What is a Mobile Device Really Going to Cost You? (Probably Not What You Think)

Leaders of almost every enterprise-level organization have come to the realization that mobile computing is a strategic component of their business. Recent data shows that, over the past 15 months, 60% of Fortune 500 companies have purchased a Zebra mobile computing product.

But it’s not just big companies that see the value of mobile technology. More than 25% of the enterprise-grade handheld mobile computers, wearables and tablets like the ones Zebra makes are ultimately used by small and medium-sized businesses (SMBs). That number continues to grow as SMBs invest in technology to increase their competitiveness with enterprise organizations. That’s because mobile computers, when running the right software, help people do more each minute of their day which, in turn, enables them to collectively serve more customers and make more money.

Of course, mobile computers also help companies boost output despite there being less labor because the people who do show up every day are able to work more efficiently when they have a mobile computer in – or on – their hand, ready to assist. These workers can cover down, doing the jobs of multiple people, because they can receive guidance on where to go, what to do, and how to do it. They can also automate status updates, which are more time consuming than people realize, as well as data capture for reporting and inventory management purposes. In other words, mobile computers can be a force multiplier that prevents the labor shortage from dragging revenue down as much, and there’s tremendous value in that.

That’s why I rarely hear anyone asking me to help them justify the cost of handheld mobile computers, wearables, or tablets categorically speaking. They’re going to buy them. They don’t have a choice.

However, everyone wants to know what it’s going to cost them to get their teams equipped with the right mobile technology tools.

But does anyone really know the cost of mobility?

I mean, some simple math will show you what the sticker price will add up to. But the purchase price of a mobile computer or software platform is not the same thing as the cost of mobility. The sticker price – or upfront cost – is just one line item contributing to the total cost of mobility, or the total cost of ownership (TCO) as we more commonly say.

That’s why I’m asked almost every day, “Is it true that buying less expensive mobile hardware is costing organizations 2-3 times more in the long run?”

To which I respond, “yes.”

The cost of mobility can only be determined by the TCO. So, if you’re only considering the upfront cost, you’re likely going to be stuck paying a lot more than you bargained for in the long run.

Fortunately, TCO awareness is growing. A recent VDC Research study found 75% of respondents responsible for building and managing mobile computing portfolios for their workforces are now performing a TCO analysis before investing. Unfortunately, that means that business leaders, industry analysts and even mobility solution engineers like me are increasingly debating what constitutes an accurate TCO number.

I’m not going to sugarcoat it: calculating TCO is no simple task. There is no simple formula, there is no one-size-fits-all approach.

That’s why, today, I want to dive into some of the details of TCO by walking through data received firsthand from Zebra customers along with data extracted from various independent studies. My goal is to equip you with a starting point for doing your own TCO assessment when buying handheld mobile computers, tablets or even wearables. Though we provide nominal values, we expect these will vary by your organization’s specific instance.

Therefore, I want you to remember three things while (and after) reading the rest of this post:

You should meticulously scrutinize TCO when it comes to selecting either an enterprise or consumer device.

If you look exclusively at hardware acquisition costs, you’re missing over 90% of the problem.

The growth of enterprise rugged mobile computers has in large part been driven by lower TCO.

So for you past moviegoers, we dedicate this post to the 1996 movie “Jerry Maguire”:

Talk is cheap. “Show-me-the-money!”

Now, let me answer the most FAQs around TCO…

Q: Is a TCO analysis really necessary? Can’t I just buy the cheapest mobile computer I can find?

Some customers I’ve worked with in the past did just that. That’s why I ended up working with them. Over time, many realized (and studies have confirmed) that the hardware acquisition cost is the proverbial “tip of the iceberg.” Like navigating a ship, it’s the part of the iceberg underneath the surface that you need to watch out for. In fact, several studies have shown that the hardware acquisition cost often represents under 10% of a mobile computing TCO. This realization has in part underpinned the growth of enterprise/rugged devices. As IDC analysts have stated, “The adoption of rugged mobile devices among large enterprises is strong overall, with 41% of U.S. enterprises currently using and planning to purchase more rugged devices.” They went on to say, “Rugged mobile solutions should present a clear return on investment (ROI) over consumer-grade mobile devices for businesses deploying them.”

Q: I know you just mentioned IDC, but I hear a lot about VDC and their TCO studies. Who is VDC and why should I trust their advice regarding TCO?

