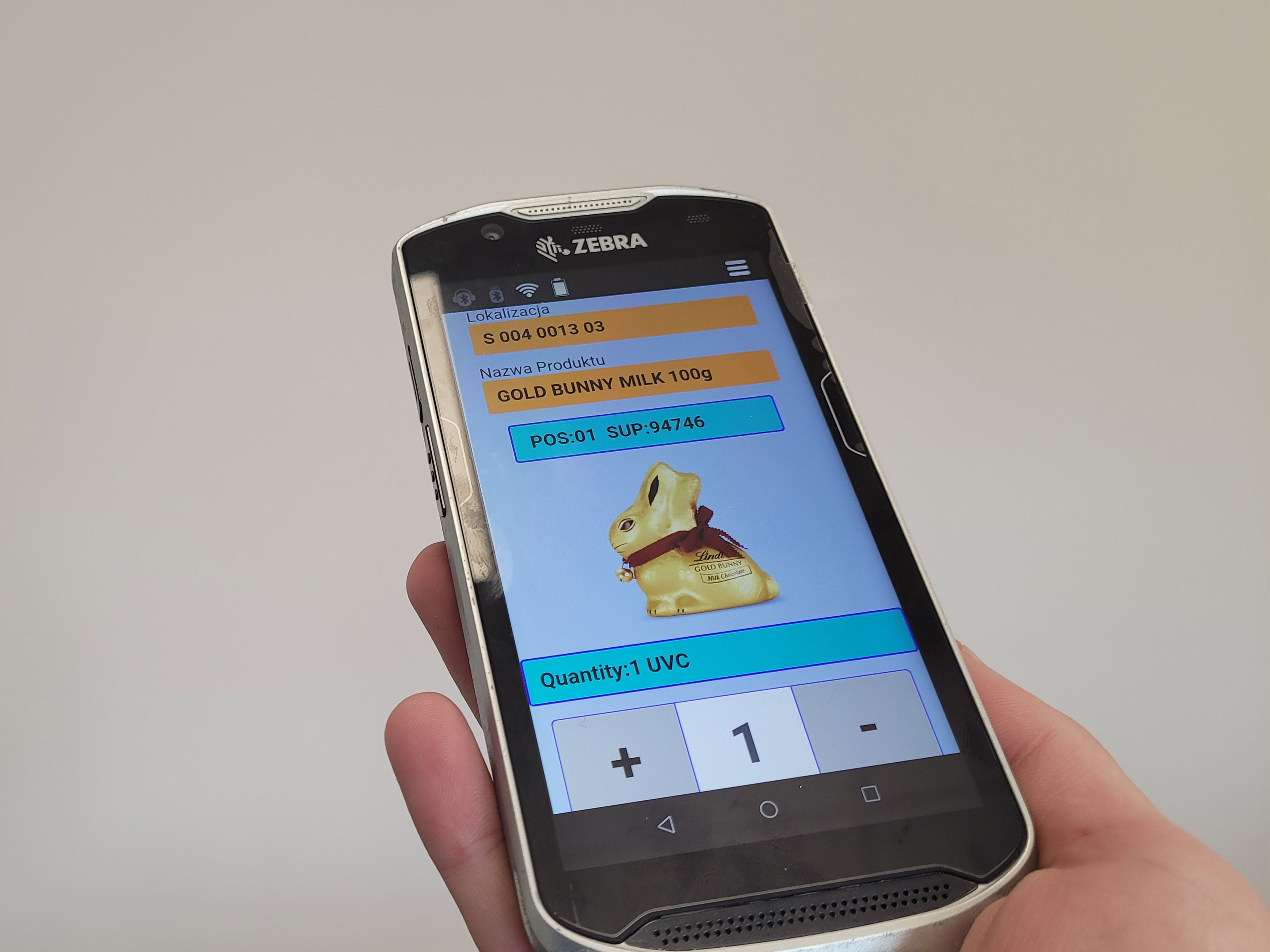

Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimise workflows.

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Zebra's public sector technology solutions enhance decision-making, streamline operations, and safeguard communities with advanced software and rugged hardware.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

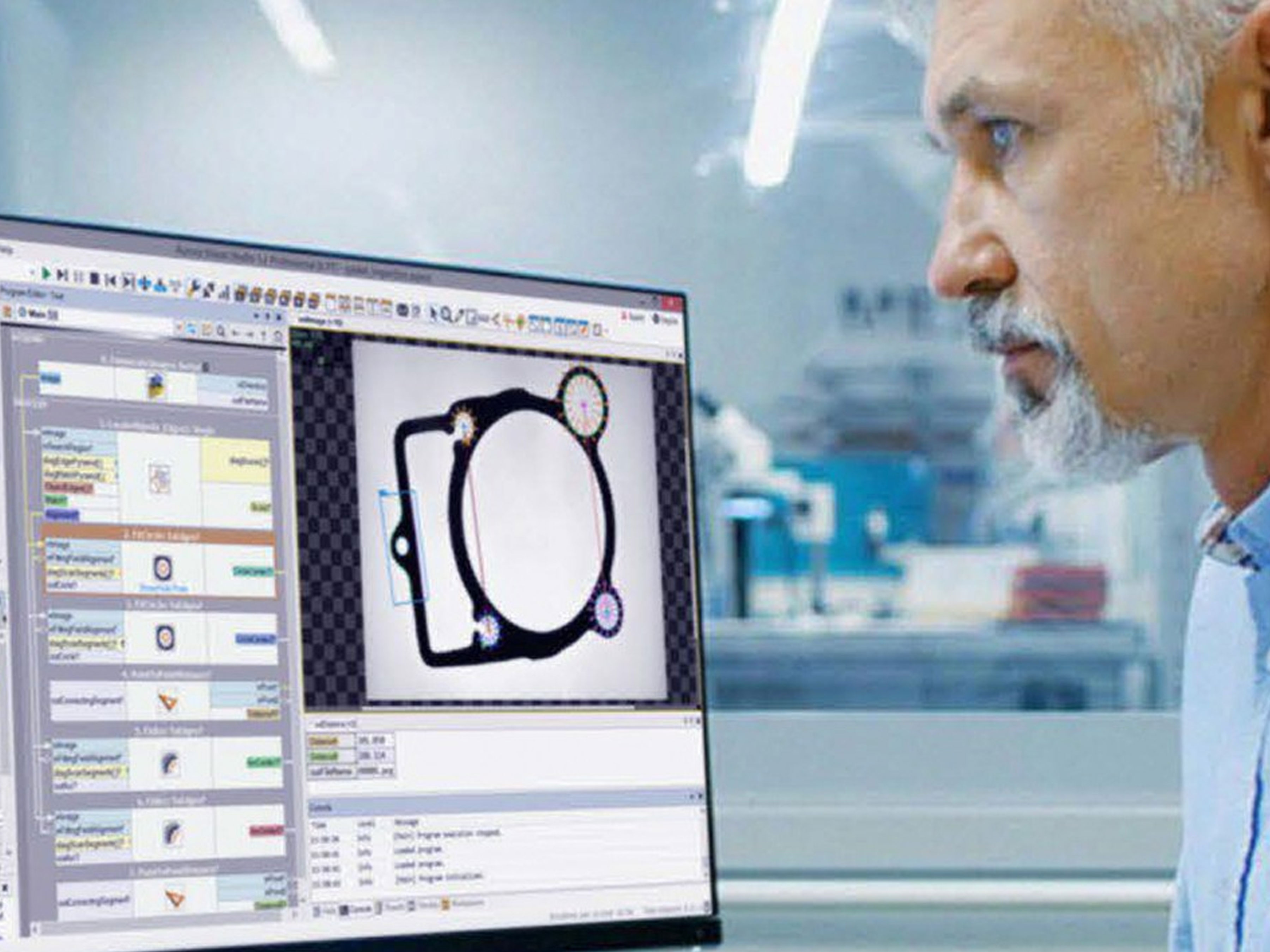

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customise your mobile device for optimal efficiency.

