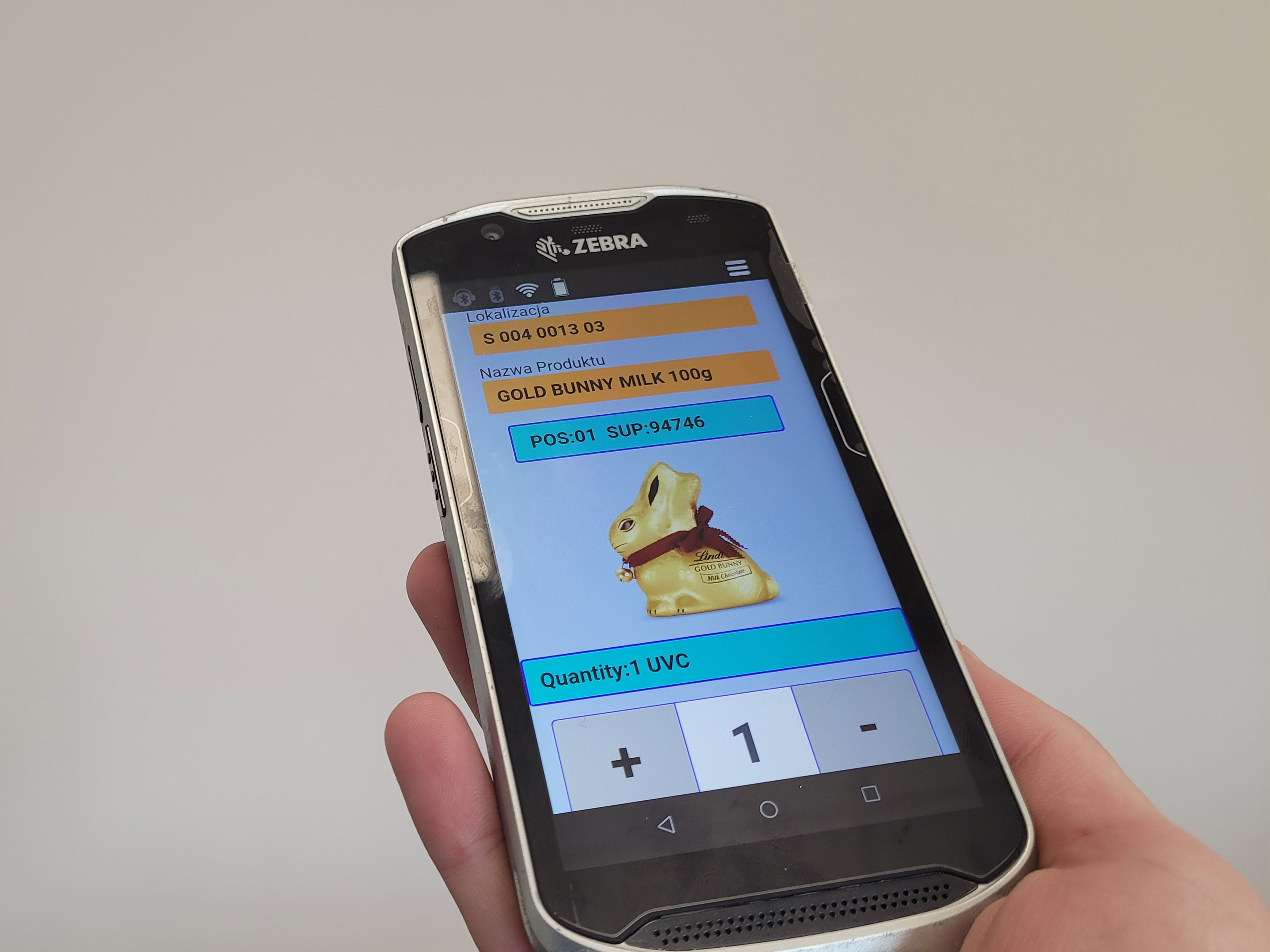

Transform retail operations with Zebra’s retail technology solutions, featuring hardware and software for improving inventory management and empowering teams.

Streamline operations with Zebra’s healthcare technology solutions, featuring hardware and software to improve staff collaboration and optimize workflows.

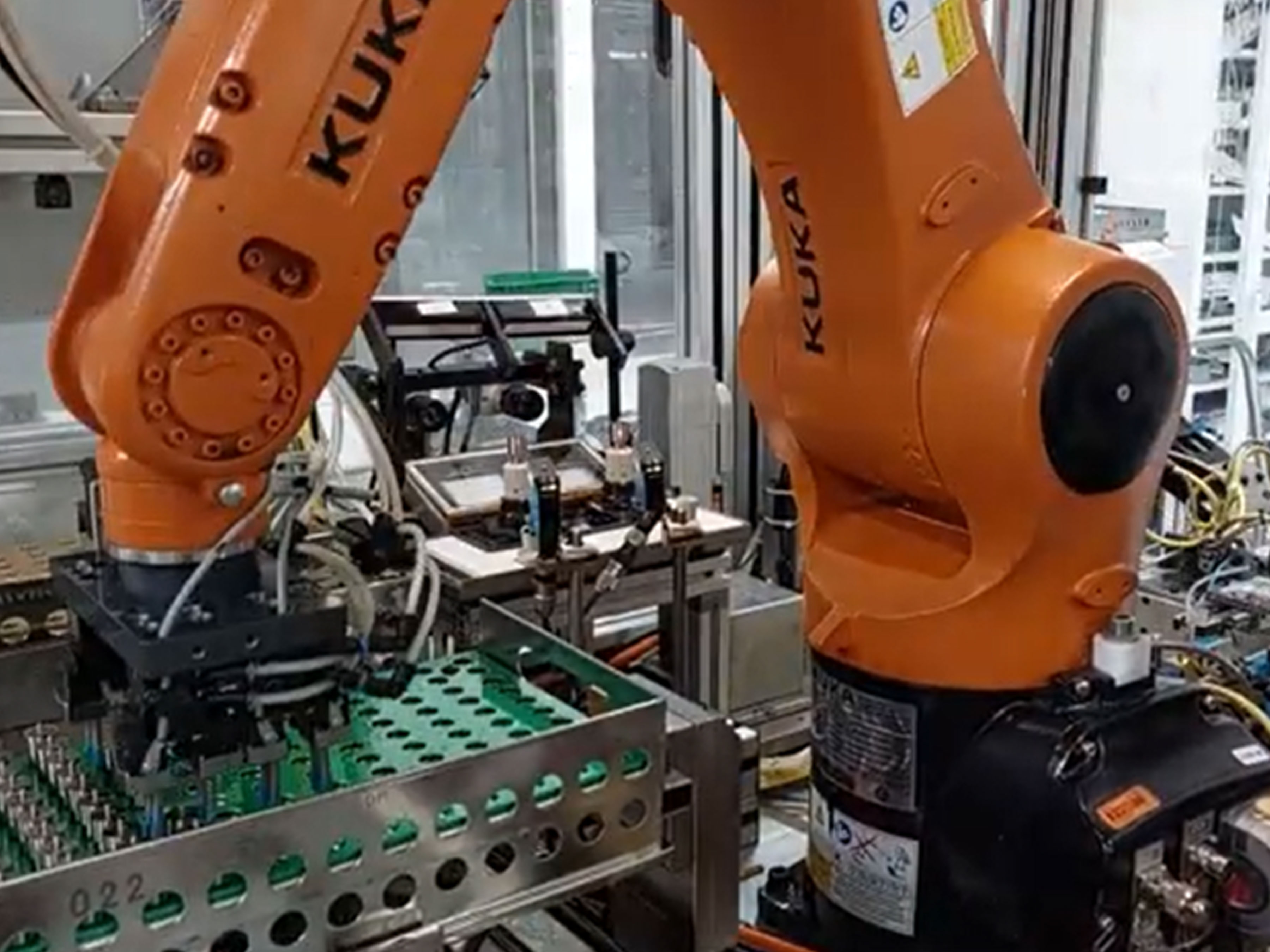

Enhance processes with Zebra’s manufacturing technology solutions, featuring hardware and software for automation, data analysis, and factory connectivity.

Zebra’s transportation and logistics technology solutions feature hardware and software for enhancing route planning, visibility, and automating processes.

Learn how Zebra's public sector technology solutions empower state and local governments to improve efficiency with asset tracking and data capture devices.

Zebra's hospitality technology solutions equip your hotel and restaurant staff to deliver superior customer and guest service through inventory tracking and more.

Zebra's market-leading solutions and products improve customer satisfaction with a lower cost per interaction by keeping service representatives connected with colleagues, customers, management and the tools they use to satisfy customers across the supply chain.

Empower your field workers with purpose-driven mobile technology solutions to help them capture and share critical data in any environment.

Zebra's range of Banking technology solutions enables banks to minimize costs and to increase revenue throughout their branch network. Learn more.

Zebra's range of mobile computers equip your workforce with the devices they need from handhelds and tablets to wearables and vehicle-mounted computers.

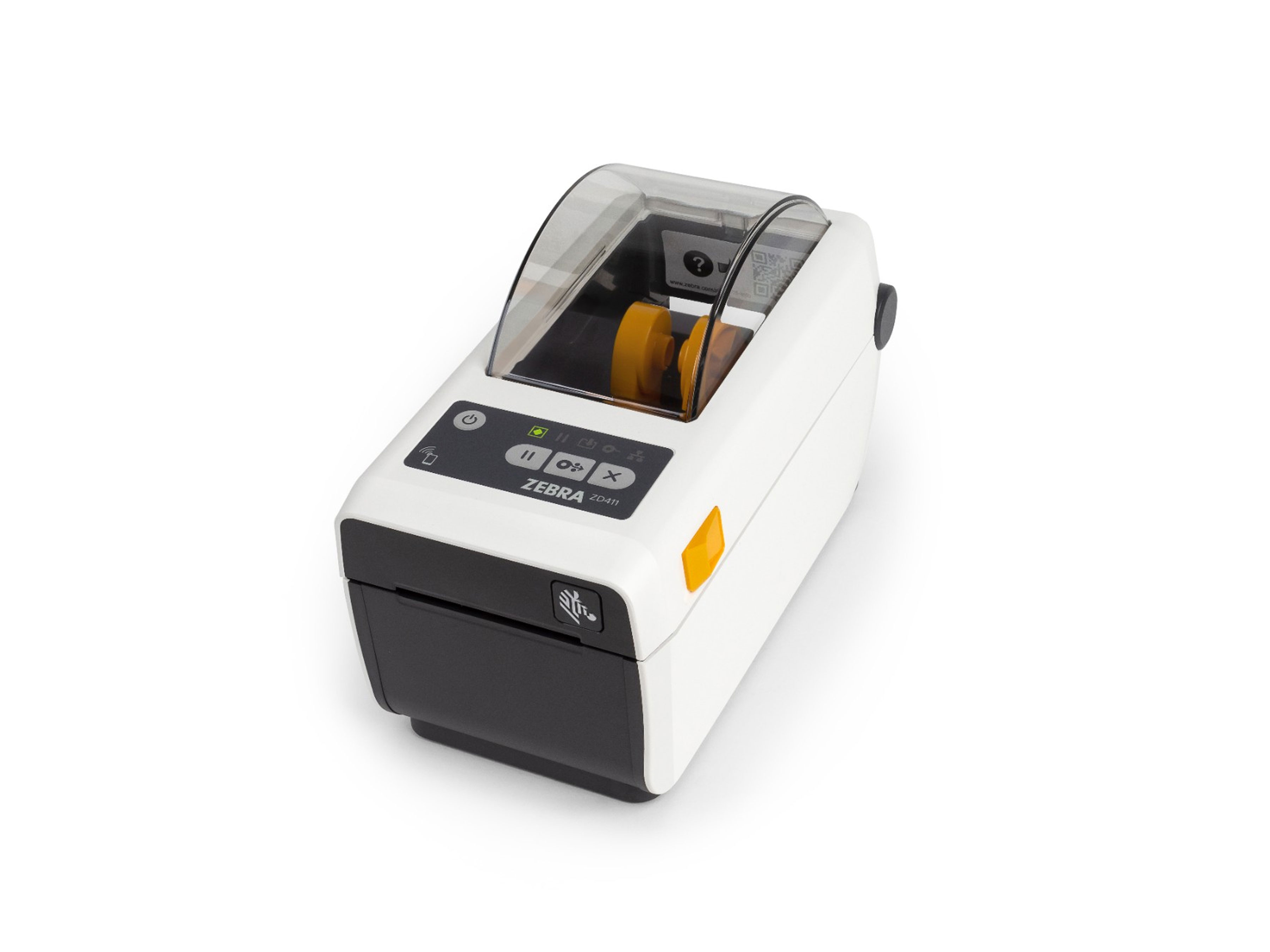

Zebra's desktop, mobile, industrial, and portable printers for barcode labels, receipts, RFID tags and cards give you smarter ways to track and manage assets.