VDC is an analyst firm that has been reporting on mobile computing TCO for over a decade. Its analysts have performed and documented four separate TCO studies since 2012, and its studies are typically based on data from mobile solution decision-makers in multiple verticals managing anywhere from 50 to 10K+ devices. A large part of the VDC analysis compares TCO factors for enterprise rugged devices vs. consumer smartphones. VDC analysts are, in my opinion, the foremost experts on this topic.

Q: What would you say were the top 3 findings from the VDC studies?

First, enterprise business leaders are increasingly scrutinizing TCO. Secondly, every one of the VDC studies reported that rugged devices offered a significantly lower TCO than consumer devices. And, finally, the two main drivers of TCO are IT overhead and lost worker productivity – not hardware acquisition cost.

Q: Is there data on how much IT spending contributes to TCO?

There is, and for this I can cite multiple independent studies. Much of this calculation depends on an “IT Ratio” (the # of mobile devices per IT technician) and what practitioners report as the number of incidents for consumer vs. enterprise devices. Leveraging these reports, we can derive both the amount of absolute IT spend and estimate the difference in spend between consumer and enterprise solutions.

Let’s start with VDC. First and foremost, VDC reported that “consumer grade devices for frontline mobile solutions experienced a 20% higher service ticket volume in comparison to organizations with rugged mobile devices.” In 2020, VDC reported the average time spent by IT per incident was 64 minutes; this increased to 70 minutes in the firm’s 2023 report. On average, enterprise organizations had a 70:1 IT Ratio (70 mobile devices per each technician), and each technician serviced 85 tickets per month. This equates to 1.2 tickets per device per month.

From this data, we can calculate the increased IT cost to service a consumer device. We start by assuming an IT burdened labor rate of $40/hour. At 70 minutes/ticket, the cost/ticket is $46.67. At 1.2 tickets/device/month, the monthly IT cost is $56.67 or $680 annually. Thus, the 20% increase in consumer incidents yields an incremental overhead for consumer devices of $136/device/year.

A second 2023 study comes from Oxford Economics. Unlike the VDC study, the Oxford study did not focus on enterprise task workers and thus had a very different IT ratio. Oxford reported that it takes 54.1 hours/week to manage 250 employer-issued devices, which equates to an IT Ratio of 185:1 (in contrast to the VDC 70:1). Thus, given the prior parameters, the IT administrative overhead cost is $432/device/year (compared to $680 for VDC), and an incremental overhead for consumer devices of $87/device/year.

From these two studies we can draw several conclusions. First is that, over a four-year service life, the IT administrative overhead per device ranged from $1,728 to $2,720 (the latter being more focused on enterprise task worker use cases). The second conclusion is that, over a four-year service life, the incremental cost for consumer devices equates to $348-$544. That’s a significant cost overhead for just routine IT overhead. Note that this does not include other cost factors incurred during initial provisioning and a portfolio refresh.

As stated earlier and repeated multiple times throughout this post, TCO is a complex, multivariate analysis. So, I strongly recommend you do your own TCO due diligence.

Q: What about lost worker productivity?

According to VDC, lost worker productivity along with IT administrative overhead are the two leading drivers of TCO. The 2023 VDC study found that for each incident, the average worker downtime was 74 minutes, marginally up from the 73 minutes reported in its 2020 study.

Assuming a burdened associate labor rate of $35/hour, at 74 minutes/incident, the cost/incident is $43. At 1.2 incidents/device/month, the monthly productivity loss is $51.80 or $621 annually. Thus, the 20% increase in consumer incidents yields an incremental overhead for consumer devices of $124/device/year. Of course, you can reduce the impact on worker productivity by having a spares pool, but this incurs additional capital expenditures.

Note that this calculation does not factor the impact of incidents on associate and customer satisfaction.

Q: What about device failures?