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organisation to better manage and optimise your critical assets and create more efficient workflows.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

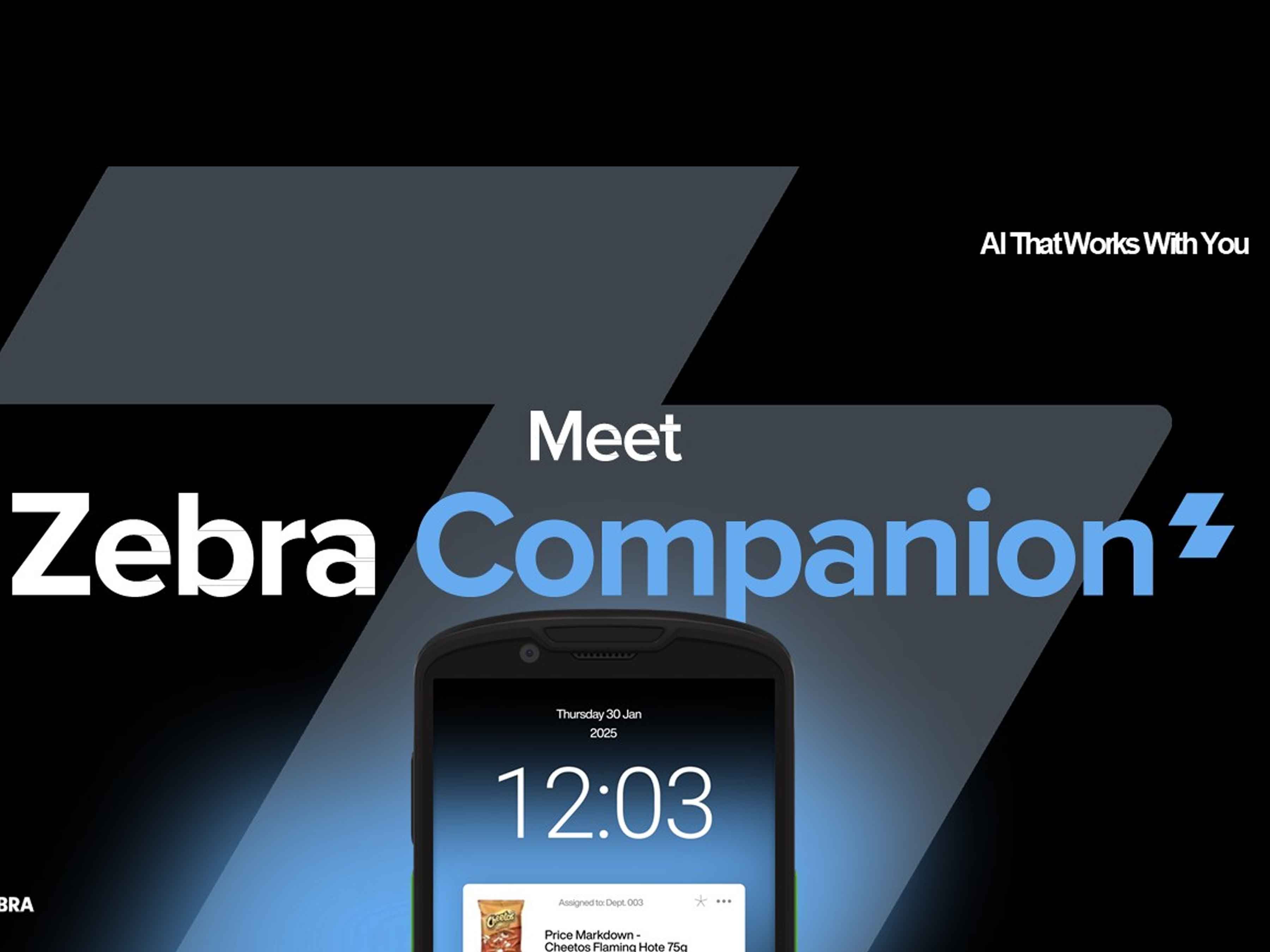

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

Boost productivity with Zebra Frontline AI Enablers: AI vision models, sample apps, and APIs streamline workflows for efficient business processes.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labour costs low, your talent happy and your organisation compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximising IT resources and minimising down time.

Make the most of every stage of your scanning journey from deployment to optimisation. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customisation starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximise productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

Press Releases

Latest Press Releases

Zebra Technologies Helps Sentinel Cut Defect Rates by Up to 15% for Automotive Customers

More

Zebra Technologies Appoints Melissa Luff Loizides as Chief People Officer

More

Zebra Study: 88% of Retailers in Europe Believe Gen AI to Have Significant Impact on Loss Prevention

More

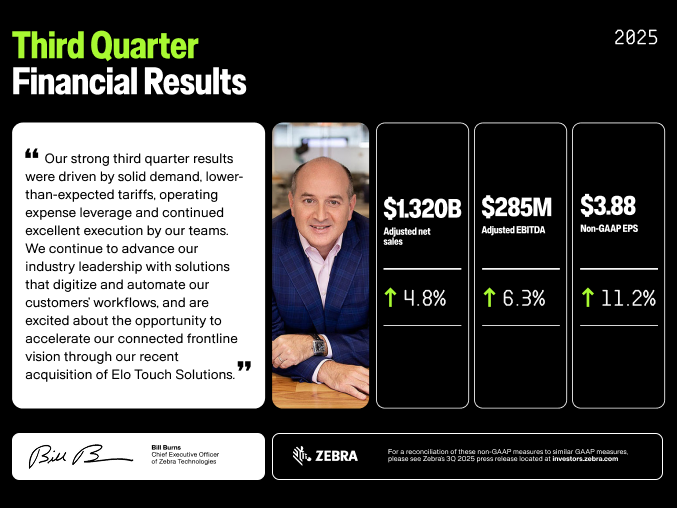

Zebra Technologies Announces Third-Quarter 2025 Results

More

Sentinel Vision Improves Injection Moulding Inspection with Zebra Technologies’ Machine Vision

More

Zebra and Salesforce Introduce Retail Cloud POS Solution on Android to Streamline Store Operations

More

Polytag Unlocks Real-Time Recycling Traceability with Zebra Machine Vision Software

More

Zebra Technologies Completes Acquisition of Elo to Accelerate Connected Frontline Experiences

More

Zebra Technologies Jumps to Top Ten on Fast Company’s 2025 Best Workplaces for Innovators List

More

Zebra Study with Oxford Economics: Automation of Workflows Drives 20% Increase in Productivity

More

Zebra Technologies to Acquire Elo to Accelerate Connected Frontline Experiences

More

Zebra Technologies and Clearview Launch Industrial Automation Centre of Excellence

More

Zebra Technologies Launches FR55 Mobile Computer to Support First Responders

More

Zebra Technologies Introduces Sleek Enterprise Mobile Computer to Boost Frontline Productivity