Zebra's 1D and 2D corded and cordless barcode scanners anticipate any scanning challenge in a variety of environments, whether retail, healthcare, T&L or manufacturing.

Zebra's extensive range of RAIN RFID readers, antennas, and printers give you consistent and accurate tracking.

Choose Zebra's reliable barcode, RFID and card supplies carefully selected to ensure high performance, print quality, durability and readability.

Zebra's rugged tablets and 2-in-1 laptops are thin and lightweight, yet rugged to work wherever you do on familiar and easy-to-use Windows or Android OS.

With Zebra's family of fixed industrial scanners and machine vision technologies, you can tailor your solutions to your environment and applications.

Zebra’s line of kiosks can meet any self-service or digital signage need, from checking prices and stock on an in-aisle store kiosk to fully-featured kiosks that can be deployed on the wall, counter, desktop or floor in a retail store, hotel, airport check-in gate, physician’s office, local government office and more.

Adapt to market shifts, enhance worker productivity and secure long-term growth with AMRs. Deploy, redeploy and optimize autonomous mobile robots with ease.

Discover Zebra’s range of accessories from chargers, communication cables to cases to help you customize your mobile device for optimal efficiency.

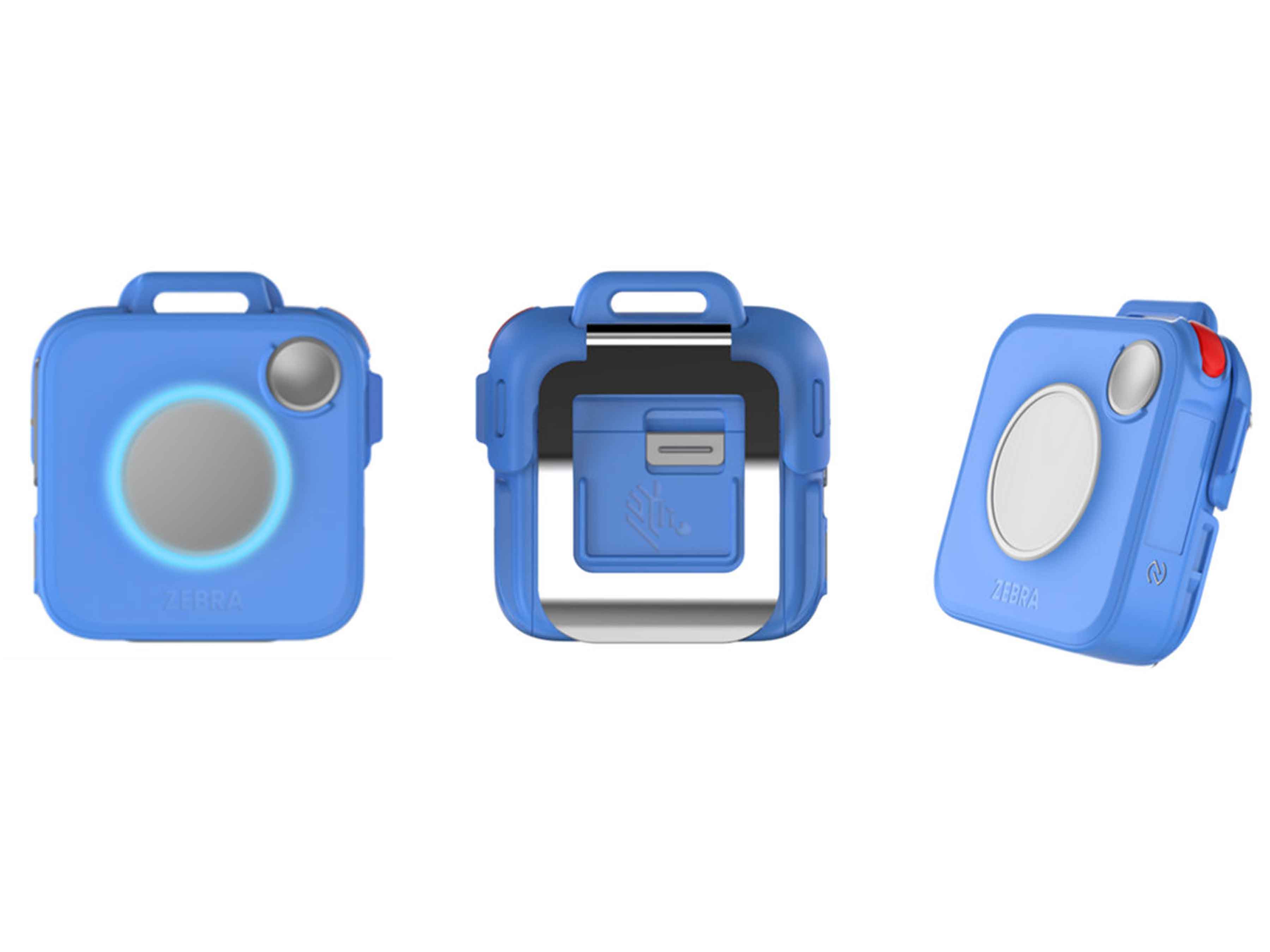

Zebra's environmental sensors monitor temperature-sensitive products, offering data insights on environmental conditions across industry applications.

Zebra's location technologies provide real-time tracking for your organization to better manage and optimize your critical assets and create more efficient workflows.

Enhance frontline operations with Zebra’s AI software solutions, which optimize workflows, streamline processes, and simplify tasks for improved business outcomes.

Empower your frontline with Zebra Companion AI, offering instant, tailored insights and support to streamline operations and enhance productivity.

The everything you need to rapidly and cost effectively develop high-performance AI vision applications on Zebra mobile computers.

Zebra Frontline AI Blueprints deliver adaptable, real-world AI frameworks that automate manual tasks and drive efficiency in high-pressure frontline operations.

Zebra Workcloud, enterprise software solutions boost efficiency, cut costs, improve inventory management, simplify communication and optimize resources.

Keep labor costs low, your talent happy and your organization compliant. Create an agile operation that can navigate unexpected schedule changes and customer demand to drive sales, satisfy customers and improve your bottom line.

Drive successful enterprise collaboration with prioritized task notifications and improved communication capabilities for easier team collaboration.

Get full visibility of your inventory and automatically pinpoint leaks across all channels.

Reduce uncertainty when you anticipate market volatility. Predict, plan and stay agile to align inventory with shifting demand.

Drive down costs while driving up employee, security, and network performance with software designed to enhance Zebra's wireless infrastructure and mobile solutions.

Explore Zebra’s printer software to integrate, manage and monitor printers easily, maximizing IT resources and minimizing down time.

Make the most of every stage of your scanning journey from deployment to optimization. Zebra's barcode scanner software lets you keep devices current and adapt them to your business needs for a stronger ROI across the full lifecycle.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

RFID development, demonstration and production software and utilities help you build and manage your RFID deployments more efficiently.

Zebra DNA is the industry’s broadest suite of enterprise software that delivers an ideal experience for all during the entire lifetime of every Zebra device.

Advance your digital transformation and execute your strategic plans with the help of the right location and tracking technology.

Boost warehouse and manufacturing operations with Symmetry, an AMR software for fleet management of Autonomous Mobile Robots and streamlined automation workflows.

The Zebra Aurora suite of machine vision software enables users to solve their track-and-trace, vision inspection and industrial automation needs.

Zebra Aurora Focus brings a new level of simplicity to controlling enterprise-wide manufacturing and logistics automation solutions. With this powerful interface, it’s easy to set up, deploy and run Zebra’s Fixed Industrial Scanners and Machine Vision Smart Cameras, eliminating the need for different tools and reducing training and deployment time.

Aurora Imaging Library™, formerly Matrox Imaging Library, machine-vision software development kit (SDK) has a deep collection of tools for image capture, processing, analysis, annotation, display, and archiving. Code-level customization starts here.

Aurora Design Assistant™, formerly Matrox Design Assistant, integrated development environment (IDE) is a flowchart-based platform for building machine vision applications, with templates to speed up development and bring solutions online quicker.

Designed for experienced programmers proficient in vision applications, Aurora Vision Library provides the same sophisticated functionality as our Aurora Vision Studio software but presented in programming language.

Aurora Vision Studio, an image processing software for machine & computer vision engineers, allows quick creation, integration & monitoring of powerful OEM vision applications.

Adding innovative tech is critical to your success, but it can be complex and disruptive. Professional Services help you accelerate adoption, and maximize productivity without affecting your workflows, business processes and finances.

Zebra's Managed Service delivers worry-free device management to ensure ultimate uptime for your Zebra Mobile Computers and Printers via dedicated experts.

Find ways you can contact Zebra Technologies’ Support, including Email and Chat, ask a technical question or initiate a Repair Request.

Zebra's Circular Economy Program helps you manage today’s challenges and plan for tomorrow with smart solutions that are good for your budget and the environment.

The Zebra Knowledge Center provides learning expertise that can be tailored to meet the specific needs of your environment.

Zebra has a wide variety of courses to train you and your staff, ranging from scheduled sessions to remote offerings as well as custom tailored to your specific needs.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

Build your reputation with Zebra's certification offerings. Zebra offers a variety of options that can help you progress your career path forward.

Press Releases

Latest Press Releases

Zebra Technologies Cites 2026 Industry Trends for the Era of Intelligent Operations

More

Zebra Technologies Helps Charles County Fire & EMS Save Time in Emergency Response

More

Digimarc and Zebra Technologies Team Up to Dramatically Reduce Gift Card Fraud and Improve the Shopping Experience

More

Zebra Technologies Appoints Melissa Luff Loizides as Chief People Officer

More

Zebra Technologies to Present at Investor Conferences

More

Zebra Study: 87% of Retailers Believe Gen AI to Have Significant Impact on Loss Prevention

More

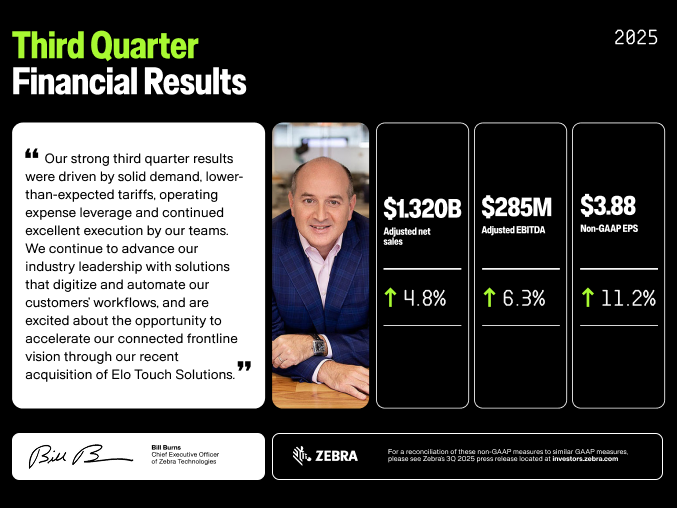

Zebra Technologies Announces Third-Quarter 2025 Results

More

Sentinel Vision Improves Injection Molding Inspection with Zebra Technologies’ Machine Vision

More

Zebra and Salesforce Introduce Retail Cloud POS Solution on Android to Streamline Store Operations

More

ODW Logistics Expects to Improve Pick Rates by 42% with Zebra Technologies

More

Zebra Technologies and Tulip Collaboration Delivers Mobile-First Experience to the Frontline

More

Polytag Unlocks Real-Time Recycling Traceability with Zebra Machine Vision Software

More

Zebra Technologies Completes Acquisition of Elo to Accelerate Connected Frontline Experiences

More

Zebra Technologies to Release Third Quarter Results on Oct. 28

More

Zebra Technologies Jumps to Top Ten on Fast Company’s 2025 Best Workplaces for Innovators List

