately predicting consumer demand and optimizing inventory to better serve the customer—all while strengthening the bottom line.

Whether you’re a grocer or other large retailer, we’d be happy to talk with you about how AI-based software like this can make a real difference toward better serving your customers. You can contact us here when you’re ready.

Zebra Developer Blog

Zebra Developer BlogZebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story HubZebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the BlogSearch the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2026 Zebra Technologies Corp. and/or its affiliates.