More

Zebra Technologies Celebrates Six Red Dot and Two iF Design Awards 2025

More

Currys Saves 900 Management Hours with Zebra Technologies Workcloud Software Suite

More

Dimar Group Cuts Operation Time in Half with Zebra Intelligent Automation Solutions

More

Zebra Recognises AI Developer Challenge Winners for Visionary Approaches to Increase Frontline Efficiency

More

Zebra Technologies and Merck Collaborate to Create Safety and Traceability Solutions

More

Zebra Technologies Unveils Solutions Advancing Intelligent Automation at ProMat 2025

More

Zebra Technologies Empowers First Responders with Channel Public Sector Specialisation

More

Zebra Study: 79% of Bank Employees Say Streamlining Administrative Tasks Boosts Job Satisfaction

More

Zebra Technologies Completes Acquisition of Photoneo

More

70% of Frontline Workers Report Rising Concerns with Injuries on the Warehouse Floor

More

Zebra Technologies Expands Symmetry Fulfillment Solution to Increase Productivity with 30% Fewer Robots

More

Zebra Technologies Introduces New AI Solutions to Empower Retail Frontline Operations

More

Zebra Technologies Named a Major Player in IDC MarketScape: Worldwide Retail Promotions Management 2024–2025 Vendor Assessment

More

Zebra Technologies to Acquire Photoneo, Expanding Its Portfolio of 3D Machine Vision Solutions

More

Zebra Technologies Recognized on Forbes’ Inaugural List of Most Trusted Companies in America

More

Computerworld Names Zebra Technologies to 2025 List of Best Places to Work in IT

More

Zeelandia Saves Time and Money with Zebra Technologies Fixed Scanning Solution

More

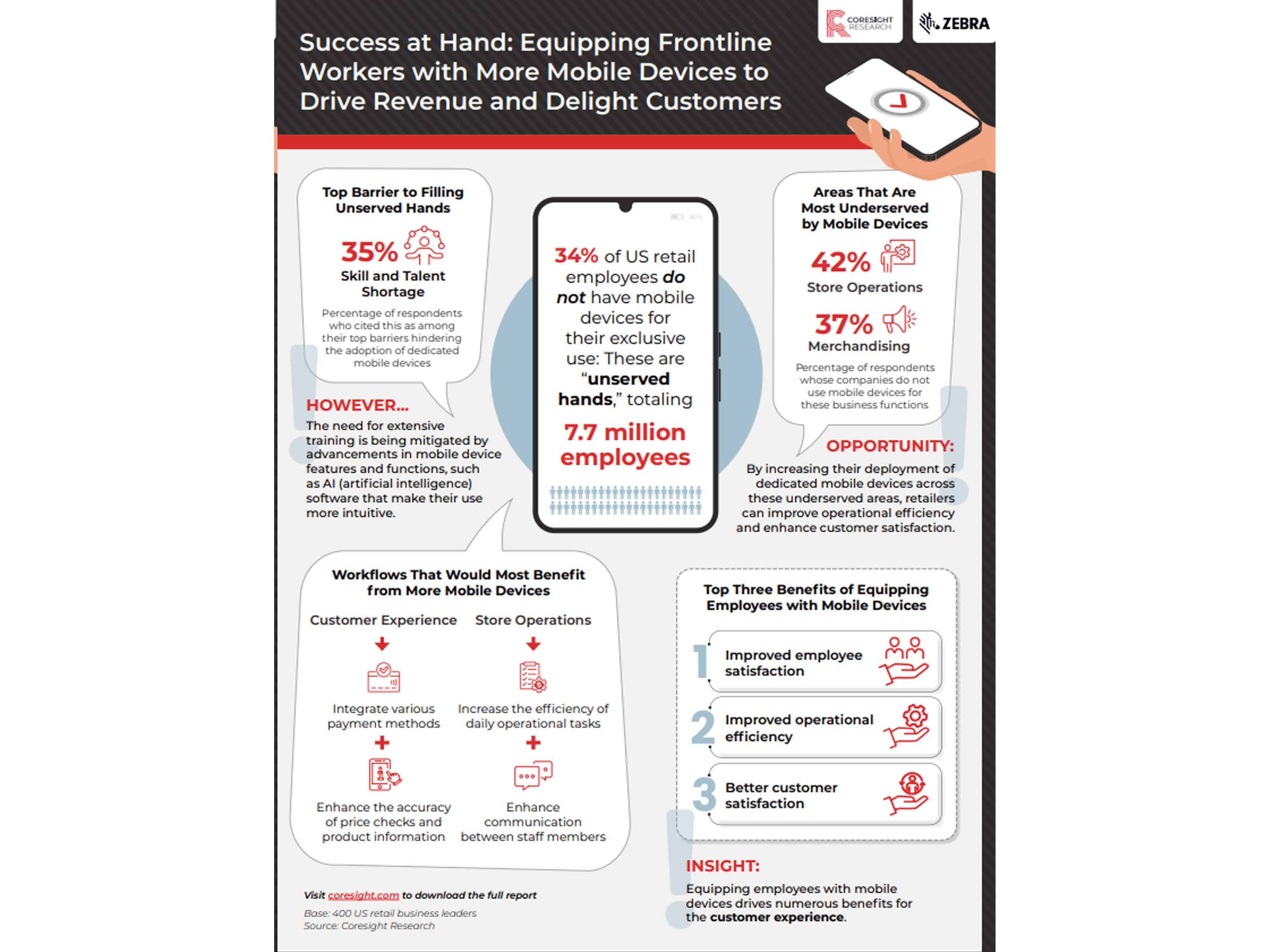

New U.S. Report: One in Three Retail Associates Lack Individual Mobile Devices

More

87% of Retail Associates in Europe Concerned About Loss Prevention, According to Zebra Study

More

JAS Jet Air Service SPA Achieves Zero Error Count with Zebra Technologies’ RFID Solutions

