Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimize workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Learn how Zebra's public sector technology solutions empower state and local governments to improve efficiency with asset tracking and data capture devices.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of Banking technology solutions enables banks to minimize costs and to increase revenue throughout their branch network. Learn more.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customize your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organization to better manage and optimize your critical assets and create more efficient workflows.

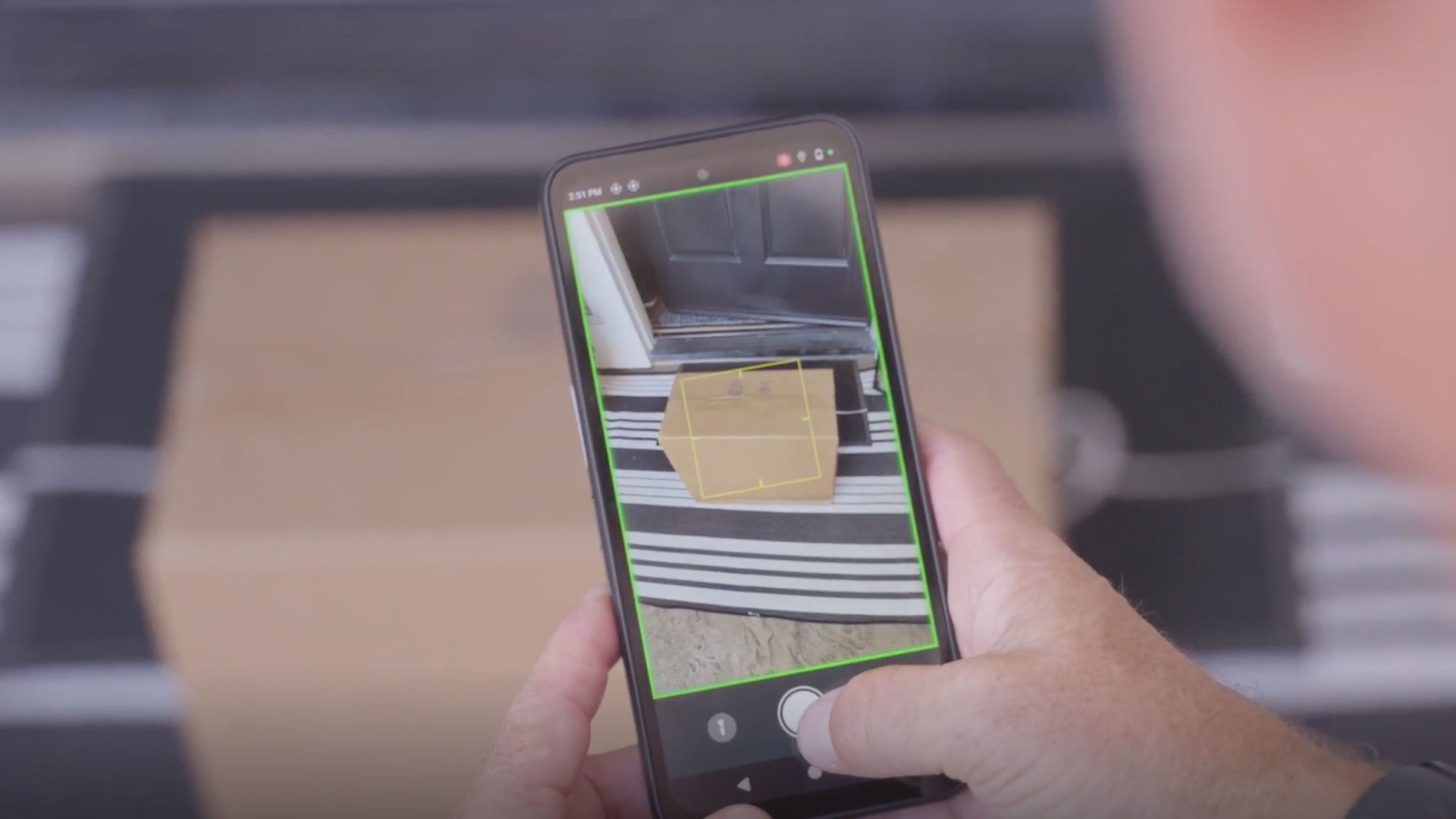

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

Boost productivity with Zebra Frontline AI Enablers: AI vision models, sample apps, and APIs streamline workflows for efficient business processes.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labor costs low, your talent happy and your organization compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximizing IT resources and minimizing down time.