More

Zebra Study with Oxford Economics: Automation of Workflows Drives 20% Increase in Productivity

More

Zebra Showcases AI for the Frontline at Inaugural Frontline AI Summit and Annual ZONE Conference

More

Indianapolis Colts Team Up with Zebra Technologies for Real-Time Player Performance Insights

More

Zebra Technologies Appoints Richard Tjiputra as Head of Channels, Australia and New Zealand

More

Zebra Technologies Announces Second-Quarter 2025 Results

More

Zebra Technologies to Acquire Elo to Accelerate Connected Frontline Experiences

More

Geneva10 Fulfillment Selects Zebra’s Automation Solution to Boost Productivity by Over 40%

More

Mary McDowell Joins Zebra Technologies Board of Directors

More

Zebra Technologies Enhances Customer and Partner Experience with New ANZ Headquarters

More

Zebra Technologies Makes Strategic Investment in Xemelgo to Support Intelligent Automation

More

Armstrong Asia Boosts Efficiency in Asia with Zebra Technologies’ Warehousing Solutions

More

Zebra Technologies to Release Second Quarter Results on Aug. 5

More

Zebra Technologies and Clearview Launch Industrial Automation Centre of Excellence

More

Zebra Technologies Appoints Tran Thi Bao Tran as Vietnam Country Manager

More

Zebra Technologies Expands Presence in India with New Office in New Delhi

More

Zebra Technologies Introduces Sleek Enterprise Mobile Computer to Boost Frontline Productivity

More

Lorsa Modernizes Warehouse Operations with Zebra Technologies’ Traceability Solutions

More

United States Postal Service Recognizes Zebra Technologies with Supplier Performance Award

More

PouchNATION Cuts Guest Check-In Times by 83% with Zebra’s Advanced Scanning Solutions

More

Zebra Technologies Celebrates Six Red Dot and Two iF Design Awards 2025

More

Zebra Technologies Showcases New Intelligent Automation Solutions at Automate 2025

More

Zebra Technologies to Present at Investor Conferences

More

Zebra Technologies Announces First-Quarter 2025 Results

More

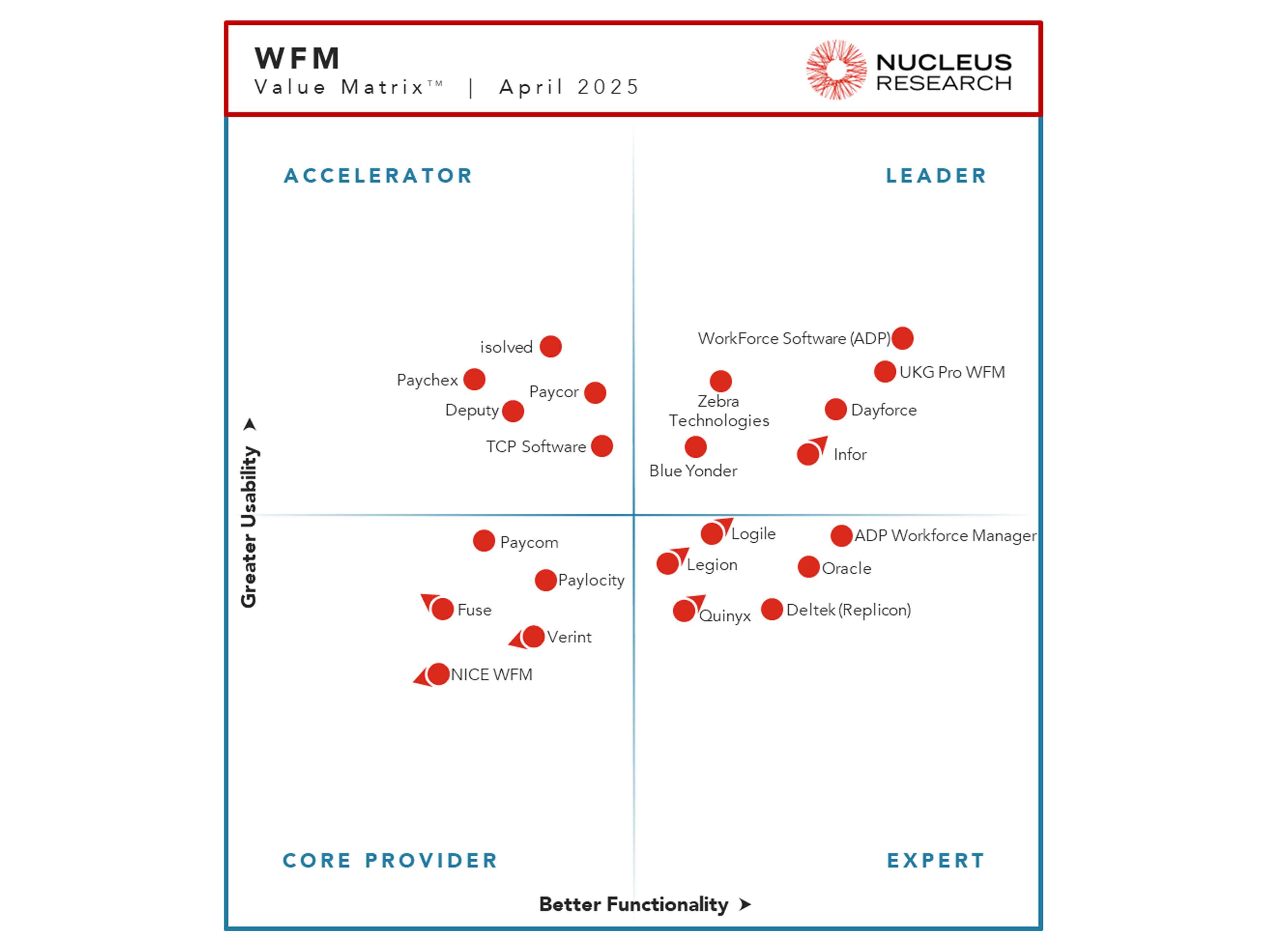

Zebra Recognized as a Leader in Nucleus Research 2025 Workforce Management Technology Value Matrix

More

Zebra Recognizes AI Developer Challenge Winners for Visionary Approaches to Increase Frontline Efficiency

More

Zebra Technologies Appoints Seo Heejung as South Korea Country Lead

More

Zebra Technologies Expands Partner Network to Empower Frontline Workers with AI in Emerging Indian Markets

More

Zebra Technologies to Release First Quarter Results on April 29

More

Bohn Modernizes its Distribution Centers with Zebra RFID Solutions

More

Zebra Technologies and Merck KGaA, Darmstadt, Germany Collaborate to Create Safety and Traceability Solutions

More

Zebra Technologies Unveils Solutions Advancing Intelligent Automation at ProMat 2025

More

Zebra Study: 79% of Bank Employees Say Streamlining Administrative Tasks Boosts Job Satisfaction

More

Zebra Technologies to Showcase Solutions Designed to Empower Healthcare Workers at HIMSS 2025

More

Zebra Technologies Completes Acquisition of Photoneo

More

70% of Frontline Workers Report Rising Concerns with Injuries on the Warehouse Floor

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media & Telecom Conference

More

Zebra Technologies Recognized in Gartner® Magic Quadrant™ for Clinical Communication and Collaboration Solutions

More

Zebra Technologies Announces Fourth-Quarter and Full-Year 2024 Results

More

Data Experts Share Super Bowl LIX Predictions through Lens of Next Gen Stats

More

Sanmina Enhances Manufacturing Productivity in Malaysia with Zebra Technologies

More

Zebra Technologies Expands Symmetry Fulfillment Solution to Increase Productivity with 30% Fewer Robots

More

NFL Next Gen Stats Super Bowl LIX Preview Presented by Zebra Technologies

More

Zebra Technologies to Release Fourth Quarter and Full Year Results on Feb. 13

More

Rack Room Shoes Achieves 95% Task Completion Rate with Zebra Technologies Workcloud Software

More

Zebra Technologies Introduces New AI Solutions to Empower Retail Frontline Operations

More

Zebra Technologies Named a Major Player in IDC MarketScape: Worldwide Retail Promotions Management 2024–2025 Vendor Assessment

More

Zebra Technologies to Acquire Photoneo, Expanding Its Portfolio of 3D Machine Vision Solutions

More

Zebra Technologies Recognized on Forbes’ Inaugural List of Most Trusted Companies in America

More

Computerworld Names Zebra Technologies to 2025 List of Best Places to Work in IT

More

Zeelandia Saves Time and Money with Zebra Technologies Fixed Scanning Solution

More

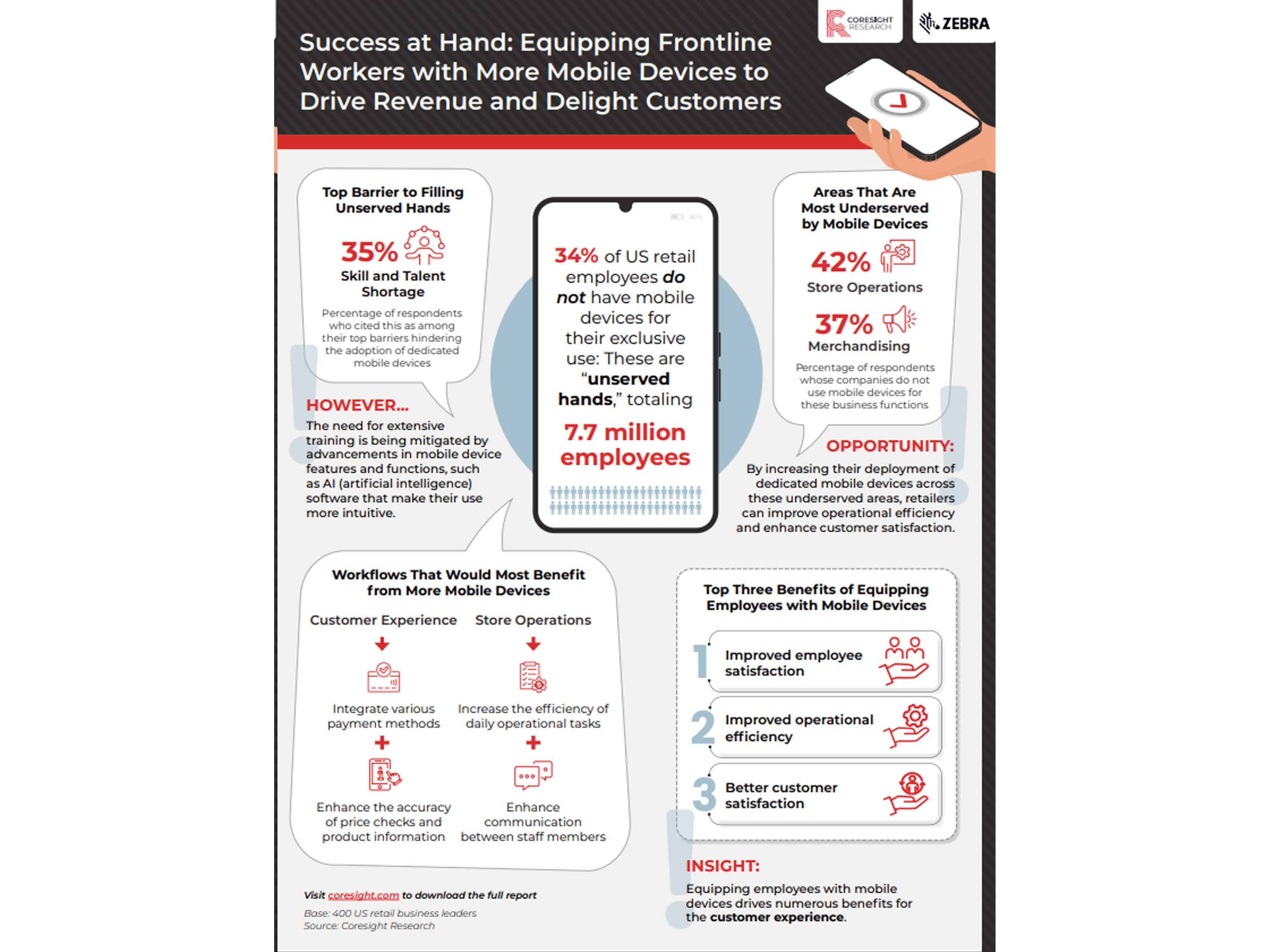

New U.S. Report: One in Three Retail Associates Lack Individual Mobile Devices

More

Zebra Technologies and Singapore Manufacturing Federation Sign MOU to Help Boost Singapore SMEs