More

DPD Drivers Can Scan Up To 1,000 Parcels A Day with Zebra Mobile Computers

More

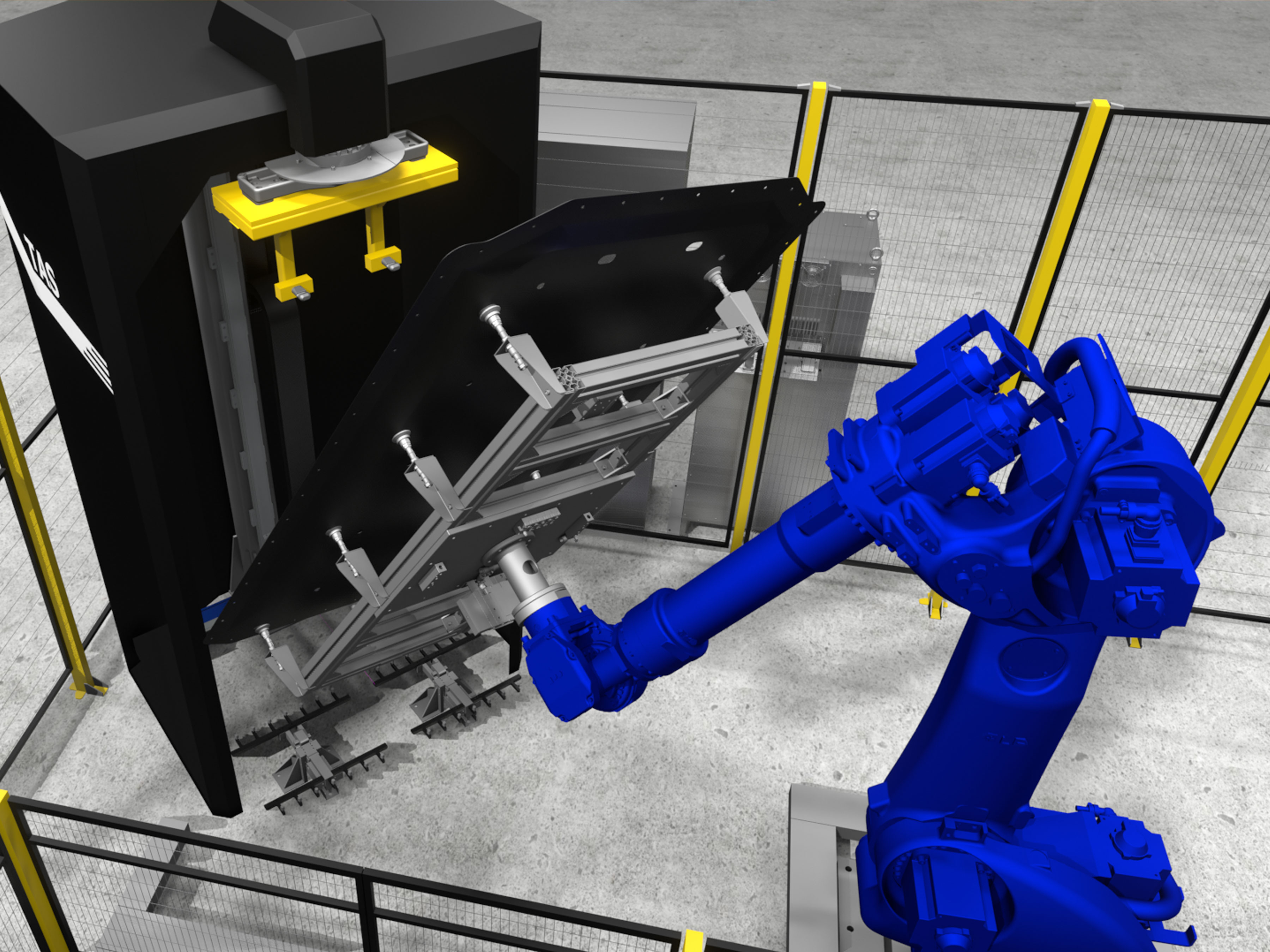

TAS Enhances Electric Battery Production with Deep Learning by Zebra Technologies

More

Zebra Technologies Introduces Solutions to Increase Retailers’ Efficiency at ZONE Conferences

More

Zebra Technologies Among Fast Company's 100 Best Workplaces for Innovators

More

Zebra Technologies Adds New Deep Learning Tools to Aurora Machine Vision Software

More

Zebra Technologies Empowers Future Tech Leaders with Global Internship and Development Programs

More

Zebra Technologies Launches AI Developer Challenge to Drive Innovation

More

Zebra Technologies Named a Best Place to Work for People with Disabilities

More

I.D.E.A. Inspects 200 Different Automotive Brake Discs with Zebra Technologies Machine Vision

More

Iperal Optimises Costs and Shopper Experience with Zebra Technologies Self-Scanners

More

Zebra Technologies to Release Second Quarter Results on July 30

More

Zebra Study: Only 15% of European Manufacturers Have Real-Time Visibility into Manufacturing Production

More

Zebra Technologies Named on U.S. News & World Report’s Best Companies to Work for List

More

Zebra Technologies Brings Deep Learning Machine Vision to The Battery Show Europe

More

Zebra Technologies Launches Fixed Industrial Scanner for AI Applications and Powerful 3D Sensors

More

Zebra Technologies to Present at the Bernstein 40th Annual Strategic Decisions Conference

More

Ken Miller Joins Zebra Technologies Board of Directors

More

Zebra Study: 84% of U.S. and UK Hospital Leaders Prioritize Digitizing Inventory Management Solutions

More

Zebra Technologies to Host Innovation Day on May 14

More

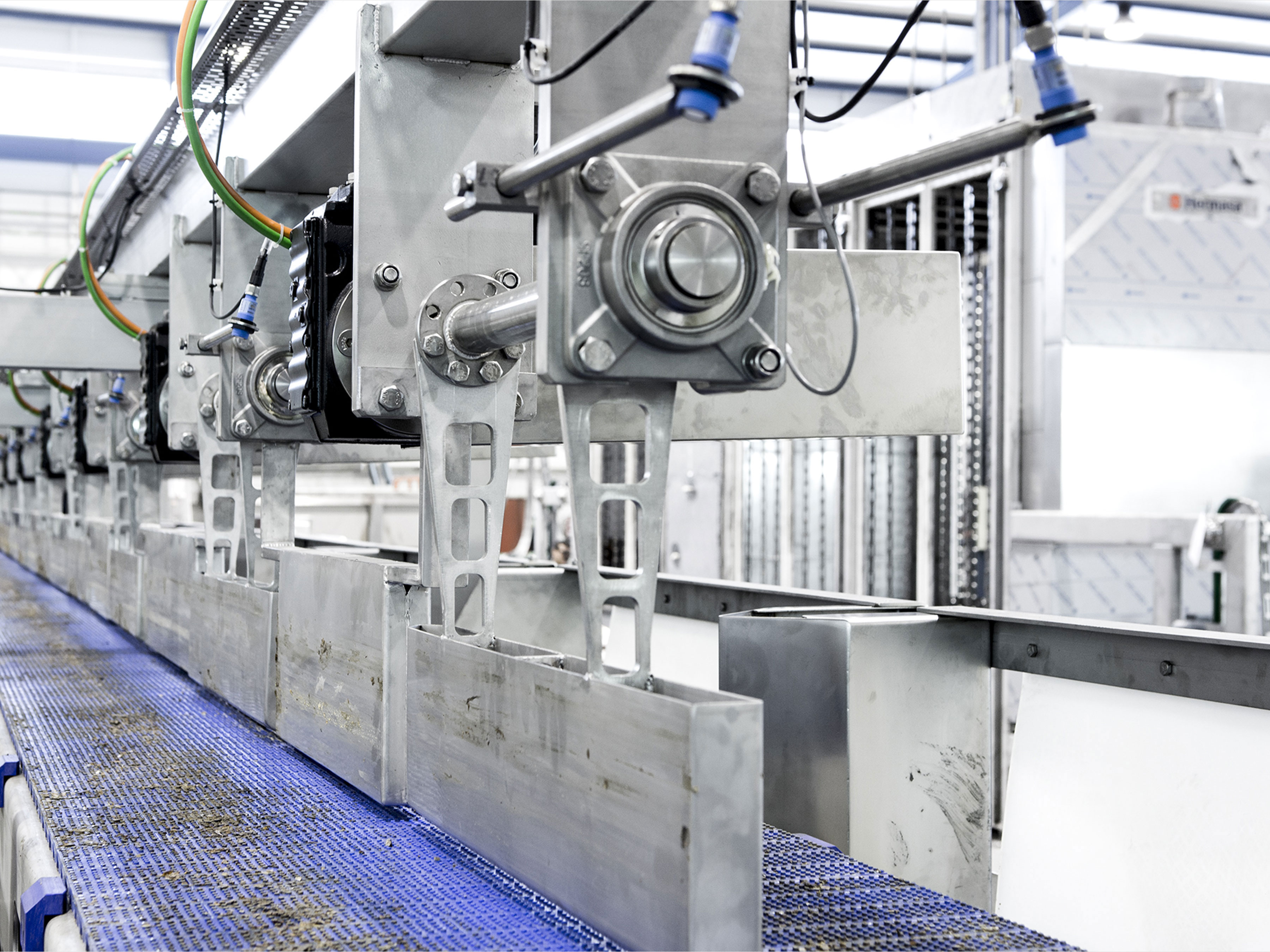

Industrial Bakery Increases Throughput, Lowers Errors with Zebra Technologies Machine Vision