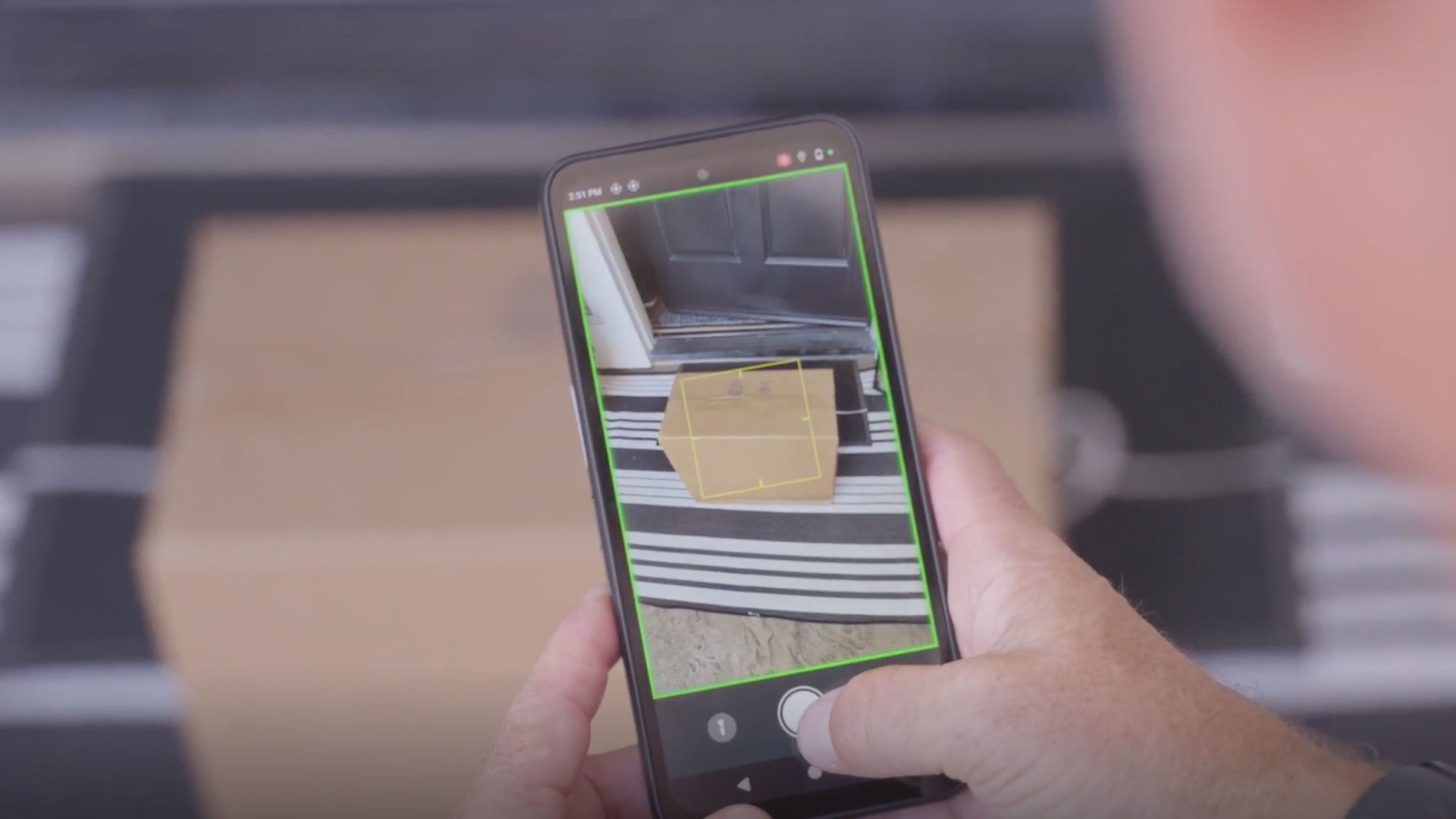

As expected, there is a significant disparity in device failure/survival rates between consumer and enterprise devices in enterprise use cases. Failure rates are impacted by numerous direct and indirect factors. The most predominant direct factor is the durability/ruggedness of the hardware design (i.e., the ability to withstand tumbles and drops). This often represents a challenge for consumer devices in manufacturers’ efforts to minimize size and weight. Nearly half (47%) of the 2023 VDC study respondents reported that cracked displays were the number one issue for mobile devices.

Though durability has a direct impact on failures, there are secondary, indirect factors to consider. One example is device provisioning. Individually assigned devices (versus devices shared among multiple employees) drive direct individual accountability, causing associates to take better care of devices and ultimately leading to fewer failures.

As to the numbers, the 2021 VDC study reported annual failure rates for smartphones and rugged handheld devices for years one through five. This data shows that 63% of consumer devices survived through year three and 47% through year four. In contrast, 85% of rugged devices survived through year three and 78% through year four. If we assume devices are replenished as they fail, then for an initial 1,000 device rollout, at the end of year four you would have procured 1,574 consumer devices vs. 1,231 rugged devices. That’s the purchase of 33% more consumer devices than enterprise devices over a four-year period.