More

Loja do Mecânico Enhances Omnichannel Operations with Zebra Technologies

More

84% of Retail Associates Concerned About Loss Prevention, According to Latest Zebra Study

More

Zebra Technologies to Present at Stephens Annual Investment Conference

More

Instituto do Coração do Brasil Improves Asset Management with Zebra’s RFID Solutions

More

JAS Jet Air Service SPA Achieves Zero Error Count with Zebra Technologies’ RFID Solutions

More

Gramedia Improves Inventory Time By 50% with Zebra’s RFID Solution

More

Zebra Technologies Announces Third-Quarter 2024 Results

More

DPD Drivers Can Scan Up To 1,000 Parcels A Day with Zebra Mobile Computers

More

Zebra Technologies Wins Four Australian Good Design® Awards for Design and Innovation

More

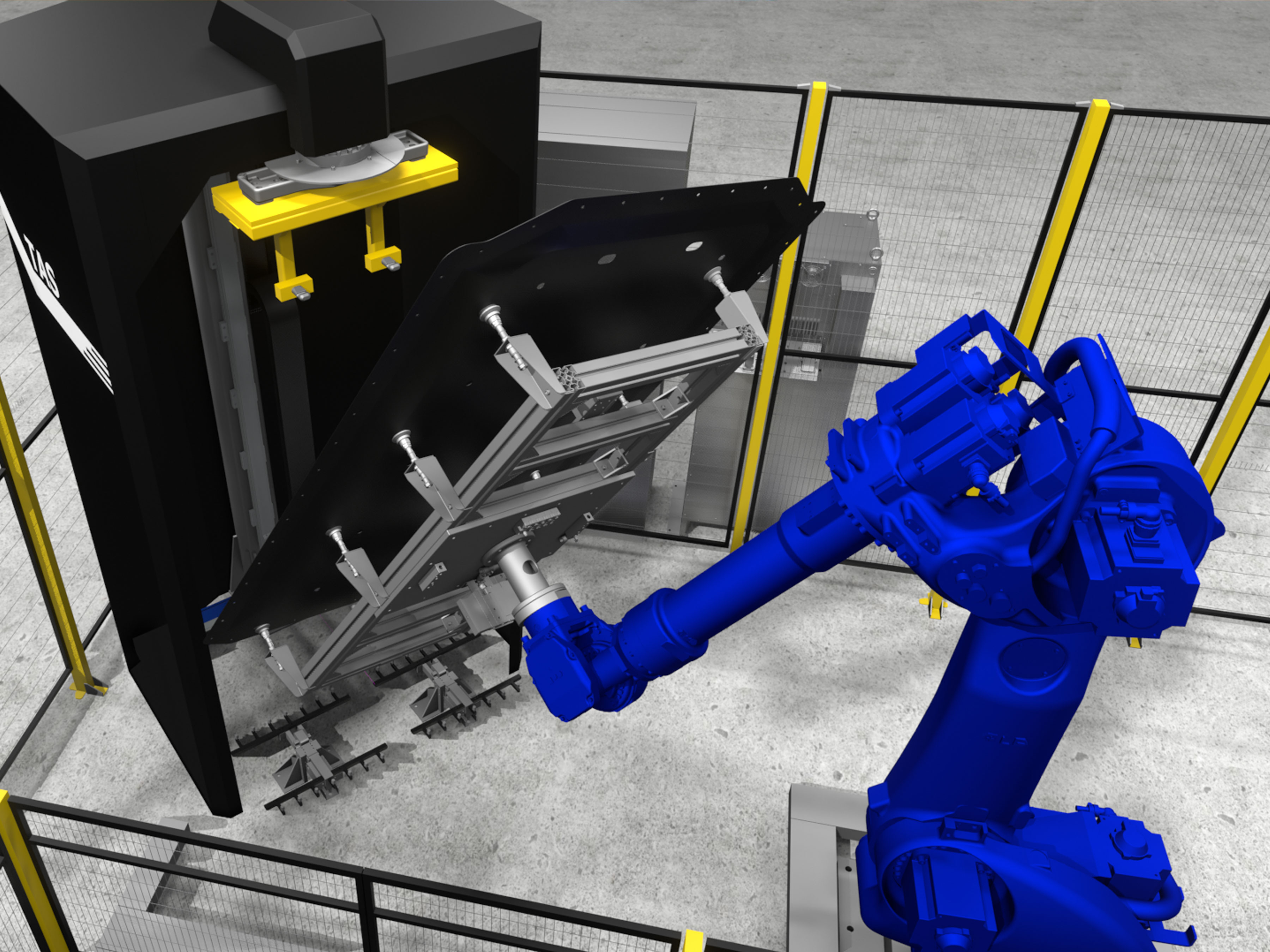

TAS Enhances Electric Battery Production with Deep Learning by Zebra Technologies

More

Zebra Technologies to Release Third Quarter Results on Oct. 29

More

Zebra Technologies Helps Clínica de las Américas Reduce Patient Care Errors by 40%

More

Zebra Technologies Among Fast Company's 100 Best Workplaces for Innovators

More

Zebra Technologies Introduces Solutions to Increase Retailers’ Efficiency at ZONE Conferences

More

Ingram Micro Australia Improves Warehouse Operational Efficiency with Zebra Technologies

More

Zebra Technologies Adds New Deep Learning Tools to Aurora Machine Vision Software

More

Zebra Technologies Empowers Future Tech Leaders with Global Internship and Development Programs

More

Zebra Technologies Launches AI Developer Challenge to Drive Innovation

More

Zebra Technologies Announces Second-Quarter 2024 Results

More

Zebra Technologies Named a Best Place to Work for People with Disabilities

More

I.D.E.A. Inspects 200 Different Automotive Brake Discs with Zebra Technologies Machine Vision

More

Iperal Optimises Costs and Shopper Experience with Zebra Technologies Self-Scanners

More

Zebra Technologies to Release Second Quarter Results on July 30

More

Zebra Study: Only 16% of Manufacturers Have Real-Time Visibility into Manufacturing Production

More

Zebra Technologies Named on U.S. News & World Report’s Best Companies to Work for List

More

Real Máquinas Improves Inventory Management Time by 40% with Zebra Technologies

More

Zebra Technologies Makes Newsweek’s List of Most Loved Workplaces®

More

Zebra Technologies to Present at the Bernstein 40th Annual Strategic Decisions Conference

More

CRN Honors Five Zebra Technologies’ Leaders as 2024 Women of the Channel

More

Ken Miller Joins Zebra Technologies Board of Directors

More

Zebra Technologies Hosts Innovation Day

More

Zebra Study: 84% of U.S. and UK Hospital Leaders Prioritize Digitizing Inventory Management Solutions

More

Zebra Technologies Recognized for Healthcare Technology Innovation in 8th Annual MedTech Breakthrough Awards Program

More

Kitchen Ware Reduces Picking Time by 50% with Zebra Technologies’ Warehouse Solutions

More

Zebra Technologies Unveils New Solutions at Automate 2024, Advancing the Connected Factory

More

Zebra Named Leader in 2024 Nucleus Research Workforce Management Technology Value Matrix

More

Zebra Technologies Announces First-Quarter 2024 Results

More

Zebra Technologies to Host Innovation Day on May 14

More

Zebra Technologies Launches New Sustainability Partner Recognition Program Globally

More

Zebra Technologies to Unveil New Generative AI Capabilities at Google Cloud Next

More

Zebra Technologies to Release First Quarter Results on Apr. 30

More

Zebra Technologies Earns Spot on CRN’s 2024 Internet of Things 50 List

More

MYDIN Increases E-Commerce Productivity By Seven Fold with Zebra’s Warehouse Mobility Solution

More

Zebra Technologies Sponsors NFL Health & Safety Summit to Enhance Player Performance

More

Branch Bank Managers Say Modern Technology Would Improve Job Satisfaction

More

Zebra Technologies Introduces Automation Solutions at MODEX 2024 to Empower Connected Workers

More

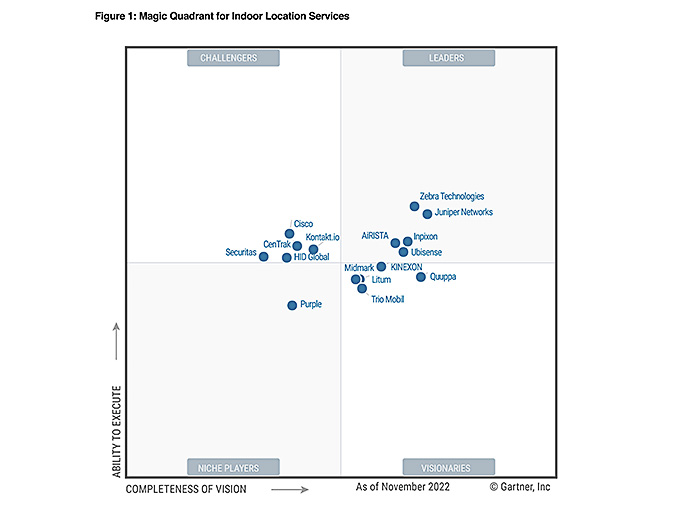

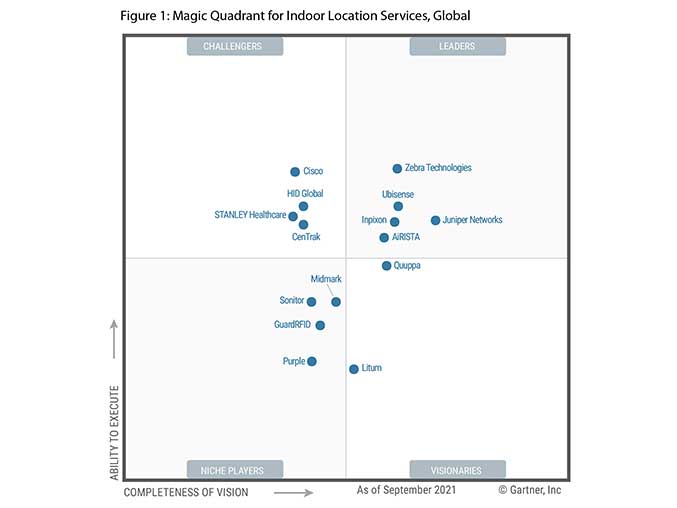

Zebra Technologies Named a Leader in 2024 Gartner® Magic Quadrant™ for Indoor Location Services

More

Zebra Technologies Appoints Yu Fang as Greater China Country Lead

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media & Telecom Conference

More

Zebra Technologies Named to Forbes’ 2024 List of America’s Best Midsize Employers

More

Zebra Technologies Announces Fourth-Quarter and Full-Year 2023 Results

More

Zebra Technologies' Rob Armstrong and Mike Mughetto Named 2024 CRN Channel Chiefs

More

A Super Bowl LVIII Preview with Next Gen Stats

More

Zebra Technologies Makes CRN Cloud 100 List for Commitment to Channel and Innovation

More

Zebra Technologies to Release Fourth Quarter and Full Year Results on Feb. 15

More

United States Postal Service Selects Zebra Technologies for Printer Technology Refresh

More

Zebra Technologies to Unveil New Solutions at NRF 2024 Advancing the Modern Store

More

Office Depot Improves In-Store Task Completion Rate by 42% with Zebra Workcloud

More

Zebra Technologies Introduces Ultra-Rugged Mobile Computer to Improve Workflow Efficiency

More

Siam Coconut Achieves Greater Operational Efficiency and Accuracy with Zebra Technologies

More

Zebra Technologies Voted Top Software Vendor in 2024 RIS Software LeaderBoard

More

Zebra Earns Highest Score on Human Rights Campaign Foundation’s Corporate Equality Index

More

Verizon Business, Zebra Launch Device and Software Solutions to Accelerate Private 5G

More

Zebra Technologies Appoints Chang Ug Seo as South Korea Country Lead

More

Rockland Trust Bank Selects Zebra Technologies to Modernize Branch Operations

More

Zebra Technologies Makes Computerworld’s 2024 List of Best Places to Work in IT

More

PT Dunia Express Transindo Significantly Increases Throughput with Zebra Technologies