More

Zebra Technologies Launches New Sustainability Partner Recognition Program Globally

More

Zebra Technologies to Unveil New Generative AI Capabilities at Google Cloud Next

More

Frozen Fish Inspection Approaches 100% Accuracy with Zebra Technologies’ 3D Sensors

More

Zebra Technologies Sponsors NFL Health & Safety Summit to Enhance Player Performance

More

BigChange Selects Zebra Technologies to Support Its Business Transformation and Growth Plan

More

Branch Bank Managers Say Modern Technology Would Improve Job Satisfaction

More

Autodemolizione Pollini Group Improves Car Recycling Processes with Zebra Technologies

More

A Super Bowl LVIII Preview with Next Gen Stats

More

United States Postal Service Selects Zebra Technologies for Printer Technology Refresh

More

Zebra Technologies Introduces Ultra-Rugged Mobile Computer to Improve Workflow Efficiency

More

Zebra Technologies Voted Top Software Vendor in 2024 RIS Software LeaderBoard

More

Zebra Technologies’ New Healthcare-Grade Mobile Computers Elevate Patient Care

More

Verizon Business, Zebra Launch Device and Software Solutions to Accelerate Private 5G

More

Over Half of UK Automotive Industry Companies Now Using AI for Machine Vision

More

Over 80% of Retailers Challenged by Shrink; Better Analytics Can Drive Profitability

More

Zebra Technologies Unveils Reimagined Software Portfolio at ZONE Customer Conferences

More

MPREIS Transforms Operations with Zebra Workcloud Task Management™ Software Solution

More

Zebra Technologies Demonstrates Generative AI on Devices Powered by Qualcomm

More

Zebra Study: Nearly Six in 10 Warehouse Leaders Plan to Deploy RFID by 2028

More

Zebra Technologies Introduces Zebra Pay™ Enterprise-Grade Mobile Payment Solution

More

Aramtec Selects Zebra Technologies to Digitally Transform its Warehouse Operations

More

ID Logistics Polska Chooses Zebra to Increase Capacity; Boosts Warehouse Productivity by 15%

More

Zebra Technologies Helps NHS Hospital Boost Efficiency, Saving Nearly 90,000 Staff Hours Annually

More

Zebra Tops Its Category on Fast Company’s 2023 List of Best Workplaces for Innovators

More

Zebra Technologies Launches TC22/TC27 Mobile Computer for Enterprise-Grade Manageability and Productivity

More

Zebra Technologies’ Latest Android Rugged Tablets, ET6x Series Extend Versatility, Efficiency

More

Newsweek Names Zebra Technologies to 2023 Top 100 Global Most Loved Workplaces

More

GEODIS Enhances Dock Operator Capabilities with Zebra Technologies Solution on Android™ Platform

More

Machine Vision and Robotics Automation Will Support Italy’s Sustainable Manufacturing Recovery

More

Zebra Technologies Reinforces Commitment to UK Aerospace, Defence and Security Industry

More

Satish Dhanasekaran Joins Zebra Technologies Board of Directors

More

Zebra Technologies Showcases ‘Triple Key’ to Unlock Future of Public Safety

More

Zebra Technologies Grows Mobile Robotics Specialisation for Partners

More

Zebra Technologies Recognized for Mobile Healthcare Innovation in 2023 MedTech Breakthrough Awards Program

More

Zebra Technologies Debuts New Solutions at LogiMAT

More

Healthcare Providers Face ‘Triple Squeeze’; Enhanced Technology and Communication Are Best Remedy

More

Zebra Technologies Appoints Joe White as Chief Product and Solutions Officer

More

CDP Names Zebra Technologies to 2022 Supplier Engagement Leaderboard

More

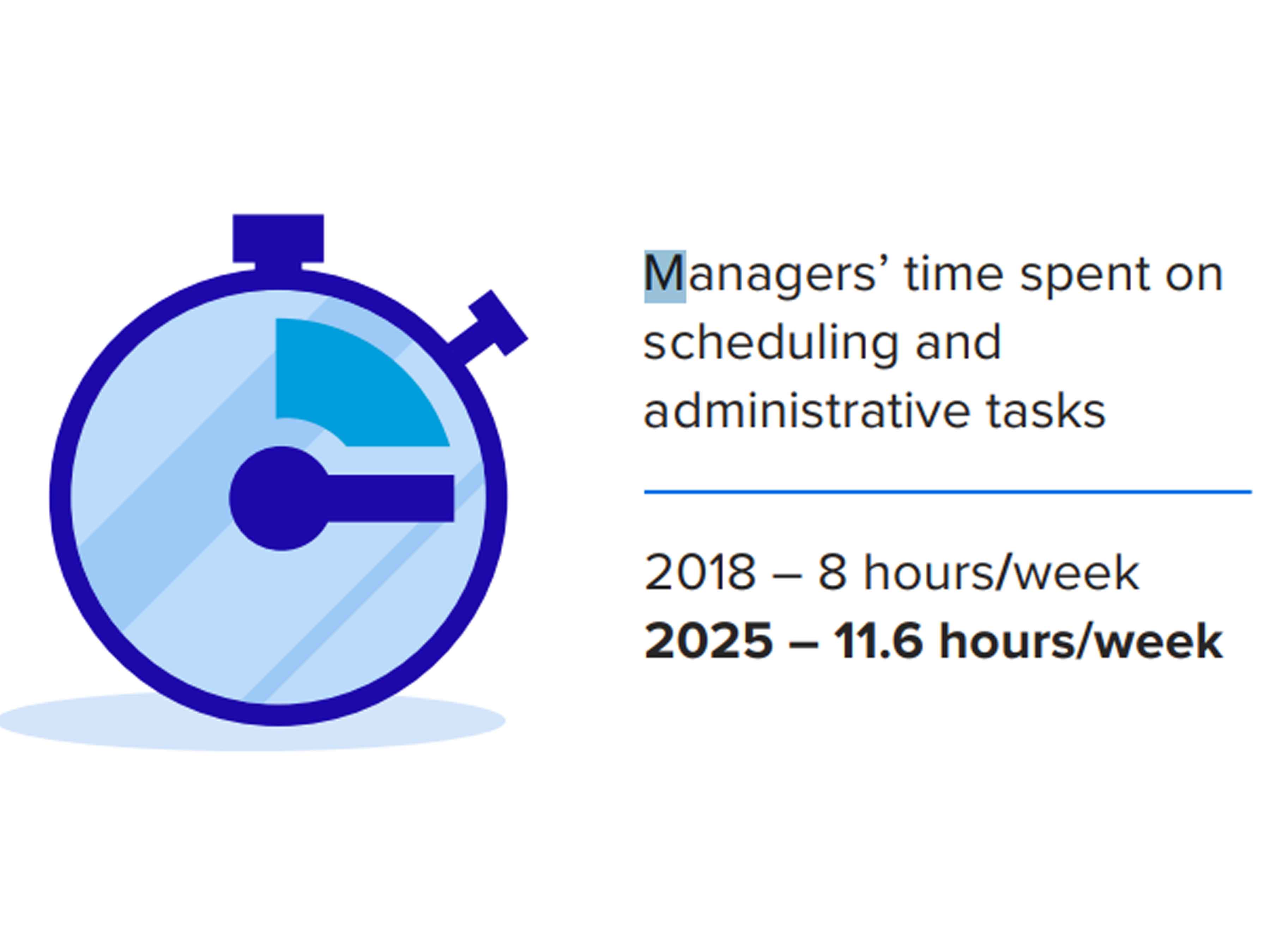

Branch Banking Survey Shows Managers Waste Almost 25% Of Their Time On Scheduling