Q: Can procuring Android Enterprise Recommended (AER) devices reduce failures?

Google launched the AER program in 2014. Under AER, qualified mobile handheld solutions are listed as either “knowledge worker” or “rugged” certified. Rugged devices must comply with “MIL-STD-810G or IEC 62-2-32,” thus assuring some degree of durability. With regards to drop and tumble tolerance, these standards are very broad in scope. As such, the durability of even compliant devices may vary significantly. In the case of Zebra, we go well beyond the minimum for standards compliance and additionally perform vibration and thermal shock testing. Therefore, selecting a device listed under AER Rugged is a great start to reducing failures, but it should not be considered an end-all.

Q: As consumers, we’re always paranoid about running out of battery or having devices that no longer take a full charge. How does this reflect on enterprise TCO?

Failures manifest in many ways. In the 2023 VDC study, 11% of respondents reported that batteries lasted a full shift. On the contrary, 89% said batteries were not lasting a full shift. In the 2021 VDC study, 27% said their batteries were lasting a full shift. Thus, the battery problem is worsening. A dead battery may drive a temporary disruption in work or a more sustained failure.

Consumer device manufacturers focus on lightweight, small-sized devices able to run high-end gaming apps with high refresh rate displays, all of which drive battery demands. Battery issues are compounded by wear over an extended lifecycle, ambient temperature, charge/discharge cycles and rates, and numerous other factors. As stated by Apple, “A normal battery is designed to retain up to 80% of its original capacity at 500 complete charge cycles when operating under normal conditions.”

Of course, from a TCO perspective, this brings up the question of serviceability. Consumer device batteries may not be swappable and/or readily replaceable. Replaceable implies a battery that can be replaced by a customer but is expected to be done only several times over the life of the product. Swappable implies that devices can be continually interchanged, a feature of most enterprise rugged devices.

Consumer devices generally have more integrated batteries, which can require housings to be pried open and glue joints dislodged. This has two implications on TCO: the direct service cost to replace the battery (~$50 retail) and the logistics costs associated with the replacement process. Since the device battery may not last a full shift and is not swappable, many organizations equipping workers with consumer devices may opt to procure a second set of devices, enabling them to swap devices from a charging cradle when the battery is depleted. Of course, this potentially doubles the number of devices to procure and manage.

Thus, data has shown us that batteries continue to be an issue creating incidents and/or failures with consumer devices. Depending on service life expectations and numerous other conditions, you may want to increase their device refresh rate and/or allocate funds for battery service if you choose to go this route.

Q: What about lost or stolen devices?

I am always amazed at what customers report as the annual percentage of devices that go lost or stolen (i.e., “attrition”). Attrition numbers vary significantly. In general, business leaders report much higher attrition rates for consumer devices (presumably based on their ability to be resold). We’ve had high-end retailers report that 14-20% of their fleets go missing each year with several reporting well over 20%+ per year. In contrast, we had a retail pharma company estimate losing ~2.5-5% of their Zebra devices annually, and another retailer that was able to significantly reduce device losses after they started using tools such as Device Tracker. Though difficult to find the base data, it has been reported that 4.3% of company issued smartphones are lost or stolen every year. VDC estimates that the theft rate of handheld consumer devices is 227% higher than that of rugged devices. (Empirically, we’ve heard that the difference is much larger).

In any event, any TCO analysis should include a factor for attrition. It’s important to note that Zebra has introduced tools to more closely track and locate Zebra devices, which reduces the rate of attrition as described in this post. You should expect that individually assigned devices, or devices that are checked out to specific individuals, will exhibit lower attrition rates. For TCO budgetary purposes, I recommend using nominal values of 2.5-3.5% per year for enterprise devices and 10-15% for consumer devices.

Q: Do device sales cycles impact TCO?

We’ve seen multiple instances where customers using consumer devices face a “last time buy” immediately after completing a rollout. Consumer device vendors focus on churn, frequently releasing new devices every 12 months with sales cycles of <18 months. Take for example, Samsung. Its Enterprise Edition products are only available for purchase for two years after launch. Even a two-year sales cycle can significantly increase TCO.