More

Ricoh Cuts Inspection Time by 94% with RFID Solution from Zebra Technologies

More

Lusqtoff Argentina Increases its Sales by 40% with Zebra Warehouse Solutions

More

Farmacity Improves In-Store Operations with Zebra Workcloud Task Management

More

Zebra Technologies’ New Healthcare-Grade Mobile Computers Elevate Patient Care

More

Pontificia Universidad Católica de Ecuador Reduces Inventory Time by 70% with Zebra

More

Zebra Technologies Appoints Richard Hudson as Chief Revenue Officer

More

Bosch Group Improves Quality of Inspection Process with Zebra Machine Vision Solution

More

Zebra Technologies Announces Third-Quarter 2023 Results

More

Junior Achievement of South Florida Brings Zebra Technologies’ Tablets to the Classroom

More

Over 80% of Retailers Challenged by Shrink; Better Analytics Can Drive Profitability

More

Zebra Technologies Named Android Enterprise Gold Partner by Google

More

Hippo Harvest Cuts Water Use by 92% with Zebra Autonomous Mobile Robots

More

Zebra Technologies Unveils Reimagined Software Portfolio at ZONE Customer Conferences

More

MPREIS Transforms Operations with Zebra Workcloud Task Management™ Software Solution

More

Zebra Technologies Demonstrates Generative AI on Devices Powered by Qualcomm

More

JAS Worldwide Reduces Workers’ Walking Time by 40% with Zebra Technologies

More

Zebra Study: Nearly Six in 10 Warehouse Leaders Plan to Deploy RFID by 2028

More

Nhat Tin Logistics Enhances Operational Performance and Cost Savings with Zebra Technologies

More

Le Biscuit Boosts Its Omnichannel Operations and Modernizes Its Stores with Zebra Technologies

More

Zebra Technologies Introduces Zebra Pay™ Enterprise-Grade Mobile Payment Solution

More

Aramtec Selects Zebra Technologies to Digitally Transform its Warehouse Operations

More

ID Logistics Polska Chooses Zebra to Increase Capacity; Boosts Warehouse Productivity by 15%

More

Minnesota Vikings Partner with Zebra to Gain Real-Time Insights on Player Performance

More

Zebra Technologies Helps NHS Hospital Boost Efficiency, Saving Nearly 90,000 Staff Hours Annually

More

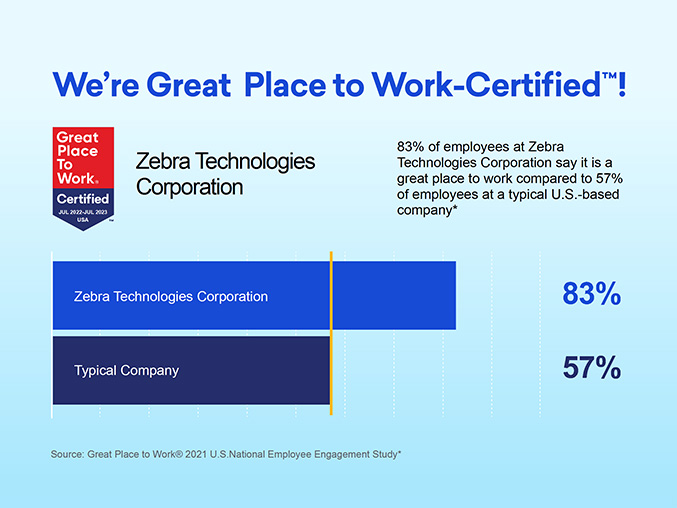

Zebra Technologies Earns Great Place to Work Certification™ for Second Consecutive Year

More

Bimbo Bakeries USA Minimizes Waste by Improving Its Forecasts by 30% with Zebra Technologies

More

Zebra Technologies Announces Second-Quarter 2023 Results

More

Stony Brook University Names Zebra Technologies 2023 Employer Partner of the Year

More

Zebra Tops Its Category on Fast Company’s 2023 List of Best Workplaces for Innovators

More

Zebra Technologies Launches TC22/TC27 Mobile Computer for Enterprise-Grade Manageability and Productivity

More

Zebra Technologies’ Latest Android Rugged Tablets, ET6x Series Extend Versatility, Efficiency

More

Newsweek Names Zebra Technologies to 2023 Top 100 Global Most Loved Workplaces

More

GEODIS Enhances Dock Operator Capabilities with Zebra Technologies Solution on Android™ Platform

More

Machine Vision and Robotics Automation Will Support Italy’s Sustainable Manufacturing Recovery

More

Zebra Technologies Reinforces Commitment to UK Aerospace, Defence and Security Industry

More

EiT Reduces Operational Costs by 20% with Zebra Technologies’ Warehouse Solutions

More

Satish Dhanasekaran Joins Zebra Technologies Board of Directors

More

Zebra Named Leader In 2023 Nucleus Research Workforce Management Technology Value Matrix

More

Zebra Technologies Showcases ‘Triple Key’ to Unlock Future of Public Safety

More

Zebra Technologies' James Lawton and John Wirthlin Named Supply Chain Pros to Know

More

Zebra Technologies Grows Mobile Robotics Specialization for Partners

More

Zebra Technologies Earns 5-Star Rating in 2023 CRN® Partner Program Guide

More

Zebra Technologies Recognized for Mobile Healthcare Innovation in 2023 MedTech Breakthrough Awards Program

More

Zebra Technologies Announces First-Quarter 2023 Results

More

Zebra Technologies Debuts New Solutions at LogiMAT

More

Healthcare Providers Face ‘Triple Squeeze’; Enhanced Technology and Communication Are Best Remedy

More

Southeastern Grocers Leverages Zebra’s Software Solutions to Improve Store Performance

More

Zebra Technologies Appoints Joe White as Chief Product and Solutions Officer

More

CDP Names Zebra Technologies to 2022 Supplier Engagement Leaderboard

More

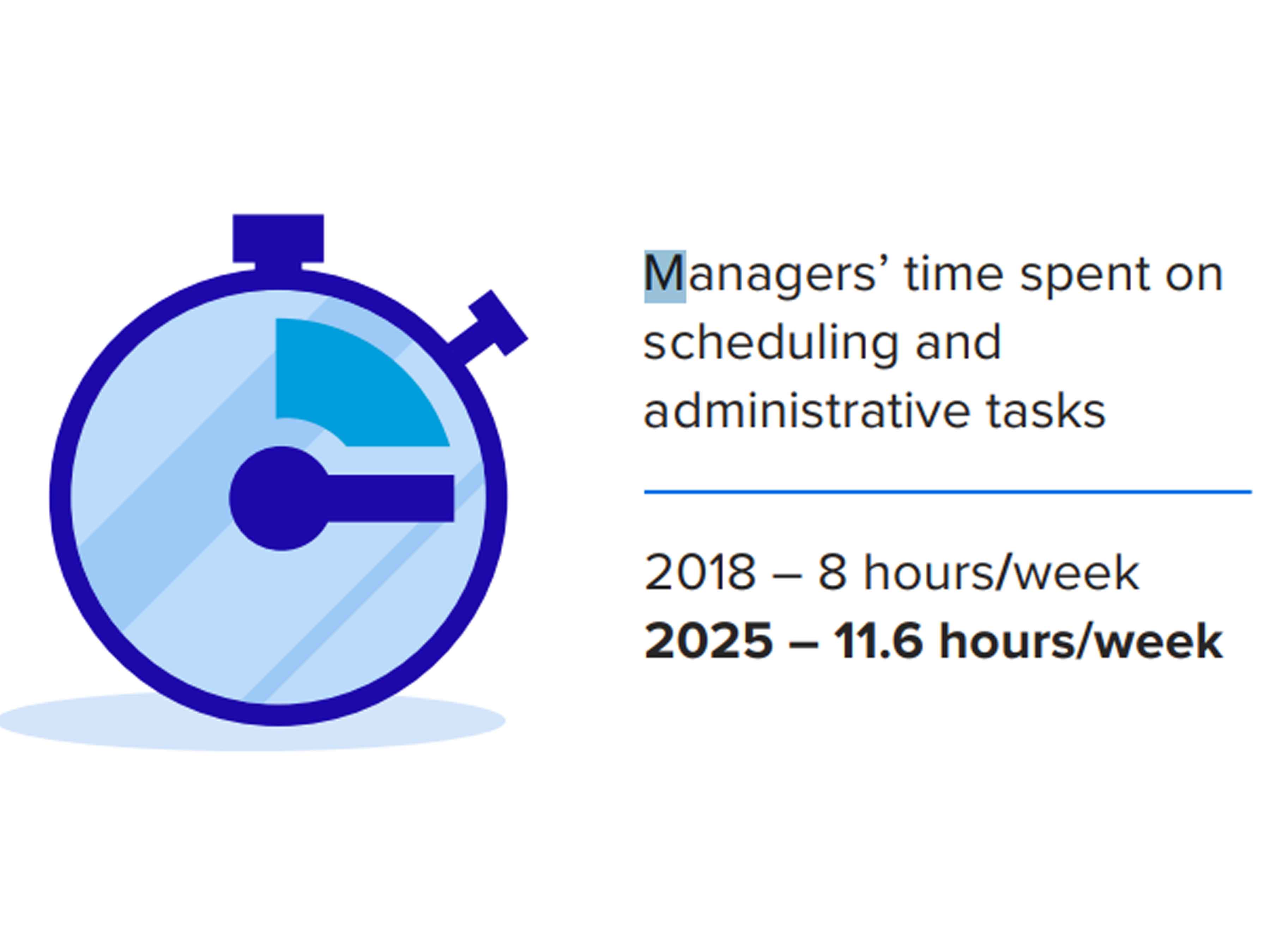

Branch Banking Survey Shows Managers Waste Almost 25% Of Their Time On Scheduling

More

Zebra Technologies’ Bill Cate Named as a 2023 CRN Channel Chief

More

Zebra Presents Warehouse Solution Built on Industry 5.0 Human-Centred Automation at IntraLogisteX

More

Waterman Onions Digitizes Its Logistics Operations with Zebra Technologies

More

Zebra Technologies Introduces Seamless Integration with SAP EWM Cloud

More

Zebra Technologies Appoints Rob Armstrong as Chief Marketing Officer

More

Zebra’s New Environmental Sensors Increase Supply Chain Visibility in Food, Pharmaceutical and Healthcare Industries

More

CEWE Automates Production Workflows with Zebra Technologies’ Fixed Industrial Scanning Solution

More

Zebra Technologies Named a Leader in 2023 Gartner® Magic Quadrant™ for Indoor Location Services

More

Zebra Technologies’ New Visionary Framework and Insights Take Centre Stage at EuroShop

More

Retailer Bonita Transforming Store Operations with Zebra’s Task Management Software Solution

More

Zebra Technologies Announces Fourth-Quarter and Full-Year 2022 Results

More

Zebra Technologies’ Chuck Bolen Receives AIM Global’s Clive Hohberger Technology Award

More

FITT Optimises Warehouse and Yard Operations with Zebra Technologies’ Warehouse Mobility Solution

More

Zebra Helps Fundación Cardiovascular de Colombia Reduce Medication Administration Times by 40%

More

Zebra Technologies Extends Partnership with National Football League

More

Zebra Technologies is One of America’s Greatest Workplaces for Diversity

More

Stuart Achieves 70% Warehouse Productivity Gains with Comprehensive Solution from Zebra Technologies

More

Zebra Technologies Launches Advanced Tier Machine Vision Specialization for Partners