More

Zebra Presents Warehouse Solution Built on Industry 5.0 Human-Centred Automation at IntraLogisteX

More

Waterman Onions Digitises Its Logistics Operations with Zebra Technologies

More

Zebra’s New Environmental Sensors Increase Supply Chain Visibility in Food, Pharmaceutical and Healthcare Industries

More

Zebra Technologies Appoints Rob Armstrong as Chief Marketing Officer

More

CEWE Automates Production Workflows with Zebra Technologies’ Fixed Industrial Scanning Solution

More

Zebra Technologies’ New Visionary Framework and Insights Take Centre Stage at EuroShop

More

Retailer Bonita Transforming Store Operations with Zebra’s Task Management Software Solution

More

FITT Optimises Warehouse and Yard Operations with Zebra Technologies’ Warehouse Mobility Solution

More

Stuart Achieves 70% Warehouse Productivity Gains with Comprehensive Solution from Zebra Technologies

More

Zebra Technologies Launch Advanced Tier Machine Vision Specialization for Partners

More

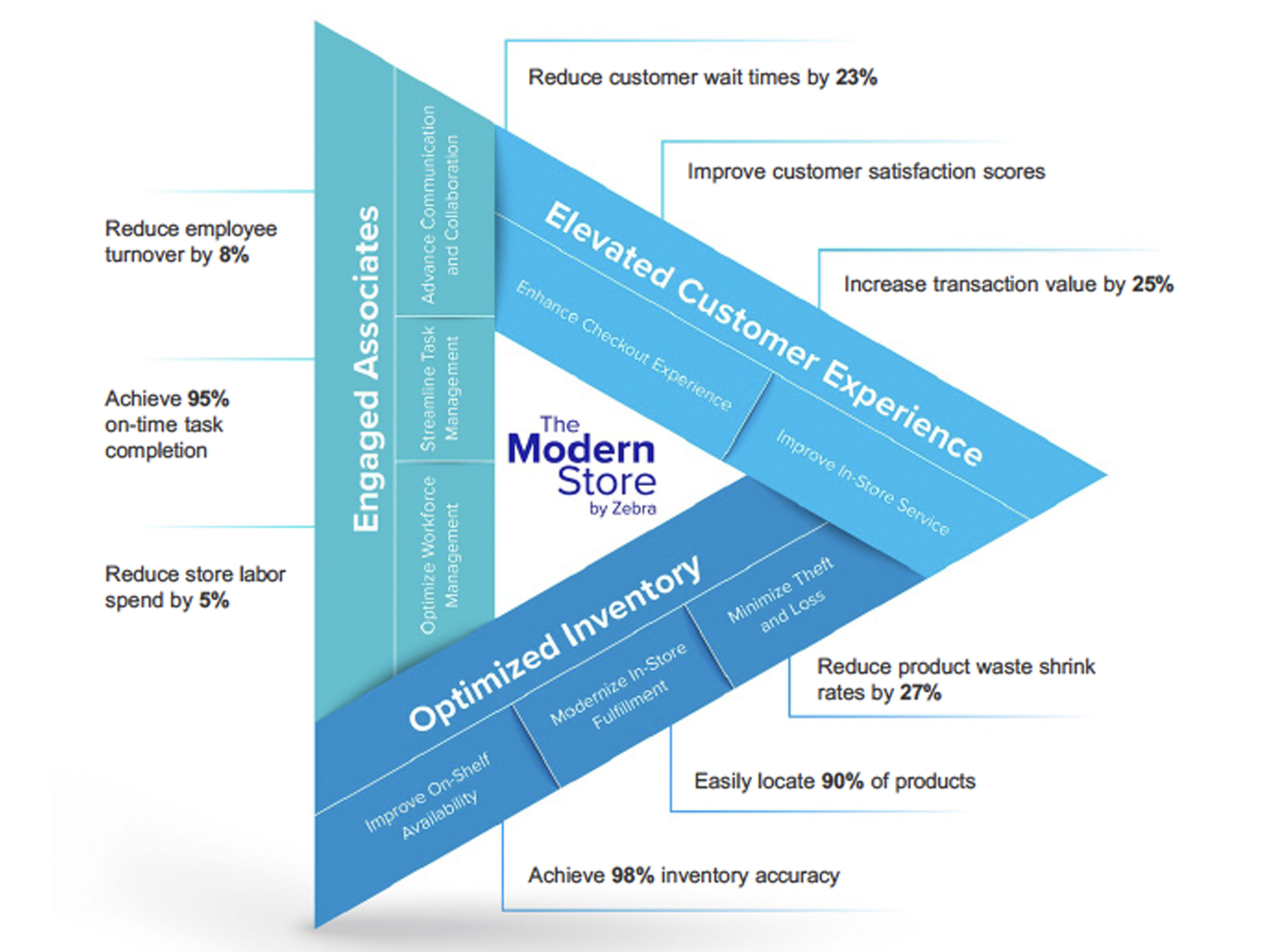

Zebra Technologies Introduces “The Modern Store by Zebra” to Help Retailers Solve Ongoing Store Challenges

More

Britain’s Warehouse and Retail Workers Say Technology Makes Jobs Easier, More Enjoyable

More

Computerworld Names Zebra Technologies to 2023 List of Best Places to Work in IT

More

Zebra Technologies Names Bill Burns as Next Chief Executive Officer

More

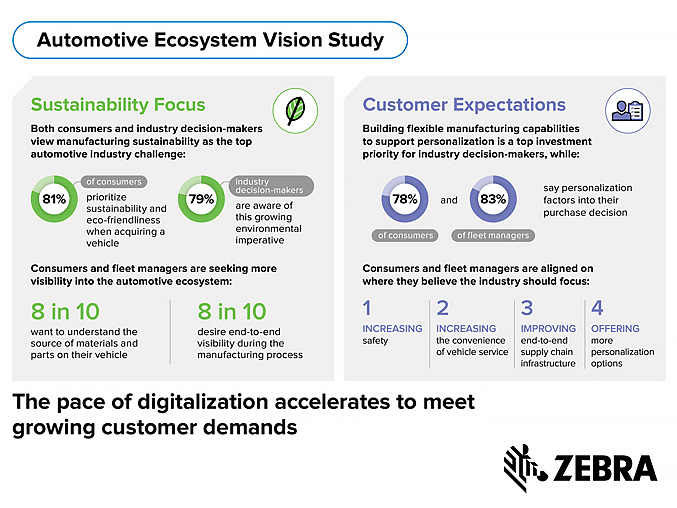

Zebra Survey Shows Eight-in-10 Millennials Expect More Transparency in Automotive Manufacturing

More

Zebra Technologies Appoints Tami Froese as Chief Supply Chain Officer

More

Hasenauer+Koch Improves Efficiencies for Local Deliveries with Zebra Technologies