Make the most of every stage of your scanning journey from deployment to optimization. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customization starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximize productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

The Zebra Knowledge Center provides learning expertise that can be tailored to meet the specific needs of your environment.

Zebra has a wide variety of courses to train you and your staff, ranging from scheduled sessions to remote offerings as well as custom tailored to your specific needs.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

Protecting Bank Branches from Regulatory Pitfalls: The Communication Compliance Challenge

It’s been a turbulent time in the financial world. Major investment arms of big banks have found themselves under scrutiny, shouldering hefty fines for using non-compliant communication tools. While headlines might focus on these departments, the ripple effect of such regulatory pitfalls can permeate into other banking areas - notably bank branches.

Now, I’ve been in banking for a long time, and I can’t stress enough how critical it is for us to learn from these events. When it comes to bank branches, the challenges they face might be different, but they're no less significant.

In Zebra’s Fourth Annual International Branch Banking Employee Survey, we found that a staggering 88% of respondents admitted to using non-bank communication tools to complete their work. Even more concerning? More than half (55%) had shared or seen shared Personally Identifiable Information (PII) - either about colleagues or customers - on platforms like WhatsApp or iMessage. These figures aren’t just numbers; they represent a brewing storm of potential non-compliance.

Such unauthorized channels can leave your bank exposed to the possibility of leaked confidential business information or even customer data. And it's not just about the direct implications, such as fines or legal actions. There's a more profound impact: reputational damage. It's hard to put a price tag on trust, but once lost, it's even harder to regain.

The modern customer is both informed and concerned. According to “The Deloitte Center on Financial Services’ Privacy Survey 2020”, a significant 64% of participants asserted that privacy is a top consideration every time they interact with their financial institutions. Beyond that, over six in 10 respondents expressed their concern about sharing personal identifiers like their names or Social Security numbers. Given this backdrop, your bank can’t afford any mistakes upholding the sanctity of their data.

So, how do you move ahead? How do you navigate these challenges to ensure that your bank branches are not just compliant but are also efficient and responsive to both employee and customer needs?

Centralize All Workplace Communications: In my time in banking, I've seen plenty of technological shifts. But centralizing communication stands out as an imperative. By ensuring that all workplace communication happens on one unified system, we can maintain control, enforce compliance, and improve efficiency. Moreover, this unified approach, accessible from a mobile device, ensures timely delivery and receipt of vital information, enhancing accountability.

Enable Peer-to-Peer Group Chats: As banking becomes more collaborative, the role of peer-to-peer communication cannot be understated. But it needs to be managed effectively. By introducing compliant group chats, you can foster better communication without compromising on regulatory requirements.

Harness the Power of Advanced Analytics: The digital age is all about data. With the right analytical tools, banks can not only track message read and response rates but also identify real-time trends, ensuring continuous adherence to compliance. Such proactive oversight can help in identifying and addressing potential pitfalls before they balloon into major issues.

The banking world, as I've experienced it, has always thrived on proactivity. As consumer demands and regulatory landscapes evolve, it's no longer enough to be reactive. Instead, we need to work together to stay ahead of the curve, anticipate challenges, and develop strategies that not only mitigate risks but also enhance our service offerings.

To this end, integrating real-time communication solutions is more than just a technological upgrade; it's about reshaping how we operate, communicate, and serve as bankers – as trusted financial managers and advisors.

Banking is, and always will be, about relationships. It's time we use modern tools to fortify these relationships, ensuring trust, compliance, and efficiency in every interaction.

If you’re keen on delving deeper into how you can leverage these solutions to elevate your bank branches, I'd encourage you to connect with me and my team directly. As the adage goes, "Forewarned is forearmed." Let's arm ourselves for the future, together.

Zebra Developer Blog

Zebra Developer BlogZebra Developer Blog

Are you a Zebra Developer? Find more technical discussions on our Developer Portal blog.

Zebra Story Hub

Zebra Story HubZebra Story Hub

Looking for more expert insights? Visit the Zebra Story Hub for more interviews, news, and industry trend analysis.

Search the Blog

Search the BlogSearch the Blog

Use the below link to search all of our blog posts.

Most Recent

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2026 Zebra Technologies Corp. and/or its affiliates.