More

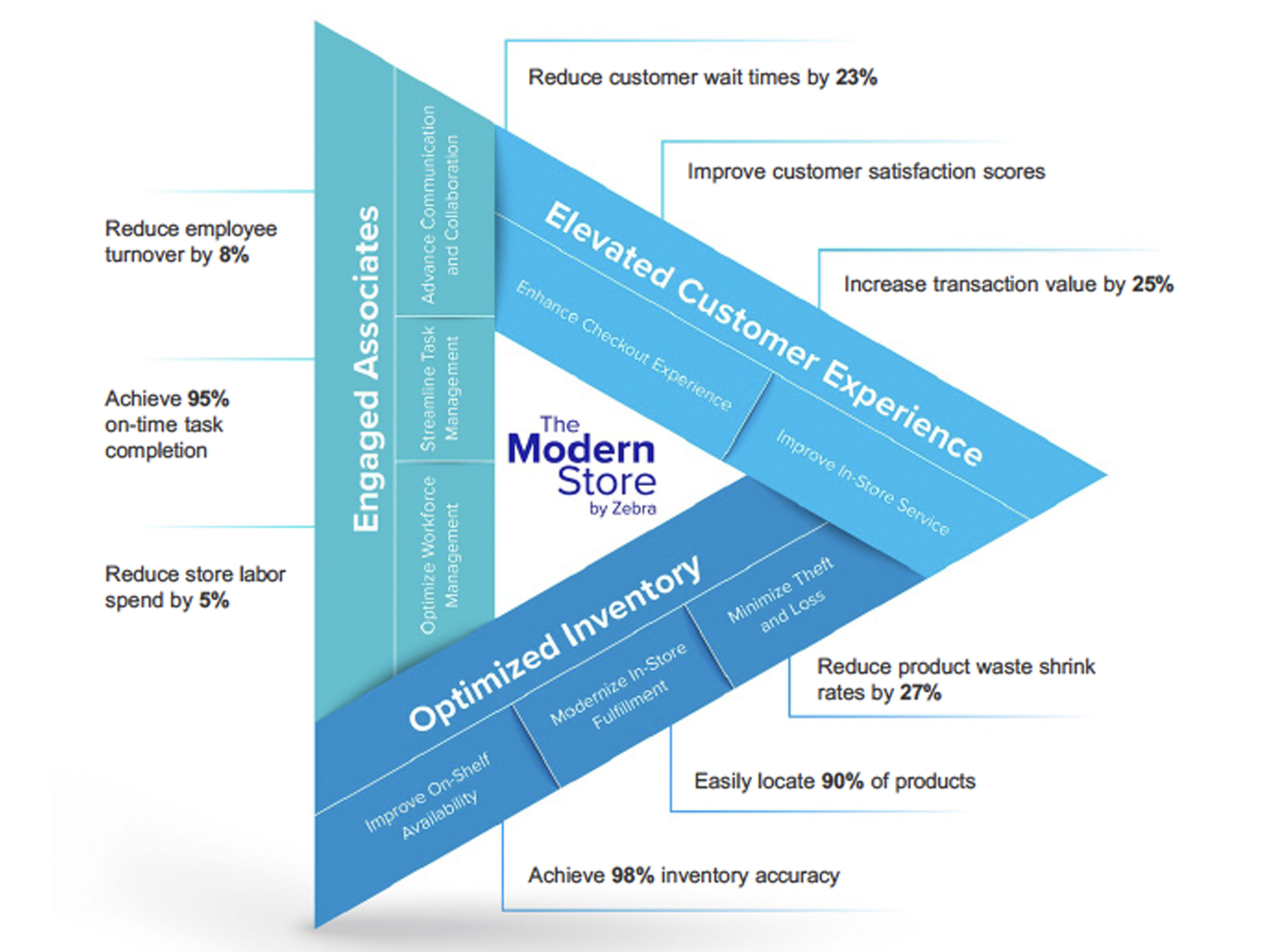

Zebra Technologies Introduces “The Modern Store by Zebra” to Help Retailers Solve Ongoing Store Challenges

More

Zebra Technologies Voted Top Software Vendor by Retailers in 2023 RIS Software LeaderBoard

More

Sally Beauty Holdings Modernizes Store Execution and Communications with Zebra Technologies’ Reflexis Solution

More

Britain’s Warehouse and Retail Workers Say Technology Makes Jobs Easier, More Enjoyable

More

Computerworld Names Zebra Technologies to 2023 List of Best Places to Work in IT

More

Zebra Technologies Names Bill Burns as Next Chief Executive Officer

More

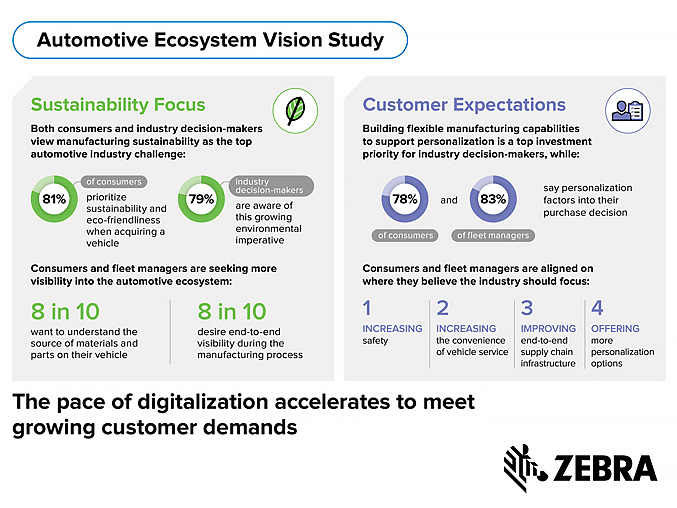

Zebra Survey Shows Eight-in-10 Millennials Expect More Transparency in Automotive Manufacturing

More

Murchison Defiba Upgrades its Container Terminal to a “Smart Port” with Solutions from Zebra

More

Zebra Technologies Appoints Tami Froese as Chief Supply Chain Officer

More

Hasenauer+Koch Improves Efficiencies for Local Deliveries with Zebra Technologies

More

Kaufland Offers Customers Seamless Shopping Experience with Zebra Self-Service Solution

More

Shoe Sensation Improves Store Execution and Labor Scheduling with Zebra Software Solutions

More

Zebra Technologies Announces Third-Quarter 2022 Results

More

Noerpel Group Accelerates Deliveries, Doubles Productivity with Zebra Fixed Industrial Scanning Solution

More

Self-Serve Drives Seven-in-10 Shoppers’ Improved Satisfaction with Retail Associates

More

RAJA Modernises its Warehouse Operations with Zebra Technologies’ Mobile Solution

More

Zebra Technologies Expands Its R&D Footprint in India

More

bp Group’s Aral Selects Zebra Technologies to Digitise Its Service Station Operations

More

Zebra Introduces New PartnerConnect Location and Tracking Specialisation for Channel Partners

More

Everything But Water Selects Zebra’s antuit.ai Retail Forecasting, Allocation and Replenishment Solutions

More

Zebra Introduces New PartnerConnect Location and Tracking Specialization for Channel Partners

More

Zebra Technologies Makes Newsweek Most Loved Workplaces List for Second Consecutive Year

More

Crewpack Reduces Order Delivery Times by 86% with Zebra Technologies

More

Zebra Technologies Unveil Deep Learning Optical Character Recognition at Vision 2022

More

Zebra, Matrox® Imaging Showcase Machine Vision, Fixed Industrial Scanning Solutions at Vision Events

More

Zebra Technologies Announces New PartnerConnect SaaS Implementation Specialisation

More

Zebra Technologies’ Michael Stent Receives Seramount 2022 ERG Impact Award

More

Zebra’s Tami Froese, Kelly Nothaft Recognized as Top Women in Supply Chain

More

Auchan Adopts Zebra Solution to Save 35 Million Products from Food Waste Annually

More

Bespoke Manufacturing Company (BMC) Selects Zebra’s Industrial and Robotics Automation to Increase Efficiency

More

Zebra Technologies Wins U.S. Postal Service’s Supplier Performance Award

More

Zebra Technologies Earns Great Place to Work Certification™

More

Zebra Technologies’ Emissions Reduction Targets Validated by the Science Based Targets Initiative

More

Fast Company Names Zebra Technologies to 2022 Best Workplaces for Innovators List

More

Zebra Technologies Announces Second-Quarter 2022 Results

More

First Tech Federal Credit Union Selects Zebra Technologies to Digitize Banking

More

Zebra Technologies’ Researchers Finish Among Top Teams in Global Computer Vision Challenge

More

Zebra Technologies Celebrates Five Wins at iF Design Awards 2022

More

Zebra Technologies Earns Its Stripes with Two Red Dot Product Design Awards

More

Zebra’s First Healthcare-Grade Tablets Deliver Better Patient and Provider Experience

More

Robotics Pioneer Melonee Wise Wins 2022 Engelberger Award

More

Zebra Technologies Introduces Rugged Tablets to Help Frontline Work Smarter and Faster

More

Zebra Technologies’ Fixed Industrial Scanners and Machine Vision Systems Win Innovation Award

More

Zebra Technologies Completes Acquisition of Matrox Imaging

More

Conad Nord Ovest Reduces Its Warehouse Operational Costs with Zebra Technologies

More

Survey Says 95% of Bank Employees Prefer Managing Their Schedules with Mobile App

More

Eight in 10 Warehouse Associates Say Positive Workplace Changes are Happening Amid Labor Shortage

More

Zebra Technologies Honored for Workplace Wellness Initiatives

More

Zebra Technologies Empowers Front-Line Workers with Next-Generation Mobile Computing Solution

More

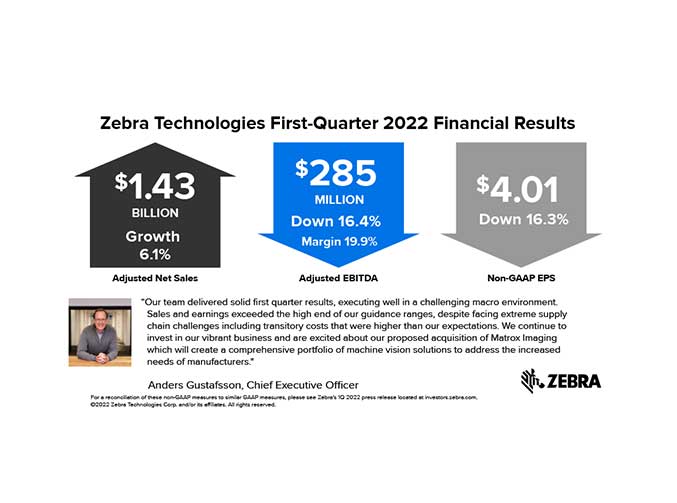

Zebra Technologies Announces First-Quarter 2022 Results

More

FIRST® and Zebra Technologies Empower Students with Real-Time Robotics Competition Insights

More

Multicenter Nearly Doubles Fulfillment Volume with Zebra Technologies

More

CRN® Honors Zebra Technologies With 5-Star Rating in 2022 Partner Program Guide

More

MODEX 2022: Zebra Introduces New Purpose-Built Offerings for Digitizing and Automating Fulfillment

More

Rakuten Super Logistics Picks Zebra Robotics Automation Solution to Increase Productivity in Warehouse Operations

More

Zebra Ranks #1 in Its Industry on Newsweek’s List of America's Most Trusted Companies

More

Forza Cash Logistics Increases Field Worker Productivity by 20% with Zebra Technologies

More

Zebra Technologies to Acquire Matrox Imaging, Broadening Its Portfolio of Machine Vision Solutions

More

Zebra Technologies Named a Leader in 2022 Gartner® Magic Quadrant™ for Indoor Location Services

More

Forbes Names Zebra Technologies to America’s Best Employers List for Sixth Year

More

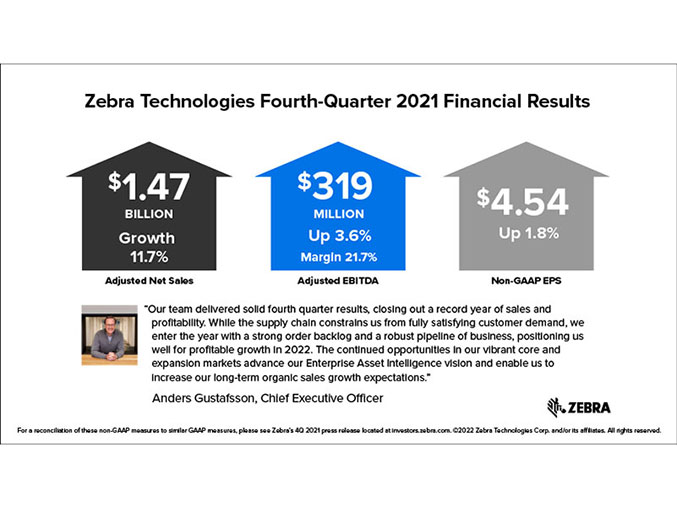

Zebra Technologies Announces Fourth-Quarter and Full-Year 2021 Results

More

Zebra Technologies Recognized in Human Rights Campaign Foundation’s 2022 Corporate Equality Index

More

Crystal Selects Zebra Technologies’ RFID Solution to Enhance Omnichannel Experience