More

Kaufland Offers Customers Seamless Shopping Experience with Zebra Self-Service Solution

More

Shoe Sensation Improves Store Execution and Labor Scheduling with Zebra Software Solutions

More

Noerpel Group Accelerates Deliveries, Doubles Productivity with Zebra Fixed Industrial Scanning Solution

More

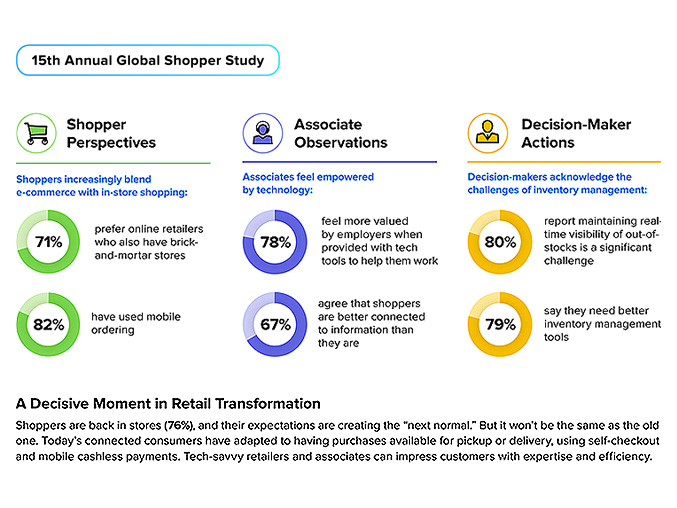

Self-Serve Drives Seven-in-10 Shoppers’ Improved Satisfaction with Retail Associates

More

RAJA Modernises its Warehouse Operations with Zebra Technologies’ Mobile Solution

More

bp Group’s Aral Selects Zebra Technologies to Digitise Its Service Station Operations

More

Zebra Introduces New PartnerConnect Location and Tracking Specialisation for Channel Partners

More

Zebra Introduces New PartnerConnect Location and Tracking Specialization for Channel Partners

More

Zebra Technologies Unveil Deep Learning Optical Character Recognition at Vision 2022

More

Zebra Technologies Announces New PartnerConnect SaaS Implementation Specialisation

More

Zebra Technologies’ Michael Stent Receives Seramount 2022 ERG Impact Award

More

Auchan Adopts Zebra Solution to Save 35 Million Products from Food Waste Annually

More

Bespoke Manufacturing Company (BMC) Selects Zebra’s Industrial and Robotics Automation to Increase Efficiency

More

Zebra Technologies’ Emissions Reduction Targets Validated by the Science Based Targets Initiative

More

Fast Company Names Zebra Technologies to 2022 Best Workplaces for Innovators List

More

Zebra Technologies’ Researchers Finish Among Top Teams in Global Computer Vision Challenge

More

Zebra Technologies Celebrates Five Wins at iF Design Awards 2022

More

Zebra Technologies Earns Its Stripes with Two Red Dot Product Design Awards

More

Zebra’s First Healthcare-Grade Tablets Deliver Better Patient and Provider Experience

More

Robotics Pioneer Melonee Wise Wins 2022 Engelberger Award

More

Zebra Technologies Introduces Rugged Tablets to Help Frontline Work Smarter and Faster

More

Zebra Technologies Completes Acquisition of Matrox Imaging

More

Conad Nord Ovest Reduces Its Warehouse Operational Costs with Zebra Technologies

More

Eight in 10 Warehouse Associates Say Positive Workplace Changes are Happening Amid Labor Shortage

More

Zebra Technologies Honored for Workplace Wellness Initiatives

More

Zebra Technologies Empowers Front-Line Workers with Next-Generation Mobile Computing Solution

More

FIRST® and Zebra Technologies Empower Students with Real-Time Robotics Competition Insights

More

Zebra Technologies to Acquire Matrox Imaging, Broadening Its Portfolio of Machine Vision Solutions

More

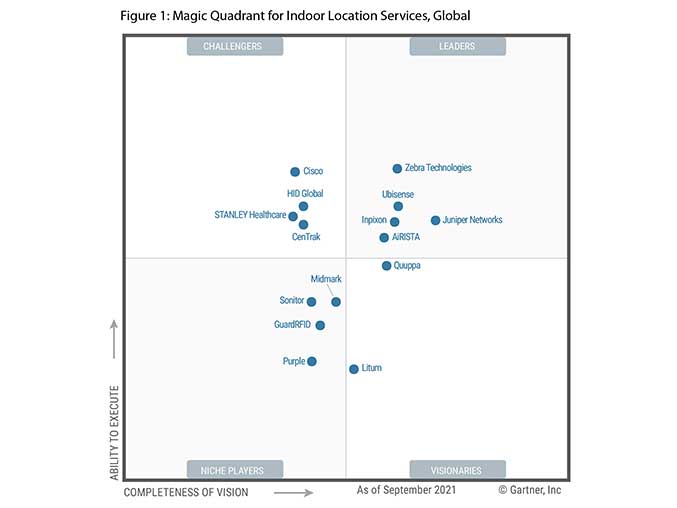

Zebra Technologies Named a Leader in 2022 Gartner® Magic Quadrant™ for Indoor Location Services

More

Four-in-10 Patients Fear Pharmaceutical Supply Chain Issues Pose Risk of Illness, Death

More

Nelda Connors Elected to Zebra Technologies Board of Directors

More

Only Four-in-10 Shoppers Completely Trust Retailers to Fulfill Orders as Promised

More

Zebra Technologies Expands Fetch Robotics Portfolio with Solution to Optimize Fulfillment Workflows

More

Zebra Technologies Completes Acquisition of Antuit.ai

More

Zebra Technologies and Its Channel Partners Continue to Support Front-Line Workers

More

Sogegross Group Increases Front-Line Worker Productivity With Zebra Technologies

More

Seven-in-10 Hospital Executives Acknowledge Need to Invest More to Maximize Staff Efficiency

More

Zebra Technologies Introduces New Windows 12-inch Rugged Tablets and 2-in-1s

More

Zebra Technologies to Acquire Antuit.ai

More

Zebra Technologies Completes Acquisition of Fetch Robotics

More

Zebra Technologies to Acquire Fetch Robotics

More

Sharp Selects Zebra Technologies to Develop And Supply Android-Powered Mobile Computers

More

Zebra Technologies Introduces Intuitive, Flexible Industrial Machine Vision and Fixed Scanning Solutions

More

Zebra Technologies Introduces Company’s First Small Office Home Office Wireless Label Printer

More

Zebra Technologies and Discount Tire Unveil First Tire Inspection Mobile Computing Solution

More

Reflexis Systems’ Second Annual Banking Survey Finds Scheduling Agility Critical Amidst Pandemic

More

Zebra Technologies Named a “Leader” in 2021 Gartner Magic Quadrant for Indoor Location Services, Global

More

Comercial Kywi Improves Customer Service and Front-Store Operations with Zebra Mobile Solution

More

Iperal Selects Zebra Technologies’ Self-Scanning Solution to Improve Customer Experience

More

2023

More

Zebra Technologies to Celebrate Youth Engagement in STEM at FIRST® Championship

More

Zebra Technologies Named a 2023 IDC MarketScape Leader in Rugged Mobile Devices

More

2022

More

Automated, Collaborative Mobile Robots Increase Warehouse Productivity by 2.5x and Close Gap on Labor Shortages