When seeking a mobile solution, your organization will often go through a four-step process:

Discovery

Evaluation

Integration

Repatriation and Deployment

Typically, the start of the cycle is not aligned with a new product’s first ship. So, let’s say you start your process six months after a consumer product’s release. The 4-step process above can conservatively take 12 months to execute. You’re now 18 months after the product first ship, putting you right up against an end-of-sale. Now you are left with a choice of doing a large last time buy or purchasing new devices and supporting a mixed portfolio, neither of which is attractive. It is not unusual for an organization to complete its rollout coincident with the last time buy date.

So yes, sales cycle duration impacts TCO. Short sales cycles associated with consumer devices can put you in an unfortunate last time buy/CapEx situation or create an OpEx issue associated with managing a mixed portfolio. You should adjust your TCO models accordingly.

Q: So, TCO is largely driven by service life, which as you’ve described so far is a function of device durability/survivability and sales cycles. Are there other factors impacting service life?

Beyond the sales cycle and failure rates, you need to consider how long you can get service for the device and how long you will get software updates, including security patches and OS upgrades. This is often a fundamental difference between consumer and enterprise offerings. In the case of Zebra, we offer security patches for select devices for up to 10 years. Our Qualcomm SD660-based devices launched on Android Oreo (Android 8) and are currently scheduled to receive Android 14 in 2024. That’s a span of seven OS releases, way beyond what consumer models would typically offer (e.g., 2-4 OS updates).

Q: Are there cost factors often overlooked when performing a TCO analysis?

We’ve had several customers fail to properly allocate budget for the refresh process. They allocate money for procuring replacement devices but assume that somehow older devices are repatriated, and newer devices magically arrive to every associate at zero cost. They also assume that associates know what to do next when the device arrives. Given that consumer device refresh cycles can occur every 2-3 years, or 2-3 times more frequently than enterprise rugged devices, failing to allocate this budget significantly impacts TCO.

Beyond the device refresh cost, you must realize that consumer devices often change form factors, connectors, and/or camera positions, all of which can render existing accessories incompatible (e.g., sled configurations.) Thus, a device refresh may also necessitate an accessory refresh. Compounding this problem is the fact that consumer device roadmaps are held in secrecy, thus enterprise customers may not have advanced notice of such changes.

So customers are advised to make sure to properly account for the basic logistical steps involved in a refresh:

Notify device users of the refresh and provide instructions/actions on the swap process and offer any online retraining if necessary.

Assign IT/admin to unbox incoming new units, install SIM(s) if necessary, and stage/kit/load default configurations.

Rebox and ship units accordingly.

Repatriate older units where applicable.

Note: we estimate that the outside service cost to stage a new device is nominally ~$30/device. You should apply your internal labor and shipping costs for all other tasks.

Q: In the past, you’ve referred to “TBO” in the context of TCO. What is TBO?

The counterpart to “cost” is “benefit.” So, alongside TCO we refer to Total Benefit of Ownership, or TBO. TBO represents a set of first and second order benefits in productivity that your customers and associates experience when leveraging features targeting enterprise applications. This can range from enhanced barcode scanning, to better work-related ergonomics, to improved keyboards for faster, more reliable data entry. We’ve done numerous studies on barcode scanning, showing improvements in acquiring and decoding barcodes, lower rates of mis-decodes, and the ability to read corrupt or mis-formed barcodes. At the end of the day, you should consider productivity enhancements in addition to TBO.

Q: So, it sounds like lowering TCO and increasing TBO can have far reaching impact.

Reducing the cost of mobile computing (TCO) and enhancing the worker experience (TBO) not only directly impacts financials but also drives increased customer and associate satisfaction.

Let me cite the findings of a recent (June 2023) study performed by Northcoast Research. In this study, Northcoast analysts interviewed retail associates that had recently been issued consumer devices in replacement of their enterprise Zebra TCXX mobile devices. Associates shared a common sentiment: “We need the Zebra TCs back. They were so much faster and efficient for item location/tagging/binning/online grocery picking (OGP).”

Does this sound like a happy associate? How do you think customers feel when their orders are taking too long to fill?

This is not a new phenomenon. Here are similar comments from a public blog board (of retail employees) going back in time at a major retailer making the transition from consumer to enterprise devices: “My store rolled out the Zebras last week and they're amazing. I love 'em.” and “Everything about them is better, android, battery life is longer, they scan faster.”

You should therefore consider both sides of the equation, both TCO and TBO. Consider both direct financial implications and indirect factors such as customer and associate satisfaction.