More

Farmacias Carol Increases Drive-thru Sales by 82% with Zebra Technologies Tablets

More

Havan Improves Customer Service and Inventory Management with Zebra Technologies’ RFID Solutions

More

Four-in-10 Patients Fear Pharmaceutical Supply Chain Issues Pose Risk of Illness, Death

More

Nelda Connors Elected to Zebra Technologies Board of Directors

More

Chicago Tribune Names Zebra Technologies to 2021 Top Workplaces

More

Only Four-in-10 Shoppers Completely Trust Retailers to Fulfill Orders as Promised

More

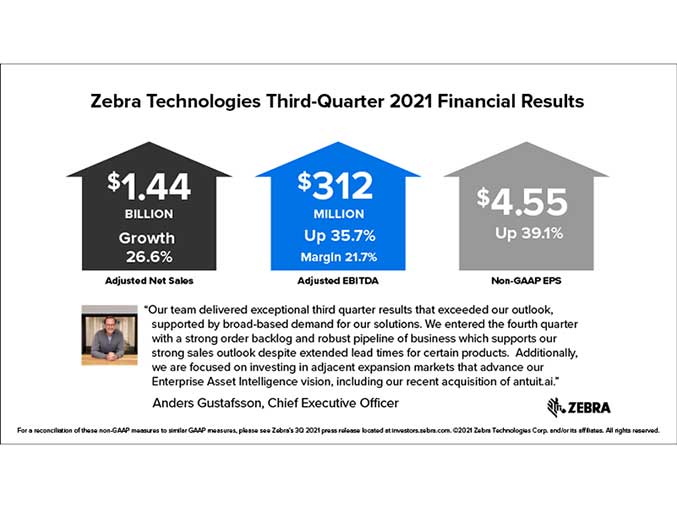

Zebra Technologies Announces Third-Quarter 2021 Results

More

Zebra Technologies Expands Fetch Robotics Portfolio with Solution to Optimize Fulfillment Workflows

More

Zebra Technologies Completes Acquisition of Antuit.ai

More

Zebra Technologies and Its Channel Partners Continue to Support Front-Line Workers

More

Sogegross Group Increases Front-Line Worker Productivity With Zebra Technologies

More

Seven-in-10 Hospital Executives Acknowledge Need to Invest More to Maximize Staff Efficiency

More

Zebra Technologies Introduces New Windows 12-inch Rugged Tablets and 2-in-1s

More

Zebra Circular Economy Program Wins Business Intelligence Group 2021 Sustainability Award

More

Zebra Technologies Named 2021 Long Island Top Workplace by Long Island Press and Dan’s Papers

More

Zebra Technologies to Acquire Antuit.ai

More

Zebra Technologies Completes Acquisition of Fetch Robotics

More

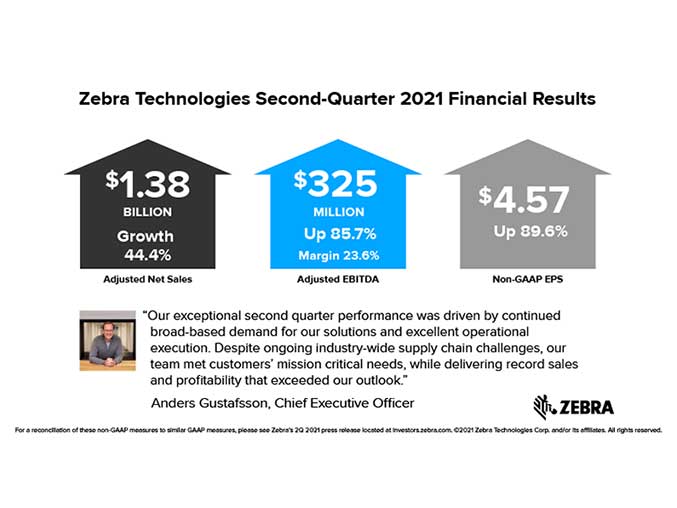

Zebra Technologies Announces Second-Quarter 2021 Results

More

Zebra Inks Multi-year Extension with Reese’s Senior Bowl to Provide Player and Ball Tracking

More

Zebra Technologies Named to 2021 Computerworld Best Places to Work in IT List

More

Zebra Technologies to Acquire Fetch Robotics

More

Sharp Selects Zebra Technologies to Develop And Supply Android-Powered Mobile Computers

More

Swiss Medical Group Improves Laundry Operations Efficiency with Zebra Technologies' RFID Solution

More

Grupo Colón Gerena Enhances Food Management Operations with Zebra Technologies

More

Zebra Technologies Introduces Intuitive, Flexible Industrial Machine Vision and Fixed Scanning Solutions

More

AutoTodo Improves Warehouse Operations with Zebra Technologies

More

Zebra Wins Fourth Consecutive MedTech Breakthrough Award for Mobile Health Innovation

More

Zebra Technologies Announces First-Quarter 2021 Results

More

Zebra Technologies Introduces Company’s First Small Office Home Office Wireless Label Printer

More

Reflexis Systems Named a “Leader” in Nucleus Research’s 2021 WFM Technology Value Matrix

More

Zebra Technologies and Discount Tire Unveil First Tire Inspection Mobile Computing Solution

More

Reflexis Systems’ Second Annual Banking Survey Finds Scheduling Agility Critical Amidst Pandemic

More

Zebra Technologies Named a “Leader” in 2021 Gartner Magic Quadrant for Indoor Location Services, Global

More

Comercial Kywi Improves Customer Service and Front-Store Operations with Zebra Mobile Solution

More

Iperal Selects Zebra Technologies’ Self-Scanning Solution to Improve Customer Experience

More

2023

More

Officeworks’ New Mobile Payment Solution with Zebra Technologies Improves Efficiency and Reliability

More

Zebra Technologies to Release Fourth Quarter and Full Year Results on Feb. 16

More

East-West Shrine Bowl Names Zebra Technologies Exclusive Player Tracking Provider for Second Consecutive Year

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media & Telecom Conference

More

Alpro Pharmacy Increases Order Fulfilment Efficiency by 80% with Zebra Technologies’ Solutions

More

Zebra Technologies to Release First Quarter Results on May 2

More

Foodstuffs South Island Enhances Productivity and Inventory Visibility with Zebra Technologies

More

Zebra Technologies to Celebrate Youth Engagement in STEM at FIRST® Championship

More

Zebra Technologies to Present at the 51st Annual J.P. Morgan Global Technology, Media and Communications Conference

More

Zebra Technologies to Present at the Bernstein 39th Annual Strategic Decisions Conference

More

Zebra Technologies Named a 2023 IDC MarketScape Leader in Rugged Mobile Devices

More

Zebra Wins 2023 Top Supply Chain Projects Award for Providing Real-Time Visibility

More

Zebra Technologies to Sponsor Rethink 2023 Summit as Strategic Partner

More

Zebra Technologies to Release Second Quarter Results on Aug. 1

More

Zebra Technologies Expands in Indonesia to Fulfill Rising Need for Digital Transformation

More

2022

More

Pacsun Improves Profitability with Intelligent Allocation and Replenishment with Antuit.ai

More

Antuit.ai and Zebra Technologies Recognized on Retail CIO Radar 2022

More

Zebra Technologies’ Machine Vision Solution Recognized for IoT Innovation

More

HBCU Legacy Bowl Launches Exclusive Partnership with Zebra Technologies

More

East-West Shrine Bowl Elevates Experience with Player Tracking from Zebra Technologies

More

Zebra Technologies to Release Fourth Quarter and Full Year 2021 Results on Feb. 10

More

NFL and Zebra Technologies to Discuss Real-Time Player and Ball Tracking at Super Bowl

More

Zebra Technologies Unveils New Portfolio of Easy-to-Deploy Integrated RFID Portals

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media & Telecom Conference

More

Zebra Technologies Introduces New PartnerConnect Specialization Program for Resellers Serving SMBs

More

North Shore Bank Selects Zebra Technologies to Streamline Branch Operations

More

Zebra Technologies’ Bill Jacob Recognized as a 2022 CRN Channel Chief

More

Zebra Technologies Introduces Reflexis Solutions in Australia and New Zealand

More

Zebra Technologies Appoints Eric Ananda as Indonesia Country Lead

More

I&H Introduces Zebra Solutions to Achieve Greater Productivity, Accuracy and Patient Safety

More

Zebra Technologies’ James Lawton and Sivakumar Lakshmanan Recognized as Supply Chain Pros to Know

More

Zebra Technologies Recognized as a 2022 Manufacturing Leadership Council Awards Winner

More

Zebra Technologies to Release First Quarter Results on May 3

More

Zebra Technologies Named a Leader in Nucleus Research’s 2022 WFM Technology Value Matrix

More

A3 Announce Zebra’s Melonee Wise as Joseph F. Engelberger Robotics Award Recipient

More

Sun Sentinel Names Zebra Technologies to 2022 Top Workplaces

More

Zebra Technologies to Present at the J.P. Morgan 50th Annual Global Technology, Media and Communications Conference

More

Zebra Technologies Board Approves Additional $1 Billion Share Repurchase Authorization

More

Zebra Technologies Awarded Best Overall mHealth Hardware Solution in 2022 MedTech Breakthrough Awards Program

More

Zebra Technologies to Present at the Bernstein’s 38th Annual Strategic Decisions Conference

More

Zebra Technologies Completes Comprehensive Debt Refinancing

More

Zebra Technologies to Present at Investor Conferences

More

Zebra Technologies to Present at the Nasdaq 46th Investor Conference

More

Zebra Technologies Expands Vietnamese Service Center to Complement Business Growth

More

Zebra Technologies Introduces New PartnerConnect Public Sector Specialization Program for Channel Partners

More

Zebra Technologies to Release Second Quarter Results on Aug. 2

More

BE Switchcraft Introduces Zebra’s RFID Solution to Achieve Greater Efficiency and Results

More

CDO Technologies Awarded $6.6M AFGET Contract

More

Zebra Technologies’ MotionWorks Enterprise Integrates with ServiceNow to Improve Workflow Visibility

More

Zebra Technologies to Release Third Quarter Results on Nov. 1

More

Zebra Technologies to Present at the Stephens Annual NASH2022 Investment Conference

More

Zebra Technologies to Present at Investor Conferences

More

Udon Thani Hospital Increases Operational Efficiency by 20% with Zebra Technologies’ Solutions

More

Automated, Collaborative Mobile Robots Increase Warehouse Productivity by 2.5x and Close Gap on Labor Shortages

More

2021

More

Farmacorp Selects Zebra Technologies and Reflexis Systems to Modernize On-Site Store Audits

More

Zebra Technologies Wins IoT Innovation Award for Enterprise Solution of the Year

More

Roadsimple Modernizes Warehouse Operations with Zebra Technologies

More

Zebra Technologies Appoints Nathan Winters as Chief Financial Officer

More

Zebra Technologies Improves Worker Productivity with Its First Individually Assigned Enterprise Mobile Computer

More

Zebra Technologies to Release Fourth Quarter and Full Year Results on Feb. 11

More

First Zebra Service Center Opens in Vietnam

More

NFL and Zebra Technologies to Discuss Real-Time Tracking and Key Insights Leading into Super Bowl

More

Zebra Technologies’ Jeff Barteld Recognized as a 2021 CRN Channel Chief

More

IFD Cápita Boosts E-Commerce Operations with Zebra RFID and Mobile Computing Solutions

More

Forbes Names Zebra Technologies to America’s Best Employers List for Fifth Year

More

Zebra Technologies Expands APAC Headquarters with Advanced Facilities

More

Zebra Technologies Announces Fourth-Quarter and Full-Year 2020 Results

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media and Telecom Conference

More

Mitre 10 Selects Zebra Technologies and Reflexis Systems to Optimize Omnichannel Customer Experience

More

Zebra Technologies to Present at the Stephens Best Ideas Conference

More

Zebra Technologies Honored With 5-Star Rating in the 2021 CRN® Partner Program Guide

More

Zebra Technologies to Launch New Printer Mobile App Designed for China

More

Zebra Technologies Provides Rugged Tablets to Angel Robotics for Wearable Robots

More

Zebra Technologies Introduces New Alliance Track for PartnerConnect Channel Program

More

Louis Widmer SA Complies with EU Anti-Counterfeiting Directive with Zebra Technologies’ Solution