More

2021

More

Louis Widmer SA Complies with EU Anti-Counterfeiting Directive with Zebra Technologies’ Solution

More

Zebra Technologies Improves Worker Productivity with Its First Individually Assigned Enterprise Mobile Computer

More

Zebra Technologies Honored With 5-Star Rating in the 2021 CRN® Partner Program Guide

More

Zebra Technologies Introduces New Alliance Track for PartnerConnect Channel Program

More

Zebra Technologies’ Warehousing Solution Helps Oegema Transport Improve Efficiency and Growth

More

Zebra Technologies Introduces Its First Wi-Fi 6-Enabled Mobile Computer

More

Zebra Technologies Hosts Successful Re-Opening of its Experience Centre

More

Zebra Technologies to Present at Stephens' NASH2021 Annual Investment Conference

More

2020

More

Zebra Technologies Unveils New Intelligent Automation Solution at NRF 2020

More

Zebra Technologies to Showcase New Solutions to Revamp the Retail Experience at EuroShop 2020

More

Zebra Study: Real-Time Data Access is Critical for Energy, Utilities Field Workers

More

Zebra Study: Number of Field Service Providers Operating Predictively Will Double by 2025

More

Zebra Technologies Introduces Flexible, Easy-To-Use Mobile Printer to Increase In-Field Efficiency

More

Zebra Technologies Enhances Parcel Pickup and Delivery for CouriersPlease

More

Maikubo Increases Staff Efficiency with Zebra Technologies’ RFID Solution

More

Zebra Study: 7 in 10 Public Safety Agencies See Need to Speed Up Mobile Technology Adoption

More

Zebra Technologies Awards Current and Future Nurses for Challenging the Status Quo

More

MPREIS Migrates to Android™ Solution for Efficient In-Store Fulfillment Management with Zebra Technologies

More

University Helps Secure Agribusiness Supply Chain with Zebra RFID Solution

More

Zebra Technologies Introduces Proximity Sensing, Alerting & Contact Tracing Software for the Enterprise

More

Fozzy Group Increases Retail Warehouse Productivity by 20 Percent with Zebra Technologies

More

Zebra Technologies Introduces Five Rugged Mobile Computers to Increase Front-Line Worker Productivity

More

Dutch Cargo Terminal Improves Operational Management Over 4G with Zebra Technologies

More

Zebra Technologies Introduces Circular Economy Program to Improve Sustainability

More

Scottish & Southern Electricity Networks (SSEN) Improves Front-Line Workers’ Productivity with Zebra Technologies

More

Jumbo Selects Zebra Technologies’ Personal Shopping Solution for Improved Customer Experience

More

Zebra Study: Only Two in 10 Consumers Have Complete Confidence Their Food is Safe to Eat

More

Smartbox and Zebra Technologies Give A Voice to Those Who Cannot Speak

More

Zebra Technologies Empowers Interdisciplinary Care with Innovative Healthcare Offerings

More

Mindray Medical International Optimizes Healthcare Workflows with Zebra Technologies

More

Ackermans Selects Zebra Technologies’ Mobile Computing Solution to Modernize Store Operations

More

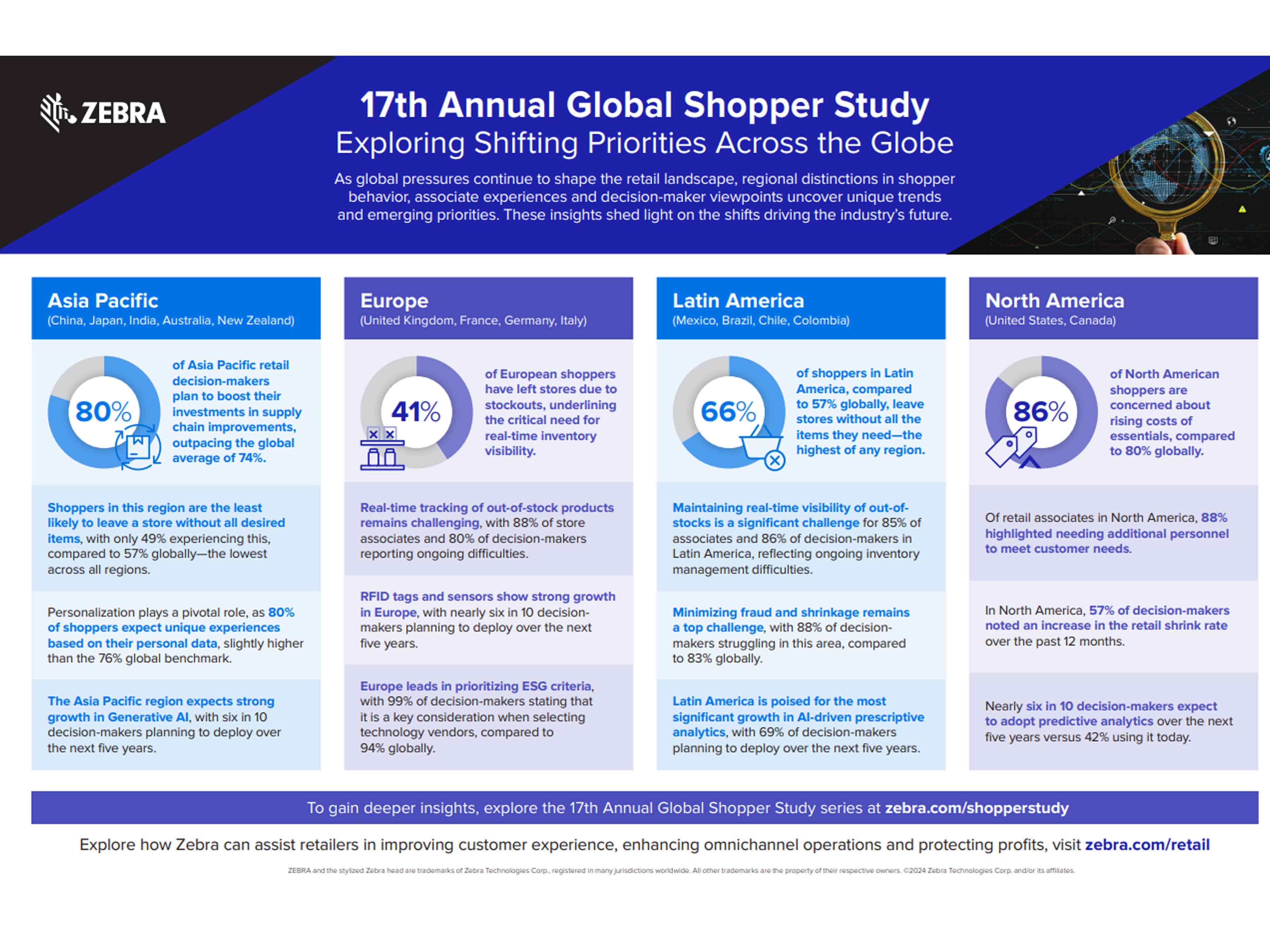

Zebra Global Shopper Study: Pandemic Accelerates Technology Spending Plans for Six-in-10 Surveyed Retailers

More

2024

More

2025

More

2026

More

Corporate

Zebra Technologies Corporation

Corporate & International Headquarters

3 Overlook Point

Lincolnshire, Illinois 60069 USA

Phone: +1 847 634 6700

Toll-free: +1 866 230 9494

Fax: +1 847 913 8766

Resources

Download Zebra's B-Roll Videos

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2026 Zebra Technologies Corp. and/or its affiliates.