Q: Are there tools available to do a TCO analysis?

Yes, Zebra has a TCO calculator available for you to model both small and large deployments. Due to the complexity and the degree of nuances in performing a TCO, we require that you engage with a Zebra representative for access to the tool. Once again, this tool is not the end-all, but it does provide some degree of configurability. Nominal values are provided based on Zebra and analyst findings, but you can readily override these values. You can either use the tool and its report generation directly or use this as the basis for your own analysis/custom-spreadsheet. Contact your local Zebra representative if you are interested in this resource.

Q: I heard that portfolio TCO is different from device TCO and that we may need to consider both since our organization has multiple devices for different work personas. Is that true?

Yes, you may need to consider both device TCO and portfolio TCO.

We don’t have the exact number, but a high percentage of Zebra customers have multiple device types deployed in order to meet the needs of various work personas. And the reality is that it’s rare for any organization to give every worker the same device model from the same manufacturer. In retail environments, for example, there may be four different personas (or roles) that need mobile technology: warehouse associates, back-of-store stock management teams, store floor associates, and managers. To optimize worker productivity, each persona/role may warrant a different device. This can create a very fragmented environment of hardware, software, accessories, vendors, user experiences (UX), operating systems, management functionality, app development, etc., ultimately leading to a high portfolio TCO.

This topic has come up with retail customers I’ve met with who were considering Apple iOS devices. They see the suitability of iPhone for the store manager, but do not consider it suitable for the other personas. Fragmenting the portfolio is a costly option. They prefer a high degree of portfolio commonality (sometimes called “platforming”). This has been a primary advantage of Android – the flexibility to span multiple device form factors (i.e., handheld, wearable, tablet), types (i.e., rugged vs. knowledge worker) and model/OS version – as it enables you to potentially choose a single device manufacturer/vendor, assuming they have a broad portfolio of devices with a high degree of commonality (i.e., Zebra).

Q: I know Zebra has different device tiers. I’ve heard them often referred to as Premium and Essential (or Value). How does this “tiering” fit into a TCO evaluation?

Before answering this question, I want to reiterate that hardware acquisition cost is generally a small percentage of TCO.

We use the term “tiering” to categorize devices, but the term can be misleading. The benefits of what we call a “premium” tier device may not necessarily map equally to all use cases. Zebra “Premium” tier devices such as a TC7x are more durable, rugged, and typically have a longer service support life (software support, sales availability, etc.), but they typically have a different form factor or ergonomic design than our value-tier devices. In a relatively benign use case, or in an individually assigned usage model, a value – or "Essential” – tier (i.e., TC2x) device may have more than adequate service life. These are the scenarios where a consumer device may be considered, but business leaders recognize that even a “value-tier” Zebra TC2x device can have up to six years of software security patches – which the competing consumer device may not. Therefore, the durability – and benefits – of the value-tier enterprise device still exceeds a consumer device, and the embedded Zebra Mobility DNA software will lower IT administrative overhead and device downtime.

Q: How can I get the analyst reports you referred to?

Zebra has permission to leverage and quote the findings; however, we cannot provide these reports directly to you. If you want the actual report, you must go directly to the respective analyst (i.e., www.vdcresearch.com). Each VDC TCO study varies slightly in structure, so you should not assume that the most recent 2022/2023 report is a superset of all findings.

REMEMBER

The goal of a TCO analysis is to ensure you are properly assessing both CapEx and OpEx in your mobile solution assessment. Upfront CapEx tends to be more deterministic and tractable, so it tends to get most of the attention. But it’s CapEx over time and OpEx that are the real dominant component drivers of TCO. As always, Zebra employees and partners are available to help you in your analysis. Feel free to reach out to your Zebra representative to discuss further in the context of your business.

###

Related Reads:

Bruce Willins

Bruce Willins is a Technology Solutions Engineering Fellow at Zebra Technologies.

He has over 30 years of experience in the marketing and development of high technology products and has served in numerous senior level positions, including Vice President of Engineering for Hauppauge Computer, Vice President of R&D at Symbol Technologies, Vice President of Engineering / General Manager, Strategic Business at SMC Networks and President/Founder of Netways Inc.

Mr Willins is a past member of the Motorola Science Advisory Board (SABA) and a Symbol Technologies Fellow. He is the recipient of the IEEE Charles Hirsch award, has numerous patents and is a frequent lecturer.