More

Zebra Technologies to Release First Quarter Results on May 4

More

Zebra Technologies’ Warehousing Solution Helps Oegema Transport Improve Efficiency and Growth

More

Zebra Technologies RFID Solution Helps Renault Modernize Manufacturing Operations and Increase Productivity

More

Modella Group Improves Inventory Visibility and Accuracy with Zebra Technologies RFID Solution

More

Shenzhen Gift Cuts Time Receiving Inventory in Half with Zebra Mobile Computers

More

Zebra Technologies’ Caryn Scherer Named One of CRN’s 2021 Women of the Channel

More

The Royal Children’s Hospital Enhances Blood Scanning Accuracy By 50% with Zebra

More

Zebra Technologies to Present at the JP Morgan 49th Annual Global Technology, Media and Communications Conference

More

Aruba and Zebra Technologies Deliver Unmatched Visibility into Mobile User Experiences, Application Performance, and Network Operations

More

Zebra Technologies Wins Compass Intelligence Innovation Leadership Award in Transportation & Logistics

More

Zebra Technologies to Present at Upcoming Investor Conferences

More

Zebra Technologies Named to the 2021 CRN® Mobile 100 List

More

Maverik Selects Zebra and Reflexis to Streamline Store Execution and Labor Scheduling

More

Vera Bradley Selects Zebra Technologies and Reflexis Systems to Manage Customer Appointments

More

Zebra Offers Broadest Portfolio of U.S. Dept. of Defense STIG Validated Rugged Devices

More

Zebra Technologies to Release Second Quarter Results on Aug. 3

More

Zebra Technologies Introduces Its First Wi-Fi 6-Enabled Mobile Computer

More

Zebra Technologies Hosts Successful Re-Opening of its Experience Centre

More

Zebra Technologies Appoints Christanto Suryadarma as Southeast Asia Sales Lead

More

FourKites and Zebra Technologies Expand Relationship, Bringing End-to-End Visibility to North American and European Customers

More

Zebra Technologies to Present at the J.P. Morgan 12th Annual U.S. All Stars Conference

More

Zebra Technologies and ioXt Alliance Certify 28 Android Devices

More

Zebra Technologies to Release Third Quarter Results on Nov. 2

More

Zebra Technologies Named to Newsweek’s 2021 List of America's Most Loved Workplaces

More

Zebra Technologies to Present at the Berenberg U.S. CEO Conference

More

Zebra Technologies Wins Four Australian Good Design® Awards for Design and Innovation

More

Zebra Technologies to Present at Stephens' NASH2021 Annual Investment Conference

More

Zebra Technologies Opens First Service Center in the Philippines

More

Zebra Technologies Appoints Rajnish Gupta as India and Sub-Continent Lead

More

Zebra Technologies Expands Indonesian Service Center to Complement Business Growth

More

Zebra Technologies Voted Top Software Vendor by Retailers in 2022 RIS Software LeaderBoard

More

2020

More

Office Depot Transforming Customer Experience and Supply Chain Operations with Zebra Mobile Solutions

More

XPO Logistics Pilots Intelligent Inventory-Picking Technology in France

More

Zebra Technologies Unveils New Intelligent Automation Solution at NRF 2020

More

Zebra Technologies to Showcase New Solutions to Revamp the Retail Experience at EuroShop 2020

More

Zebra Technologies Named a “Leader” for Global Indoor Location Services in Gartner Magic Quadrant

More

Zebra Technologies Modernizes Warehouse Operations for Mobis Parts Australia

More

Zebra Technologies and NFL to Share Key Player Insights from 49ers and Chiefs Ahead of Super Bowl LIV Matchup

More

Zebra Study: Real-Time Data Access is Critical for Energy, Utilities Field Workers

More

Zebra Technologies to Release Fourth Quarter and Full Year Results on Feb. 13

More

Zebra Technologies Announces Fourth-Quarter and Full-Year 2019 Results

More

Zebra Donates Technology to China Hospitals to Assist in Epidemic Prevention Efforts

More

Zebra Technologies to Present at the Morgan Stanley Technology, Media and Telecom Conference Feb 27

More

Zebra Technologies Introduces New UDI Scanning Application for Improved Patient Safety

More

Saddle Creek Logistics Services Modernizes Warehouse Operations with Zebra Technologies

More

Fetch Robotics Announces Integrated Fulfillment Solution with Zebra Technologies

More

Zebra’s Michael Maris and Mark Wheeler Receive Supply Chain Pros to Know Awards

More

Zebra Technologies Appoints Jason Low as New Philippines Country Advisor

More

Zebra Technologies Appoints Holly Tyson as Chief Human Resources Officer

More

Zebra Technologies to Release First Quarter Results on April 28

More

Zebra Study: Number of Field Service Providers Operating Predictively Will Double by 2025

More

Zebra Technologies Enhances Parcel Pickup and Delivery for CouriersPlease

More

Zebra Technologies Announces Location Change for Annual Shareholders Meeting on May 14

More

Zebra Technologies Announces First-Quarter 2020 Results

More

Maikubo Increases Staff Efficiency with Zebra Technologies’ RFID Solution

More

Zebra Study: 7 in 10 Public Safety Agencies See Need to Speed Up Mobile Technology Adoption

More

Zebra Technologies to Present at the 48th Annual J.P. Morgan Global Technology, Media and Communications Conference

More

Zebra Technologies Awards Current and Future Nurses for Challenging the Status Quo

More

Linda Connly Elected to Zebra Technologies Board of Directors

More

Zebra Technologies Introduces MotionWorks Warehouse for Increased Visibility and Predictability in Warehouse Operations

More

Zebra Technologies to Present at the Bernstein's 36th Annual Strategic Decisions Conference

More

Zebra Wins Third Consecutive MedTech Breakthrough Award for Innovation in Healthcare Workflow Efficiency

More

Zebra Technologies’ Gail Goebel Nominated as One of CRN’s 2020 Women of the Channel

More

MPREIS Migrates to Android™ Solution for Efficient In-Store Fulfillment Management with Zebra Technologies

More

University Helps Secure Agribusiness Supply Chain with Zebra RFID Solution

More

Zebra Technologies Introduces Proximity Sensing, Alerting & Contact Tracing Software for the Enterprise

More

Zebra Technologies to Present at William Blair’s 39th Annual Growth Stock Conference

More

Zebra Technologies’ Mark Wheeler Receives AIM’s 2020 Allan Gilligan Award

More

Fozzy Group Increases Retail Warehouse Productivity by 20 Percent with Zebra Technologies

More

Zebra Technologies Introduces Five Rugged Mobile Computers to Increase Front-Line Worker Productivity

More

Computerworld Names Zebra Technologies to 2020 Best Places to Work in IT List

More

Dutch Cargo Terminal Improves Operational Management Over 4G with Zebra Technologies

More

Zebra Technologies to Release Second Quarter Results on July 28

More

Zebra Technologies Introduces Circular Economy Program to Improve Sustainability

More

Scottish & Southern Electricity Networks (SSEN) Improves Front-Line Workers’ Productivity with Zebra Technologies

More

Zebra Technologies to Acquire Reflexis Systems, Inc.

More

Zebra Technologies Announces Second-Quarter 2020 Results

More

Fast Company Names Zebra Technologies to Best Workplaces for Innovators

More

Signet Modernizes Warehouse Operations with Zebra’s Wearable Technology

More

Jumbo Selects Zebra Technologies’ Personal Shopping Solution for Improved Customer Experience

More

Chicago Bears Gain a Performance Edge with Zebra Technologies’ On-Field Tracking Technology

More

Zebra Technologies Names Acting CFO

More

Zebra Technologies Appoints Brian Tse as Greater China Country Lead

More

Zebra Technologies Completes Acquisition of Reflexis Systems, Inc.

More

Australia’s Leading Online Book Retailer Modernizes Warehouse with Zebra Technologies

More

Zebra Study: Only Two in 10 Consumers Have Complete Confidence Their Food is Safe to Eat

More

Los Angeles Rams Continue Partnership with Zebra Technologies for On-Field Player Tracking

More

Smartbox and Zebra Technologies Give A Voice to Those Who Cannot Speak

More

Zebra Technologies Wins Three Good Design® Awards for Design and Innovation

More

IKI Selects Reflexis Systems Intelligent Workforce Management to Optimize Labour Efficiency

More

Zebra Technologies Empowers Interdisciplinary Care with Innovative Healthcare Offerings

More

Zebra Technologies to Release Third Quarter Results on Nov. 3

More

Zebra Technologies’ Leading Healthcare Device Approved for Use with Epic’s Clinical Application

More

Ferreira Costa Enhances Customer Experience, Supply Chain Operations with Zebra Mobile Computers

More

Zebra Technologies’ Cristen Kogl Receives Women, Influence & Power in Law Award

More

Zebra Technologies Announces Third-Quarter 2020 Results

More

IDC MarketScape Names Zebra Technologies a Leader in Rugged Mobile Devices

More

Mindray Medical International Optimizes Healthcare Workflows with Zebra Technologies

More

Ackermans Selects Zebra Technologies’ Mobile Computing Solution to Modernize Store Operations

More

Zebra Technologies’ Enterprise Browser Now Available for Trial and Purchase on SAP® App Center

More

Zebra Technologies to Present at Stephens Virtual Annual Investment Conference

More

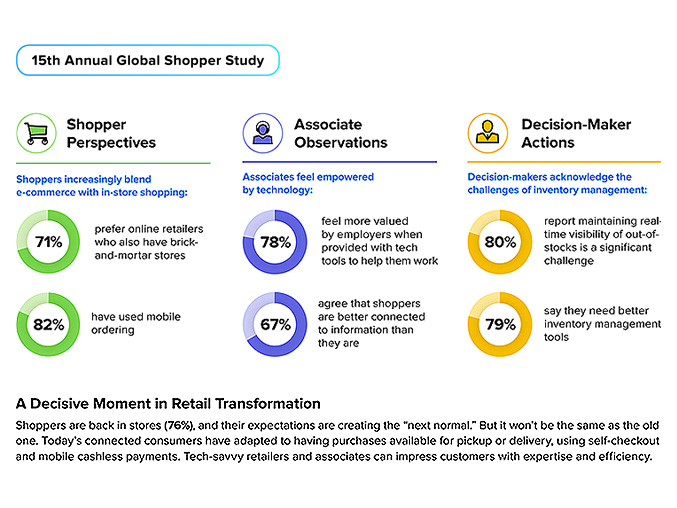

Zebra Global Shopper Study: Pandemic Accelerates Technology Spending Plans for Six-in-10 Surveyed Retailers

More

JBS Modernizes Brazilian Distribution Center Operations with Zebra Technologies

More

Leading Australian Ski Resort Improves Guest Experience with Zebra Technologies

More

Zebra Technologies Voted Top Software Vendor by Retailers in 2021 RIS Software LeaderBoard

More

Zebra Technologies to Present at Nasdaq’s 43rd Investor Conference

More

Zebra Technologies Wins IoT Innovator Award for Innovation in Retail & Customer Experiences

More

Zebra Technologies Partners with JD Logistics to Offer Modernized Warehouse Management Solutions

More

Zebra Technologies and Singapore Polytechnic Nurture Singapore’s Next Generation of Manufacturing Talent

More

Newsday Names Zebra Technologies to Long Island Top Workplaces 2020

More

2019

More

Zebra Technologies to Acquire Temptime Corporation

More

Zebra Technologies to Acquire Profitect Inc.

More

United States Postal Service Selects Zebra Technologies as Next-Generation Mobile Delivery Device Provider

More

Zebra Technologies Helps Improve Patient Care at Seoul National University Bundang Hospital

More

2024

More

2025

More

Corporate

Zebra Technologies Corporation

Corporate & International Headquarters

3 Overlook Point

Lincolnshire, Illinois 60069 USA

Phone: +1 847 634 6700

Toll-free: +1 866 230 9494

Fax: +1 847 913 8766

Resources

Download Zebra's B-Roll Videos

Legal Terms of Use Privacy Policy Supply Chain Transparency

ZEBRA and the stylized Zebra head are trademarks of Zebra Technologies Corp., registered in many jurisdictions worldwide. All other trademarks are the property of their respective owners. Note: Some content or images on zebra.com may have been generated in whole or in part by AI. ©2025 Zebra Technologies Corp. and/or its affiliates.